Now Live: ULDD Phase 4a and 5 Plus More Updates

UPDATED: This article has been updated to inform you that the Post-Fund Data Correction tool enhancement has a new date. You will see a new look and feel in early Q3 2024. Stay tuned for more information.

Enhancements to Loan Selling Advisor® can help maximize your efficiency in loan delivery. The optional delivery period for Uniform Loan Delivery Dataset (ULDD) Phase 5 is now live, and we also have updates about the customer test environment (CTE) and reminders to support you and your business.

ULDD Phase 4a Now in Effect

ULDD Phase 4a updates were implemented on June 3, 2024. Included were updates to existing ULDD data points and their revision effective dates. To learn more, visit the ULDD webpage.

ULDD Phase 5 Optional Delivery Period is Here

Effective June 3, you have the option to deliver ULDD Phase 5 data points in production. Check out the below to learn more.

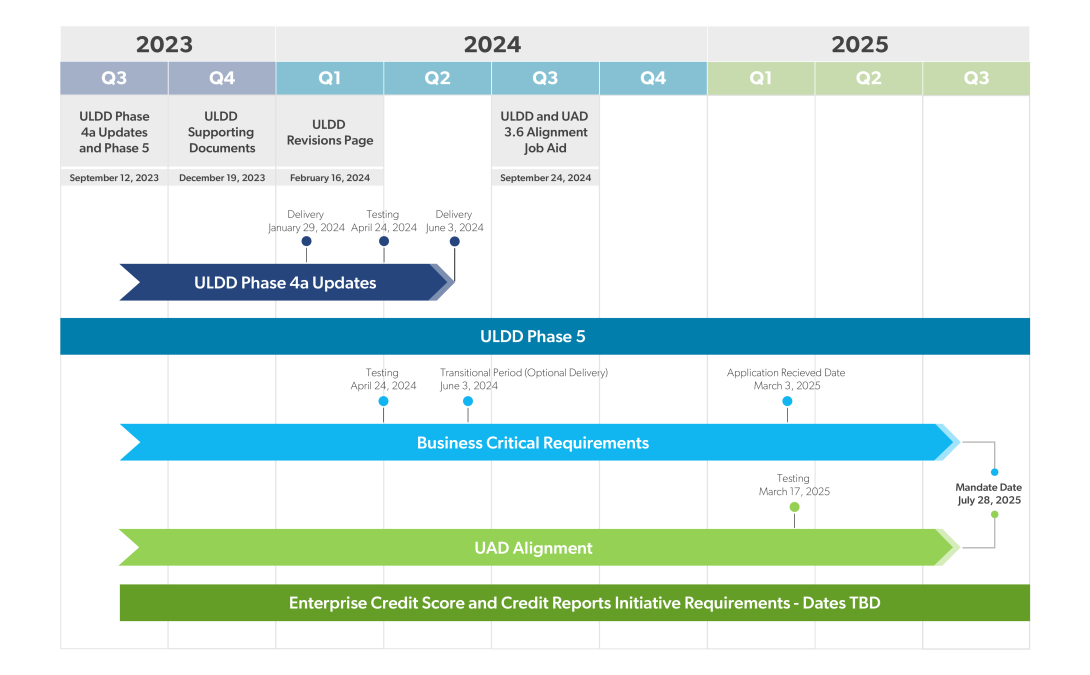

On September 12, 2023, Freddie Mac and Fannie Mae (the GSEs) announced the ULDD Phase 4a and Phase 5 data requirements.

Supporting Documentation Updates

The following resources are available to help you with the implementation of ULDD:

- ULDD Supporting Documentation Updates

- Appendix D

- Summary of ULDD Phase 4a Updates and Phase 5 Specification

- Freddie Mac ULDD Learning Help Page

Implementation Timeline

ULDD Phase 5 Testing Coming Soon to the Production Baseline CTE

To prepare for the ULDD Phase 4a updates, you tested in pre-production CTE. For ULDD Phase 5, you will test in the production baseline CTE. Your existing test environment credentials do not change, and you can use them in the production baseline CTE as well. Data will not transfer from one environment to the other. This includes contracts, or loans that were imported, as well as custom exports you may have created. The pre-production CTE will close on Friday, June 14 at 5:00 p.m. and all testing support in this environment will end.

The production baseline CTE will open on June 17, 2024, to help you prepare for the optional delivery period in production which began on June 3, 2024. Here is a recap of key info:

- The Loan Quality Advisor® CTE for ULDD Phase 5 is open.

- Use your existing test environment credentials (user ID and password) to gain access to the CTE.

- Obtain verification test case materials from your software provider representative.

