AIM to Take 5 and Save Days to Close

Our recent study, Digital Innovation Drives Loan Quality, showed how using Freddie Mac technology solutions can help you reduce defects, position loans as a more attractive purchase option and help them perform better over time. One of those technology solutions is Loan Product Advisor® (LPASM) asset and income modeler (AIM).

You already know AIM can help you improve loan quality. You might also know AIM does that by helping you automate your assessment of a borrower’s income, assets and employment. But did you know that taking advantage of that automation could help you save time? Here’s 5 ways you can use AIM to get more time back in your day.

#1: Stop the Paper Chase: Go “Direct” to the Source

No one likes waiting. Why wait for paystubs and W2s to be emailed, faxed or even sent in the mail – just go “direct” to the source. AIM can help you automatically assess a borrower’s income using direct deposits from a designated third-party service provider, so you and your borrower can get to the closing table faster Find out when you watch the video.

#2: 10-Day PCV in a Snap

Sure, there are a few different ways to verify a borrower’s employment to satisfy the 10-day pre-closing verification (PCV) requirement – a verbal acknowledgment, email or written verification of employment (VOE) chief among them. But AIM streamlines this process using account or payroll data from a third-party provider – saving you time and the hassle of tracking it down manually. Learn more - check out our reference tool.

#3: Expand Access to Credit

Does your borrower have limited credit history? Don’t let it be the difference between making a loan or not. With LPA you can use the same third-party providers and reports you’re already using to automate income, asset and employment assessment. Register for our webinar or watch our tutorials on rent payment history and borrower cash flow.

#4: Get the Power of One Report with Many Possibilities

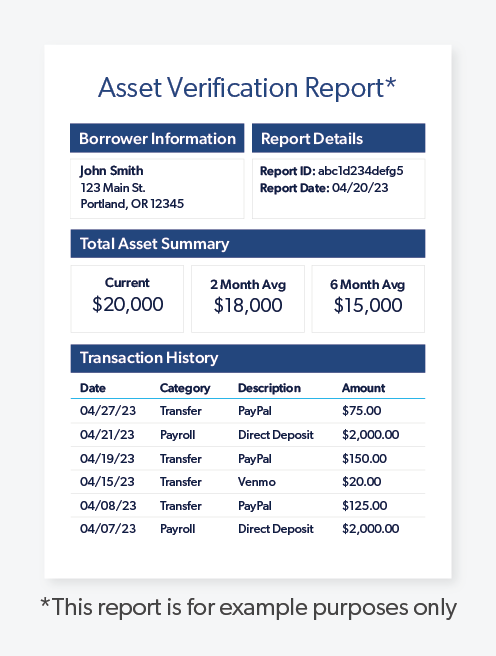

Just order an asset verification report from your third-party service provider, submit it to LPA and check out the results. Who knew one report could do so much? That’s the Power of One.

- Funds to close? Check.

- Verified income? Check.

- Automated employment verification? Check.

- Access to rent payment history and borrower cash flow analysis? Check.

Learn more - watch this video.

#5: It’s Not Rocket Science – It’s Simpler Self-Employed Income Calculation

Does the idea of a loan for a self-employed borrower give you a headache just thinking about calculating the income? It doesn’t have to be that way. With AIM for self-employed, designated third parties can leverage optical character recognition (OCR) technology to extract and process information from tax returns and summarize it in a simple and conveniently formatted workbook. Then LPA can tell you if the loan is eligible for representation and warranty relief not just on the income calculation, but on the business and income analysis too. It’s a faster, more efficient process that can help you generate more business. See how it works - view the self-paced tutorial.

Want to get started? AIM is already there in LPA through your loan origination system (LOS). You just need to contract with a third-party provider for AIM services. Check out our Exploring AIM webinar and find a provider.

Already using AIM? We’ve got resources available to help you make sure you’re getting the most out of it – check out our on-demand and live training options. View training.