Uniform Loan Delivery Dataset

The Uniform Loan Delivery Dataset (ULDD) supports the work to implement uniform data standards and defines the data that we require at loan delivery based on loan type, loan feature or other business requirements.

Business Resources

ULDD data is granular, standardized, and has clear definitions, providing sellers with a common understanding of the meaning of each data point. The result is greater transparency, which helps sellers gain a better understanding of our assessment of mortgage risk and purchase requirements on loans they sell to us.

ULDD Revisions

The ULDD Revisions webpage is designed to assist you with loan delivery requirement revisions to ULDD since the last publication. The revisions include ULDD specification updates and ULDD impacts that were previously communicated in Single-Family Seller/Servicer Guide (Guide) Bulletins. The webpage will be updated periodically.

ULDD Publications

ULDD Phase 4a Updates

Freddie Mac is providing updates to existing ULDD Phase 4a data points (i.e., enumerations, implementation notes, conditionality, and conditionality details).

ULDD Phase 5

The Phase 5 updates add new data points and updates to existing data points to support the Enterprise Credit Score and Credit Reports Initiative, alignment with the new redesigned UAD 3.6 and business critical requirements.

The following resources are available to help you with the implementation of ULDD:

- ULDD Announcement – May 20, 2025

- ULDD Announcement – September 12, 2023

- ULDD Supporting Documentation Updates

- Appendix D

- Summary of ULDD Phase 4a Updates and Phase 5 Specification

- ULDD Job Aid for the Alignment with UAD 3.6

- Freddie Mac ULDD Learning Help Page

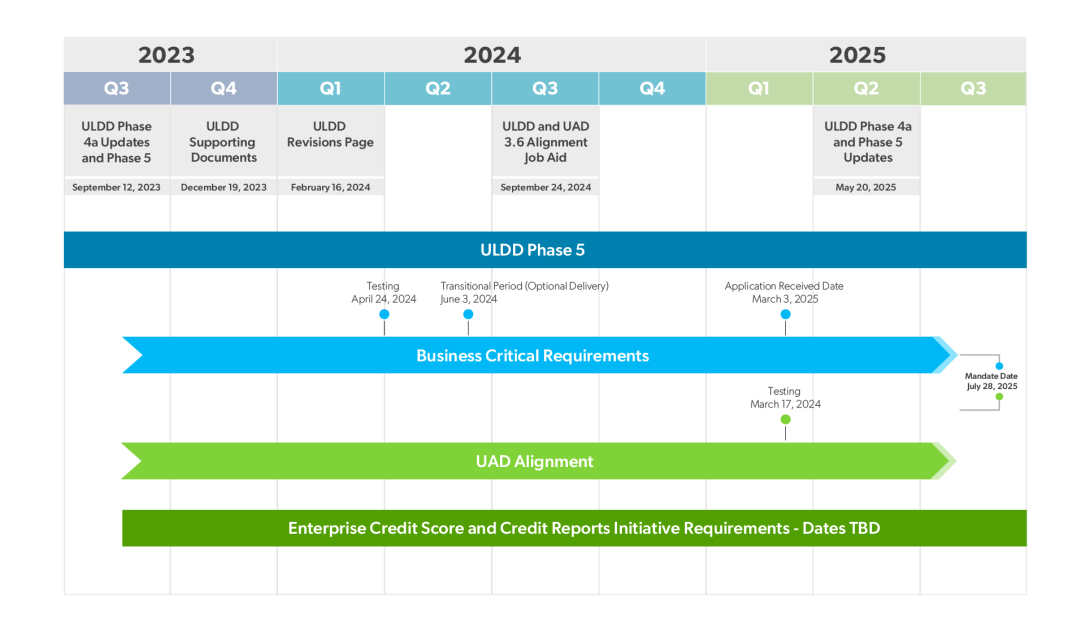

Implementation Timeline

Additional Resources

Technical Resources

The following resources provide the technical documentation that Freddie Mac-approved Sellers and vendors need to implement Freddie Mac's loan delivery data requirements:

