ECO ®: Evaluate | Compare | Optimize ®

Knowledge is power. With ECO, you get visibility into your portfolio, combined with synthetic peer data. Knowledge and visibility drive invaluable insights.

View the ECO Releases.

Monitor your loan data. Quickly identify trends or anomalies to make decisions based on data and analysis. Access daily information on your loan originations. ECO gives you an end-to-end view of your portfolio. ECO: Enlightening and powerful.

ECO Trainingtraining about ECO

ECO Is Enlightening and Powerful.

ECO enables you to evaluate your performance, compare performance to your competitors, and optimize lending strategies. Monitor your loan data and quickly identify trends or anomalies to make decisions based on data and analysis. Get an end-to-end view of your portfolio, combined with synthetic peer data. And through ECO’s My Team feature, you can easily see the members of your account team and how to contact them if you have any questions or concerns.

If knowledge is power, then ECO is a force to be reckoned with.

Always up to date

The ECO management dashboards gives you and your colleagues at-a-glance, near real-time visibility into your portfolio of mortgages alongside relevant competitive data sets.

Ready where you are

ECO is a web-based platform designed for mobile and desktop users. Get insights 24/7 - anywhere you access the internet.

Share insights

With ECO, you can share charts and full reports with colleagues, even export to your favorite spreadsheet applications for further analysis.

Know what's happening

ECO integrates data from multiple sources to give you a complete picture of what's going on in your business.

Know where you stand

ECO let's you compare apples to apples - yours versus your competitors' - to help access your relative strengths and weakness.

Know what you need to do

ECO's tools enable you to think through possible future trajectories for your company.

Gain Insight Into Your Performance

Learn about the features and capabilities that make ECO indispensable for analyzing your business performance.

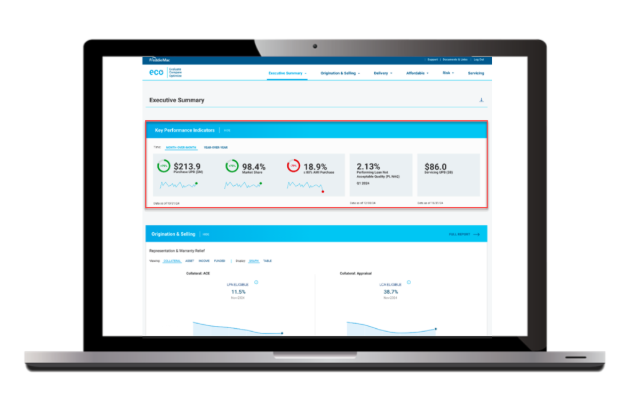

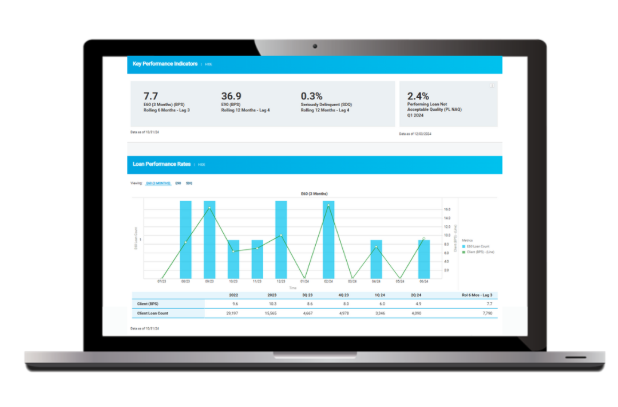

At-a-Glance KPIs

ECO displays metrics in multiple data categories and blends it into an Executive Summary.

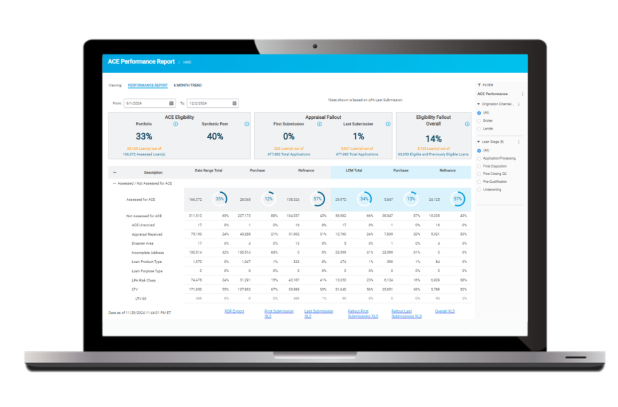

Origination & Selling®

ECO gives you daily information on your loan Origination & Selling along with loan-level exports. The Dashboards provide an aggregate view of your data across the different R&W relief offerings for collateral and capacity various opportunities in the pipeline and delivery of multiple offerings including Expanded Credit, Home Possible (Affordable), and Days saved dashboards.

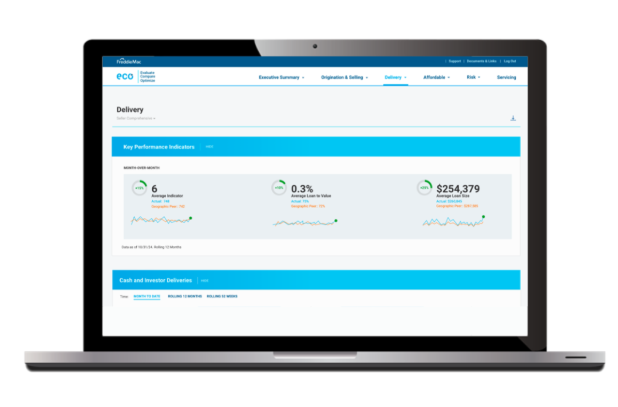

Delivery

ECO gives you a look at all loans funded based on the data you provide and filters it across several different paths, such as loan attributes, servicing option, execution method and delivery channel. There are also reports enabling you to track the Prepayment Speeds and Super Conforming volume.

Affordable

With ECO, you get the traditional affordable metrics that have historically been provided in previous reports. Affordable data may assist in determining progress on your Community Reinvestment Act (CRA) goals.

Risk

ECO displays the PLNAQ Rate the Credit standard loan performance metrics (i.e. ever 60 / ever 90 / SDQ) including delivery and loan characteristics.

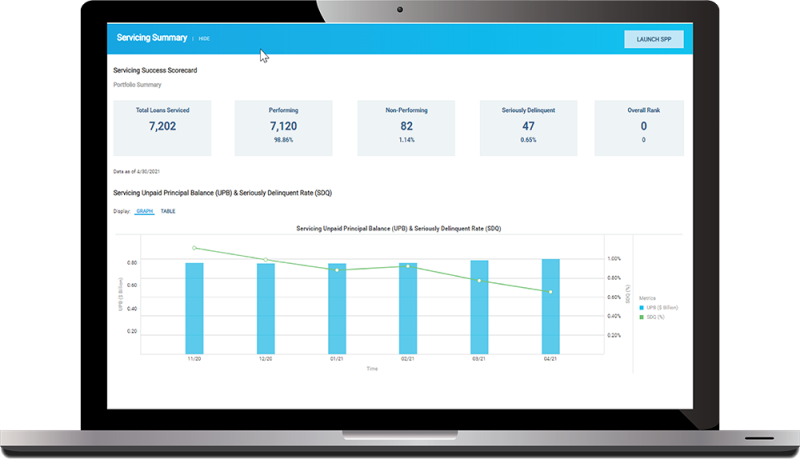

Servicing

ECO also includes top-line items from the Servicer Success Scorecard and highlights your overall portfolio and its performance.