Technology Drives Business During the COVID-19 Pandemic

2020 will be remembered as one of the most challenging lending environments in recent history.

However, since the COVID-19 pandemic began, lenders and mortgage professionals have been able to keep business moving, despite widespread impacts such as social distancing and other safety precautions. While a historically low interest rate environment has contributed to this trend, so has the acceleration of technology and innovation.

A new Forbes Insights survey helps shed light on that progress and shows an upside amid these trying times. This research lends credence to the adage: the bigger the challenge, the bigger the opportunity for growth.

The Need for Technology and Automation

Lenders and mortgage professionals have faced so many technology and automation challenges during the COVID-19 pandemic. For example, if appraisers can’t enter homes due to COVID-19 restrictions, how will they complete their appraisals? If it’s unwise to meet with potential homebuyers in person, how will lenders get the homebuyers’ documentation needed to assess financial assets and employment to determine whether they qualify for loans? If you can’t meet in person for a traditional face-to-face closing, what do you do? These questions are just a few of the reasons why leveraging technology and automation, especially in this current environment, matters more than ever.

New Research Findings Support Digitization

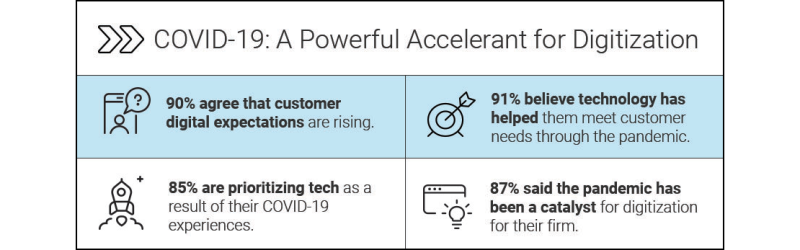

The pandemic is proving to be a powerful accelerant in terms of digitizing mortgage processes, according to a recent Forbes Insights survey.

For example:

- More than 90% of respondents agreed that customer expectations for a more robust digital mortgage experience are rising dramatically as a result of the COVID-19 crisis.

- While only a third of lenders indicated that they were ready for such a quick move, 87% said that the pandemic is proving to be a powerful catalyst for digitization of their firm’s mortgage processes in critical areas such as prequalification, applications, processing, underwriting, servicing and loss mitigation.

What the Findings Mean for Lenders and Mortgage Professionals

With the record-breaking volumes and demand for greater flexibility, it’s more important than ever for lenders to invest in automation to better compete. The survey found that:

- 91% believe technology played a key role in enabling their firms to meet the needs of customers and partners during this crisis.

- 85% say the experience they gained during this crisis is leading them to prioritize investment in technology and innovation.

What might be most striking is that respondents aren’t basing this on guesswork or estimates. In fact, 87% of respondents say demonstrable benefits of their technology investments to date are driving even more investments for the future. Clearly, lenders and mortgage professionals are banking on automated lender solutions to create more efficient, scalable processes that save money, reduce cycle times and deliver a better borrower experience.

Technology That’s Making a Difference

One area that’s been dramatically served by technology is borrower financial assessment. This used to be a hands-on, time-consuming and print documents-focused endeavor. New and enhanced technology and automation are helping provide reliable assessments of borrower assets and reduce risk for lenders.

Such innovations provide greater efficiency by allowing lenders to leverage data from third-party service providers to more effectively and efficiently assess borrower assets and income. This helps limit face-to-face interactions or required exchanges of paper documents during social distancing measures. The reliability provided by verified third-party data also helps reduce fallout in the loan origination process.

There’s also time and money to be saved – and safety to be assured – through higher tech, lower touch appraisals. Tools that leverage proprietary models along with historical data and public records allow lenders to originate eligible loans where appropriate without a traditional in-person appraisal.

On the Right Track

The new Forbes Insights research confirms what so many lenders and mortgage professionals already know. The move toward digitization isn’t going away after the pandemic ends. Innovative companies will keep enhancing their technology and automation capabilities as they look for opportunities to expand their business safely, securely and efficiently. This also means lenders can more efficiently serve borrowers in a way that minimizes underwriting risk to lenders, while helping families achieve sustainable homeownership.

Learn more about this topic and the future of technology trends.