Announcements

2025

- May 20, 2025 – ULDD Phase 4a and Phase 5 Updates and Guidance

2023

- December 19, 2023 – ULDD Phase 5 Supporting Documentation Updates

- September 12, 2023 – ULDD Phase 4a Updates and Phase 5 Specification Release

2022

- April 26, 2022 – ULDD Phase 4a Supporting Documentation Updates

2021

- December 14, 2021 – ULDD Phase 4a Specification Release

- June 8, 2021 – ULDD Updates for CMT-indexed ARMs Retirement, Implementation Notes and Enumerations

2020

- December 1, 2020 – Updates to Support ULDD LIBOR to SOFR ARM Index Transition, Condo Delivery and Home Possible® Mortgage

- April 21, 2020 – ULDD Updates Supporting SOFR ARM Index Transition

2019

- May 30, 2019 – ULDD Update Further Aligns GSE Specifications

- May 14, 2019 – ULDD Phase 3 Announcement

- January 10, 2019 – ULDD Phase 3 Reminder

2018

- July 10, 2018 – ULDD Phase 3 Update

- February 26, 2018 – ULDD Phase 3 Loan Selling Advisor Updates Deferred Until March 5

- February 21, 2018 – ULDD Phase 3 Reminder & Updates

- January 30, 2018 – ULDD Phase 3 Mandate and Application Received Dates

2017

- November 7, 2017 – ULDD Phase 3 Updates and Guidance

- June 27, 2017 – ULDD Phase 3 Addendum Updates

- March 28, 2017 – ULDD Phase 3 Update Announced

2016

- December 13, 2016 – ULDD Phase 3 Announced

2013

- November 29, 2013 – GSE Publish ULDD Phase 3 Preview Specification

- August 22, 2013 – ULDD Phase 2 Preparation Tips, Specification Update, and More

- May 20, 2013 – Preparing for the Phase 2 ULDD

2012

- December 13, 2012 – GSEs Publish Phase II ULDD Specification

Uniform Loan Delivery Dataset (ULDD) - Revisions

Most Recent Updates as of February 4, 2026

The Uniform Loan Delivery Dataset (ULDD) revisions revisions webpage is designed to assist you with loan delivery requirement revisions to ULDD since the publication of Appendices A and D on May 20, 2025. These revisions include ULDD specification updates and ULDD impacts that have been previously communicated in the Single-Family Seller/Servicer Guide (Guide) Bulletins.

The information on this webpage will be removed once the revisions have been incorporated into Appendices A and D.

The ULDD revisions are listed in the tables below. These tables identify the communication date and Guide Bulletin number if applicable, Sort ID, Data Point Name, Revision Effective Date, a description of the change, and the ULDD column(s) that have been revised (text being removed will be displayed in red strikethrough, text being added will be displayed in blue).

Revised ULDD Data Points

February 4, 2026 – Revision 1

February 4, 2026 – Bulletin 2026-1

Sort ID | Data Point Name | Revision Effective Date | Revision Description | FRE Conditionality Details | Revision for FRE Implementation Notes | Enumerations |

|---|---|---|---|---|---|---|

333 | Loan Amortization Type | May 4, 2026 | Construction to Permanent and Renovation Mortgages updates - removed Conditionality Detail (Construction Loan Indicator = "false") and updated Implementation Notes. | IF Sort ID 397-MortgageModificationIndicator = "true" | Values: ◊ For Seller-Owned Modified Mortgage ◊ For Construction to Permanent Mortgages or Renovation Mortgages enter the amortization type of the Permanent Financing prior to modification. | AdjustableRate Fixed |

404 | Loan Program Identifier | May 4, 2026 | Construction to Permanent Mortgages update - removed LPI (Construction Conversion). | IF applies | Values: ◊ Enter "EnergyConservation" for Mortgages that finance the purchase of a property that is to be retrofitted, refurbished, or improved with energy conservation components. ◊ Enter "Renovation" for Renovation Mortgages meeting the requirements of Guide Section 4602.3. | See Tab-Enumerations |

