Reducing Mortgage Cycle Times: Best Practices from the Top 25% of Performers

Numbers from new research tell a powerful story of mortgage industry progress during a time of both growth and enormous challenges.

The mortgage business is soaring amid low interest rates and pandemic-driven demand for low- to no-touch services. In a recent study, 78% of respondents said their firm’s overall revenues have significantly increased (57%) or stayed the same (21%). 87% also said that the COVID-19 crisis is proving to be a powerful catalyst for digitization of their firm’s mortgage processes.

As lenders accelerate their pursuit of the end-to-end digital mortgage, they are, notably, reducing mortgage cycle times, which the industry regards as a key efficiency measure.

Such reductions were well underway prior to the COVID-19 pandemic arrival, but the crisis has clearly furthered those efforts. It’s notable that some lenders are reducing mortgage cycle times better than others. How are they doing this, and what are the outcomes?

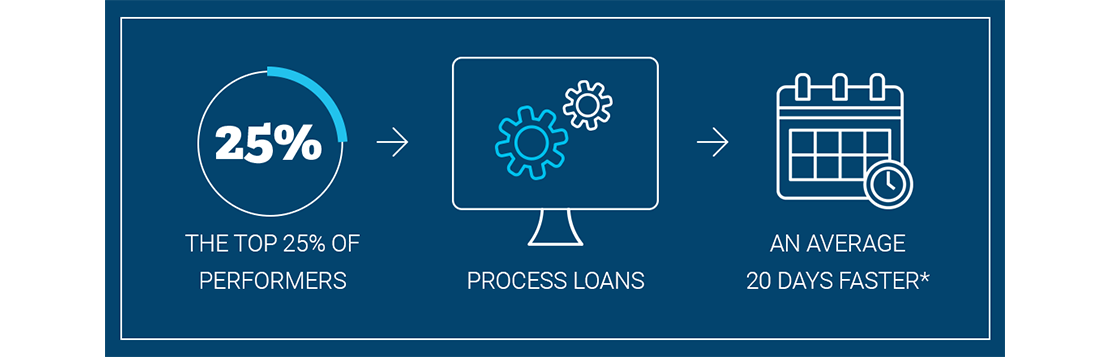

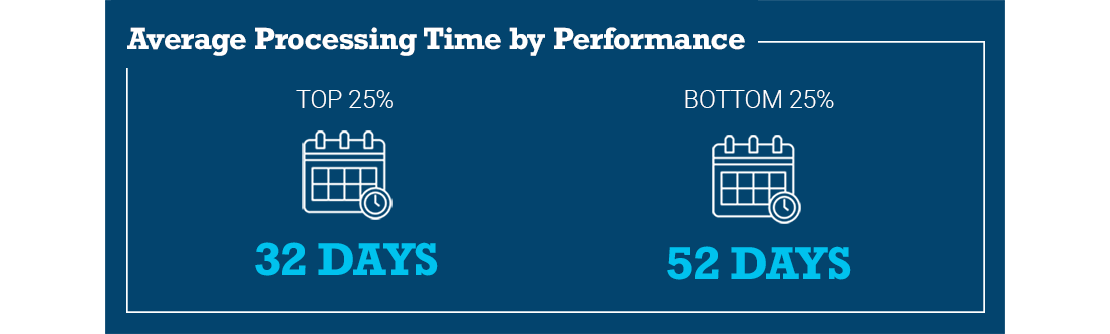

*Compared to the bottom 25% of performers.

New Research on Mortgage Cycle Times

According to the December 2020 Mortgage Closing Cycle Time Benchmark Study, the overall top 25% of performers process loans on average 20 days faster than the bottom 25% of performers (32 days vs. 52 days). This results in a savings of 63% in the average processing time.

This total includes home purchases and refinances and there is a small difference between them.

The top performers of home purchase loans process them 18 days faster than the bottom 25% companies, a savings of 58% in the average processing time.

For refinanced mortgages, the gap between top and bottom performers is even greater; on average, it takes 23 days, with top performers closing loans at a minimum of 74% faster.

What Can We Learn from Top Performers?

High volumes, enforced closures and social distancing could have caused mortgage closing cycle times to increase. Fortunately, the opposite has occurred. Lenders and mortgage professionals have avoided delays and seized opportunities to shorten cycle times. One word sums up the reason for this success: technology.

