Where to Next? Millennial Homebuyers and a Shifting Migration Track

Freddie Mac

Pinning down the migration and homebuying patterns of an entire generation of Americans is an ongoing exercise. That’s something millennials—those born between 1981 and 1996—keep proving. Previously pegged as coastal city dwellers, they have been migrating to smaller cities and towns in the West and South.

What’s causing this move? The COVID-19 pandemic and its effects on the economy and workplace flexibility add a new layer to previous conclusions about where and how millennials want to live.

While it remains to be seen how migration patterns will play out as a result of the pandemic, lenders and other housing professionals should stay on top of migratory data and the reasons behind the choices they make in order to tap into the immense buying power of this generation.

Millennial Migration by the Numbers

Nearly 22% of Americans are millennials, according to Freddie Mac analysis of 2019 U.S. Census data. Their prominence in the pool of potential homebuyers is solid: At 71.2 million strong, they’ve surpassed baby boomers as the largest adult demographic and are in their peak homebuying years.

As the analysis showed, millennials are the most educated generation—40% have at least a bachelor’s degree— and 33% hold student debt, which might foreshadow what could happen when a pandemic disrupts their jobs, expenses and lifestyle choices:

- The 2019 U.S. Census showed that across all states and regions, about 90% of millennials lived in metro areas, and more than four in 10 lived in high-cost city centers, with New York, Los Angeles, Houston, Dallas and Chicago topping the list.

- Looking at the actual population share of millennials in certain regions tells another story: Their share is growing in places like Utah, Nevada, Wyoming and Idaho.

- Nearly 60% reported having moved for job-related reasons, with affordability and lifestyle cited as well, and the pandemic is beginning to accelerate their desire to relocate.

Millennial Mortgages by Region and State

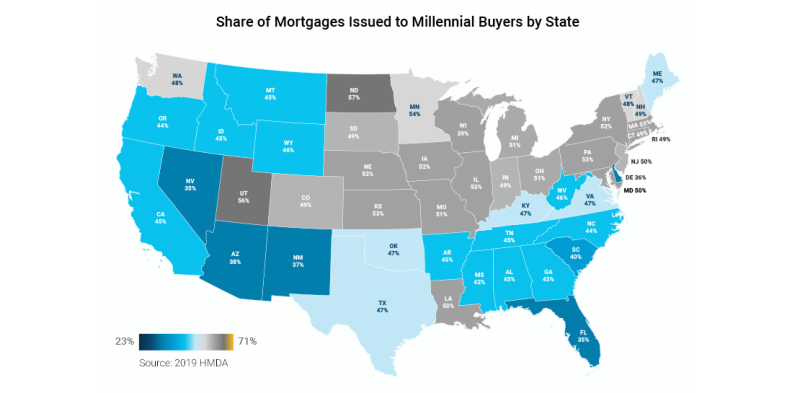

While millennials accounted for 47% of all mortgages bought nationwide by Freddie Mac in 2019, the concentration of loans purchased varied by region and state (see map). Most millennial mortgages were purchased in states with more affordable home prices compared with a national average.

While the states with highest shares of mortgages issued to millennial buyers were North Dakota, Utah, Minnesota, Illinois and Pennsylvania, the largest counts of mortgages came from Texas, California and Florida.

The Next Move: Impacts of COVID-19

Like the generations before them, millennials’ wants and needs change with age, but a once-in-a-generation event like the COVID-19 pandemic can accelerate change and push migration trends in unexpected directions.

Remote work circumstances spawned by the pandemic are already affecting millennial movement from high-cost city centers to more affordable regions

A recent Redfin survey showed two-thirds of homebuyers and sellers would consider moving (or have already) if remote work becomes permanent, and over half said they would move to a more affordable area.

The pandemic may also be driving more millennials into homeownership, improving their well-documented delay of transitioning from renters to homeowners. For example, since the pandemic:

- Millennial renters who were living in dense apartments that lack social distancing are now looking for safer and better-controlled environments.

- Consumer spending habits have changed and savings rates have increased. Drops in travel, weddings and other big-ticket expense items are contributing to more money being saved for a down payment, which we know is one of the biggest barriers facing millennials.

- An increase in out-migration from expensive city centers to the less urbanized regions as a result of expanded remote work possibilities has stimulated additional millennial demand for housing.

Keeping a close watch on millennials and their migration trends helps communities, lenders, real estate professionals and others in the housing industry who serve them attract their share of this large and important demographic group.

Subscription Center

Get and stay connected with Freddie Mac Single-Family. Subscribe to our emails and we'll send the information that you want straight to your email inbox.