February 4, 2026 – Revision 2

February 4, 2026 – Revision 2 – Bulletin 2026-1

Sort ID | Data Point Name | Revision Effective Date | Revision Description | Revision for FRE Implementation Notes |

|---|---|---|---|---|

89 | Property Valuation Method Type | February 4, 2026 | Updated Implementation Notes - replaced appraisal waiver with program identifiers. | Values: Enter the FRE-Supported Enumeration for the method that yielded the value used to calculate the LTV for the delivered loan: ◊ Enter "AutomatedValuationModel" for Home Value Explorer® (HVE). ◊ Enter “DesktopAppraisal” if a desktop appraisal was used to value the subject property. ◊ Enter "DriveBy" if an exterior-only appraisal was used to value the subject property. ◊ Enter "FullAppraisal" if an interior and exterior inspection appraisal was used to value the subject property. ◊ Enter "None" if Automated Collateral Evaluation (ACE), Property Data Collection, Property Inspection Waiver or Value Acceptance ◊ Enter "Other" if a desk review, field review, or hybrid appraisal was used to value the subject property. ◊ Enter the values as instructed in Seller's negotiated terms for all other property valuation method types. |

163 | Construction To Permanent Closing Feature Type | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Definition: This data point is applicable to Construction Values: ◊ Enter "AutomaticConversion" for One-Time Close transaction with automatic conversion ◊ Enter "Modification Agreement" for One-Time Close transaction with modification agreement ◊ Enter "NewNote" for Two-Time Close transaction |

165 | Construction To Permanent Closing Type | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Definition: This data point is applicable to Construction Values: ◊ Enter "OneClosing" for One-Time Close transactions ◊ Enter "Two Closing" for Two-Time Close transactions |

167 | Construction To Permanent First Payment Due Date | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Definition: ◊ This data point is applicable to Construction Values: ◊ Enter the Due Date of the first Principal and Interest Payment of the Permanent Financing from the Note for One-Time Close transaction with automatic conversion ◊ Enter the Due Date of the first Principal and Interest Payment after the modification agreement for One-Time Close transaction with modification agreement ◊ Enter the Due Date of the first Principal and Interest Payment for the Permanent Financing from the Note for Two-Time Close transaction as described in Section 4602.3 |

231 | Construction Loan Indicator | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: Enter "false" unless the Mortgage is a Construction |

259 | Loan Modification Effective Date | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: ◊ Enter the effective date of the modification agreement |

320 | Note Date | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values:

◊ For Seller-Owned Modifications this data point is not required. |

321 | Note Rate Percent | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: Enter the original interest rate as indicated on the Note unless the Mortgage is one of the of the following: ◊ For subsidy buydown Mortgages, enter the rate shown on the Note (without reference to the temporary buydown subsidy). ◊ For financed permanent buydown Mortgages, enter the permanently bought down initial Note Rate. ◊ For Construction ◊ For Seller-Owned Modified Mortgages, enter the rate in effect after modification. Format: The only reasonable values supported at this time are restricted to a format of Percent 3.3. |

332.1 | Adjustment Rule Type | May 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Parent Container: Provide 2 INTEREST_RATE_PER_CHANGE_ADJUSTMENT_RULE Containers: ◊ One with AdjustmentRuleType = "First" to describe the Initial Period and Initial Caps of the original Mortgage / Permanent Financing prior to modification; and ◊ One with AdjustmentRuleType = "Subsequent" to identify the periodic adjustment structure and Periodic Caps of the original Mortgage / Permanent Financing prior to modification. |

337.1 | Initial Fixed Period Effective Months Count | May 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Definition: The related Guide Glossary term is "Initial Period." Values: ◊ For Seller-Owned Modified Mortgage ◊ For Construction to Permanent Mortgages or Renovation Mortgages enter the Initial Period of the Permanent Financing prior to modification. |

