Homebuying: A Generational Snapshot

Senior Director of Single-Family Affordable Lending

As we usher in the second Spring of the COVID-19 pandemic, we hope we’ll see a steady return to “normal.” Like other socioeconomic consequences of the pandemic, the 2020 housing market pushed some people ahead and left others, including many families, behind. Historically low interest rates fueled a refinance boom that helped existing homeowners and made potential homeownership more attractive for renters. However, a limited housing supply complicated the situation by driving housing prices up and further constraining affordability for first-time homebuyers (FTHBs).

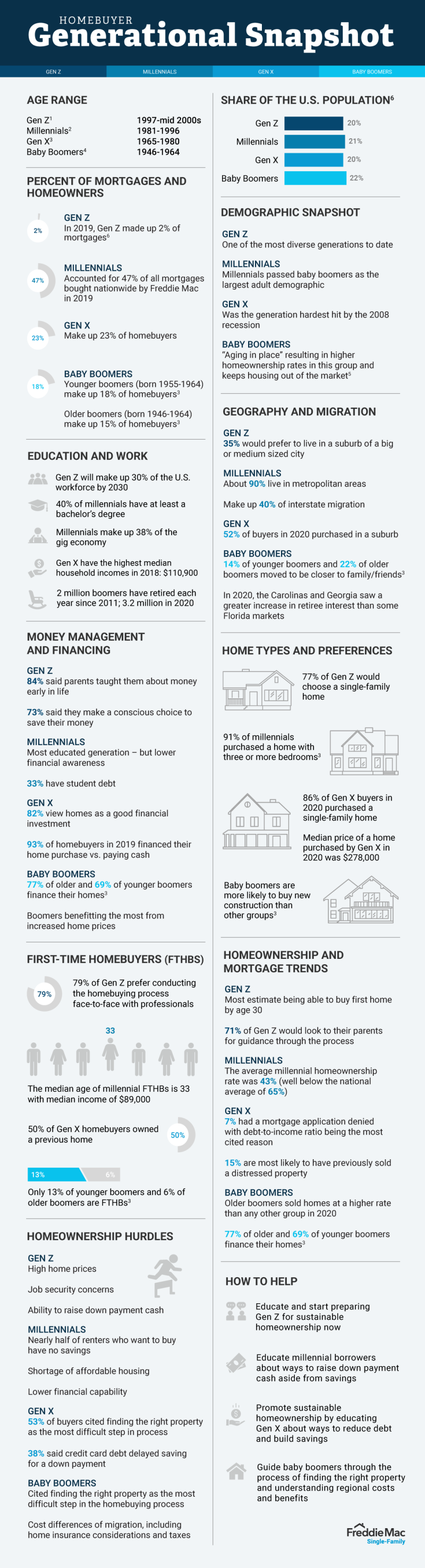

The outlook for 2021(Opens a new window) looks positive. Lenders can expect to see both post-pandemic and generational influences shifting homebuyer preferences, whether it’s Gen Z struggling to save that first down payment, millennials moving to larger suburban homes to continue working remotely or baby boomers preparing to downsize.

Read and share the infographic below for a snapshot of important characteristics among different generations of homebuyers.

While the size and complexities of today’s homebuyer population can’t be fully captured in a chart, gaining greater insight into the generational and stage-of-life influences on your borrowers is a good first step in helping you better understand their needs. With a process as complex and multi-layered as homebuying, building better insights on potential borrowers helps you formulate the right questions and lead them to the right resources and solutions—from financial education to down payment assistance—and ultimately to get them into a new home.

Sources:

- Gen Z: An Optimistic Borrower of the Futurepdf

- Deconstructing a Generation: Millennials: Homeownership Demographic Research(Opens a new window)

- 2020 Home Buyers and Sellers Generational Trends Reportpdf

- Baby Boomers Retired At A Record Pace In 2020.(Opens a new window)

- While Seniors Age in Place, Millennials Wait Longer and May Pay More for their First Homespdf

- A Millennial Sized Problem Stands in Front of Gen Z Homebuyers(Opens a new window)

Subscription Center

Get and stay connected with Freddie Mac Single-Family. Subscribe to our emails and we'll send the information that you want straight to your email inbox.