Lenders across all types and sizes understand the importance of technology to facilitate the mortgage process. It’s clear, however, that some are more successful in implementing technology than others.

The top performers are typically lenders who leverage digital technology effectively and integrate digital enhancements along with making needed changes to process management and operations.

The Mortgage Closing Cycle Time Benchmark Study gives us insights about these top 25% companies and what is driving better cycle time efficiencies for them. The following four best practices may help lenders and other mortgage professionals learn from how successful companies are leading.

Four Best Practices to Reduce Cycle Times

- Embrace automation

Success in today’s complex housing ecosystem requires levels of speed, accuracy and cost-efficiency greater than what people power alone can provide. Given that taking a loan application from start to finish isn’t simple, AI and machine learning are keys to success.

Automating repetitive tasks in the loan application process streamlines workflows and leads to greater speed and efficiency. AI technology – such as digitizing and indexing documents with optical character recognition (OCR) and tools that help lenders make credit decisions and assess customer risk levels – drastically cut manual labor times. Underwriting efficiency offerings like asset and income modeler (AIM) save time that companies can then spend on customer service and other tasks that only people can do effectively.

- Be smart about technology implementation

The traditional challenge for lenders attempting to create new technology is that systems used by all in the loan origination process have been dissimilar and unintegrated.

Lenders who leverage digital technology effectively are typically the ones who focus on integrating digital enhancements across all systems. These top performers set themselves apart by adopting easy to maneuver technology that is scalable and structured to incorporate external as well as internal digital platforms and tools.

It’s not just this integration that makes them successful. Companies who make their integrated technology thrive also focus on training, such as offering information and support relevant to each job and function. This training can include breaking down every automated process and showing how to review and document each loan properly without paper.

- Create effective digitization structure

Many leading lenders implement a digital infrastructure that leverages a mix of buy versus build when it comes to the technology they need. They look to build at least some proprietary internal capabilities but are also quick to take advantage of their partners’ tools and platforms, such as eMortgage capabilities, automated income/asset assessment, and document and rules management, among others.

Workflow and task management built outside of the loan origination system (LOS) significantly insulates the LOS by using APIs for basic functionality, while fully controlling the user experience within their own technology. These leaders also adopt a test and learn approach. What new features can they cost- effectively try out to determine efficacy prior to a more committed and costly rollout across their increasingly integrated systems?

- Put customers first

We’ve all come to expect that technology will give us what we need almost immediately. Given that, borrowers today don’t want to wait weeks for a loan decision, nor do they need to anymore. They expect speed, transparency, convenience and personalization, and they should. Not only is technology available to make their transactions easier and quicker, but also the quality is as reliable as from traditional processes.

Given the ongoing COVID-19 pandemic, customers are also demanding low-to-no touch experiences, too. This includes common aspects of the mortgage process such as pre-filling forms, managing applications, disclosures and signatures, as well as all customer interactions.

Top performers recognize that borrowers today want to be reached via the channels of their choice. So they make sure that no matter how a customer engages them – e.g. through a website or over the phone – those interactions will be pulled into an integrated digital system. That digital system must also be integrated with third parties so that appraisals, tax returns and other key documents and reports are seamlessly factored into the process.

This is especially important for millennials and Gen Xers who use multiple methods of communication to connect with their lenders more frequently than baby boomers. Direct communication across multiple channels is especially important to younger borrowers who are applying for a mortgage for the first time.

What’s Next?

What does the future hold for mortgage cycle times? With home purchases and refinances expected to remain strong throughout 2021, having high-quality, well-maintained technology will be more important than ever, especially since industry experts anticipate that closing cycle times will continue to shrink.

According to the 2019 Forbes Insights “Digital Mortgages: How Leaders Are Harnessing Tech,” 87% of lenders agree time between application and closing times will compress from months to 14 days or less.

Smart companies will continue to test out new capabilities in small pilots to allow for learning how to reduce cycle times even further. They should plan ahead to optimize new technology rollouts, which includes integrating the technology updates internally and with partners. They must also train staff to manage their ever-evolving systems and communicate effectively with customers.

Learn more about mortgage technology trends.