- Contact your Freddie Mac representative or email [email protected] to schedule your verification and initiate the software provider verification process.

- For more information and updates, visit the ULDD webpage and review the Business Resources, Technical Resources, Announcements, and Revisions tabs.

Remote Online Notarization Indicator Delivery Instructions for Loans Sold Through Cash-Released XChange®

Effective June 3 for loans closed using the Remote Online Notarization (RON) process, you have the option to deliver the new ULDD Data Point Remote Online Notarization Indicator, except for contracts fulfilled through the Cash-Released XChange execution. Please continue to deliver ULDD Data Point Investor Feature Identifier (IFI) “J22” for loan delivery and pricing. We’ll notify you when its ready to be used with Cash-Released XChange.

Credit Reporting Companies and Technical Affiliates

As part of the bi-annual activity, we have updated the list of valid values for ULDD Data Point Credit Score Provider Name (Sort ID 591.1) and as a result, 5043, 2022 and 2127 have been removed. In addition, 2277 has been added as a new technical affiliate. The current list of valid values for CRCs and Technical Affiliates codes can be downloaded from the Credit Reporting Companies and Technical Affiliates webpage.

Credit Fee Cap Pricing Pipeline Coverage related to 2024 AMI Limit Updates

On May 23, 2024, Bulletin 2024-D announced credit fee cap pricing pipeline coverage for certain loans where the mortgaged premises is located in an area where the 2024 AMI limit is lower than the 2023 AMI limit. This pricing pipeline coverage may apply to Loan Product Advisor® (LPA℠) Accept mortgages, originated under the first-time homebuyer and/or Duty to Serve credit fee caps, and where the benefit has been provided to the borrower, among other criteria. In connection with the pricing pipeline coverage, delivery of ULDD Data Point Investor Feature Identifier (Sort ID 368) valid value “K11” is required, indicating the pricing benefit was provided to the borrower. All mortgages eligible for this pricing pipeline coverage must have a Settlement date on or before July 31, 2024.

Sellers also have the option of updating the loan through the Post-Fund Data Correction tool, provided the loan meets the pricing pipeline coverage criteria.

For complete credit fee cap pricing pipeline coverage criteria and delivery requirements please refer to Bulletin 2024-D.

TLTV/HTLTV for Condominiums with Streamlined Reviews

This is a reminder of the notification we sent in May, that effective July 29, critical edits will be introduced in Loan Selling Advisor to enforce the total loan-to-value (TLTV) and Home Equity Line of Credit total loan-to-value (HTLTV) requirements for Condominium Unit Mortgages with a streamlined project review in Guide Section 5701.4, Streamlined reviews.

Post-Fund Data Correction Loan Screen Modernization

UPDATE: The Post-Fund Data Correction tool enhancement has a new date. You will see a new look and feel in early Q3 2024. Stay tuned for more information.

Do you need to make data corrections after your loans have funded? The Post-Fund Data Correction tool provides a clearer way to correct data originally submitted through Loan Selling Advisor. It can help automate your workflow for data correction requests by giving you a quick turn-around time and reduce the risk of errors with manual entry. Effective June 24, 2024, existing screens will be enhanced and modernized to help you navigate within the tool more seamlessly. We’re adding metro stops, pills and action buttons for a more streamlined experience.

Upcoming Production Baseline CTE Maintenance

We’re continually looking for ways to make your interactions with our systems as easy and secure as possible. In doing so, The Loan Selling Advisor, XChange Center, and Selling application programming interfaces (APIs) connected to the Production Baseline Client Test Environment will undergo planned maintenance from 5 p.m. Eastern Standard Time (EST) on Thursday, June 6, 2024, through 9 a.m. EST on Monday, June 10, 2024. During this time, all features in Loan Selling Advisor, XChange Center, and Selling APIs will be unavailable. Please contact your Freddie Mac Representative if you have any questions.

Prepare for Upcoming MFA Enhancements

Freddie Mac is committed to continually enhancing and improving our security standards. We previously instituted multifactor authentication (MFA) to provide greater security when accessing our systems. To further strengthen security, as of June 30, 2024, we will no longer support SMS/Text or voice for MFA. We’ll also be adding the PingID® mobile application as a new MFA method.

That means that beginning June 30, we’ll continue to offer email and introduce PingID mobile application as supported MFA methods. In preparation for this enhancement, if you would like to use the PingID mobile application for MFA and have concerns about your ability to download it, please contact your organization’s information technology (IT) or information security (InfoSec) administrators.

We’ll provide more information about how to update your MFA methods for email and/or PingID mobile application in the coming weeks.