338 | Loan State Date | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: ◊ For Seller-Owned Modified Mortgage ◊ For Construction |

345 | Lien Priority Type | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: ◊ For Seller-Owned Modified Mortgage ◊ For Construction |

349 | Note Amount | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: ◊ For Seller-Owned Modified Mortgage ◊ For Construction |

350 | Note Date | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: ◊ For Seller-Owned Modified Mortgage ◊ For Construction |

397 | Mortgage Modification Indicator | February 4, 2026 | Updated Implementation Notes for Construction to Permanent and Renovation Mortgages. | Values: Enter "false" unless the Mortgage is a: ◊ Seller-Owned Modified Mortgage, ◊ ◊ One-Time Close Renovation Mortgage with a Modification agreement |

October 1, 2025

October 1, 2025 – Bulletin 2025-13

Sort ID | Data Point Name | Revision Effective Date | Revision Description | FRE Conditionality Details | Revision for FRE Implementation Notes |

|---|---|---|---|---|---|

157 | Other Funds Collected At Closing Amount |

January 1, 2026 | Updated Conditionality Details and Implementation Notes to include Escrow Indicator and Co-Issue XChange® where All-in Funding is enabled. November 20, 2025 - Updated FRE Conditionality Details to include Buydown Temporary Subsidy Indicator and removed prepaids from the Definition. | IF [(Sort ID 234-EscrowIndicator = "true" OR Sort ID 228-BuydownTemporarySubsidyIndicator ="true") AND (Mortgage is delivered through Cash-Released XChange® | Definition: This data point captures the total amount of buydown

|

158 | Other Funds Collected At Closing Type | January 1, 2026 | Updated Implementation Notes to include Co-Issue XChange® where All-in Funding is enabled. | IF Sort ID 157-OtherFundsCollectedAtClosingAmount ≥ "1" |

Values:

|

247 | Credit Score Impairment Type |

January 1, 2026 | Updated Conditionality Details to include Co-Issue XChange® where All-in Funding is enabled. |

IF Sort ID 251-LoanLevelCreditScoreValue does not exist AND [(Sort ID 326-AutomatedUnderwritingSystemType <> "LoanProspector") OR (Sort ID 326- AutomatedUnderwritingSystemType = "Other" AND Sort ID 327-AutomatedUnderwritingSystemTypeOtherDescription <> “LoanProductAdvisor”) OR (Sort ID 328-LoanManualUnderwritingIndicator = "true") OR (Mortgage is delivered through Cash-Released XChange® |

Values: Enter if the Indicator Score does not exist or is not usable. |

251 | Loan Level Credit Score Value |

January 1, 2026 | Updated Conditionality Details to include Co-Issue XChange® where All-in Funding is enabled. | IF Sort ID 247-CreditScoreImpairmentType does not exist AND Sort ID 611-PartyRoleType = "Borrower" AND (Either Sort ID 545-LegalEntityType does not exist OR Sort ID 546- |

|

363 | Escrow Balance Amount | January 1, 2026 | Updated Conditionality Details and Implementation Notes to include Co-Issue XChange® where All-in Funding is enabled. | IF [Sort ID 234-EscrowIndicator = "true" AND (Mortgage is delivered through Cash-Released XChange® | Values:

|

366 | Escrow Monthly Payment Amount | January 1, 2026 | Updated Conditionality Details to include Co-Issue XChange® where All-in Funding is enabled. | IF Sort ID 234-EscrowIndicator = "true" AND ( | Values: Enter the amount for the associated EscrowItemType. Format: If the EscrowMonthlyPaymentAmount ≤ "0.99" enter "1.00." |

This information is not a replacement or substitute for the requirements in the Freddie Mac Single-Family Seller/Servicer Guide or any other contractual agreements. This information does not constitute an agreement between Freddie Mac and any other party. © 2026 Freddie Mac.