We’ve Made it Easier to Manage Your QC and Remedy Data

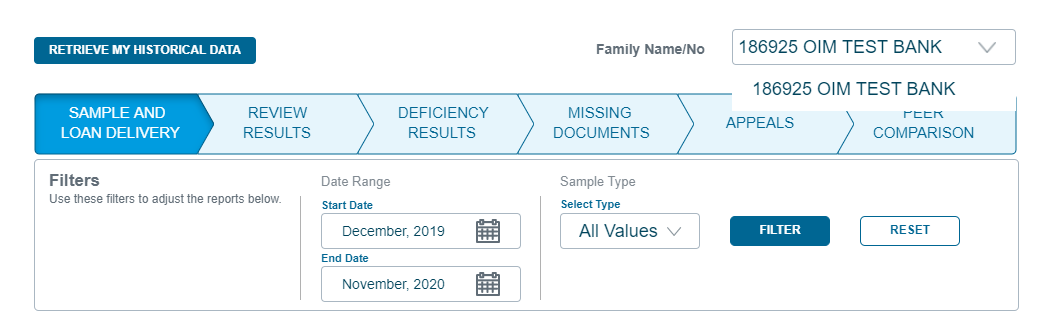

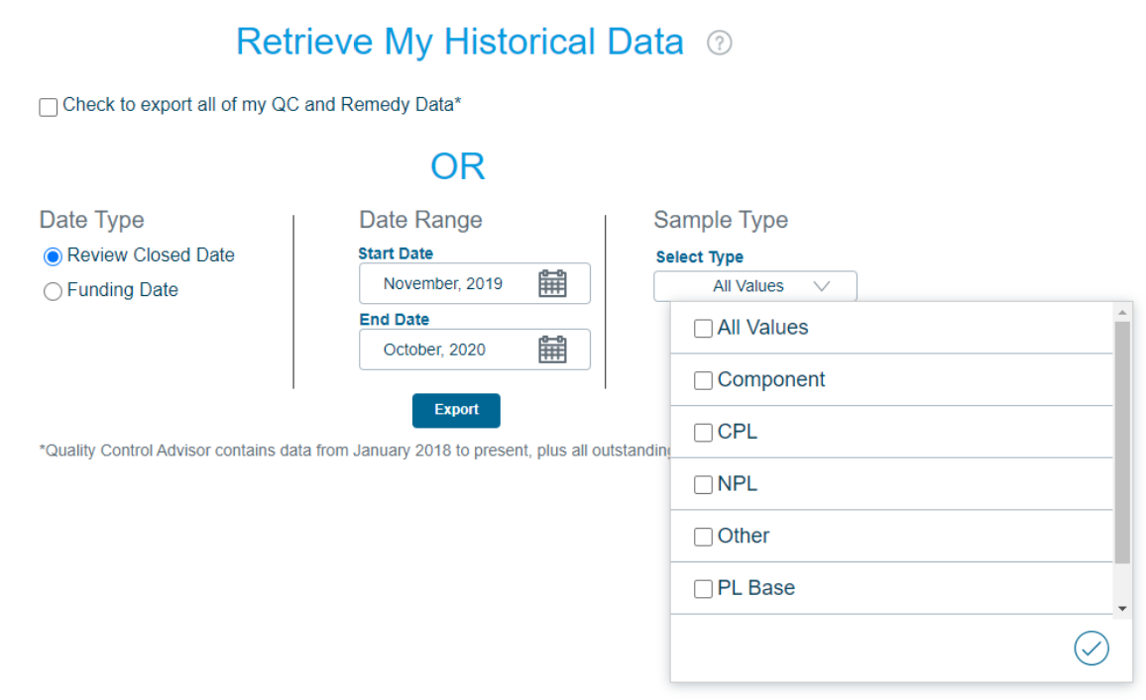

We just made it easier for you to manage the post-funding quality control (QC) and remedy process in Quality Control Advisor®. In September, we told you that component-based reviews (CBRs) were coming to the management reporting segment of Quality Control Advisor. Effective December 7, they’re now available. This means that when a loan is sampled as CBR, you’ll be able to track your progress throughout the tool. You can locate your CBRs under the management reporting function by selecting “Component” on the Sample Type filter. See image below.

Manage Your Quality Control (QC) and Remedy Data

Through the management reporting function, you can view your CBR loans and review your QC and remedy data through flexible reports and customizable dashboards.

It allows you to:

- Analyze QC data using both current and historical data, monitor key QC metrics and spot trends to help you identify and correct possible loan manufacturing process deficiencies.

- Create customizable dashboards to access and manage reports reflecting data on QC samples, loan file deficiencies, and file review pipelines.

- Generate flexible reports for further analysis or distribution within your organization.

Quicker Reviews with CBRs

Freddie Mac instituted CBRs as part of QC to review more loans over a shorter period of time, with additional focus on a specific area of risk. CBRs are quality control targeted reviews that will initially focus on employed and self-employed income plus employment and collateral, with an expectation that they will expand to additional components (such as assets, credit and eligibility) in the future. These targeted reviews won’t offer representation and warranty relief for the loan, which occurs with successful full-file reviews.

The documentation requested for the CBRs will be the same as the current pipeline review types, and the standard checklist will apply. You’ll be able to upload loan files, missing documents, and appeals, as well as address repurchase requests as you currently do for a full review.

Family Name/Number Field in Management Reporting

In addition, we’ve added a new field in management reporting. The Family Name/Number field auto populates with the name and unique identification number of the Seller/Servicer that is responsible for the mortgage and contains a dropdown list with associated Seller/Servicer numbers. See image below.