Servicer Embraces New Integration for Trickle-Down Benefits

A unique economic cycle like our current environment with the pandemic can cause a rise in delinquencies, and Servicers are going to great lengths to be prepared and respond to homeowners’ requests for relief.

“We need to be able to handle what is and what will continue to be a large number of exits out of forbearance, many of which will require a streamlined approach for resolving their hardship,” said the senior vice president of default operations of Cenlar, during a recent Home Starts Here podcast.

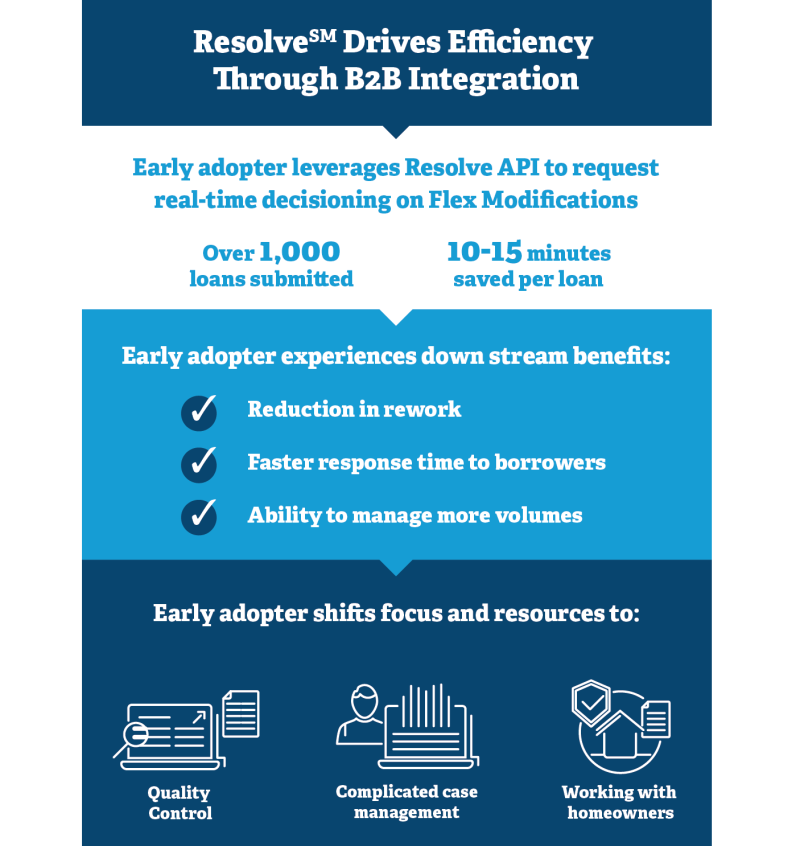

Cenlar is an early adopter of the B2B integration capabilities of our new loss mitigation solution, Resolve® – specifically in the adoption of application programming interfaces (APIs). Resolve delivers rapid, rules-based workout decisions to Servicers.

By adopting B2B integration capabilities through Resolve APIs, Cenlar has begun to turn challenges brought on by the pandemic into competitive advantages by speeding up borrower response times and using those time savings to refocus staff resources.

You don't wait to see a benefit, you see a benefit immediately, especially around staffing.

Housing Industry’s Resolve to Speed Up Mortgage Relief

It’s no secret that servicing has typically lagged compared to origination when it comes to digitizing the mortgage life cycle. By integrating with clients like Cenlar, we can automate the exchange of data and eliminate manual processes to determine the best solution for a homeowner in need of mortgage assistance.

When we allow technology to do its part and humans to do what they do best, everyone in the housing value chain benefits. The early outcomes from Cenlar demonstrated that Resolve APIs produced significant time savings, which allowed their servicing staff to spend more time assisting homeowners and dedicate more time on quality control and more complicated cases like exception requests.

Partnership Yields Positive Results

Cenlar worked with their technology solution provider, BackInTheBlack® (BITB), which provided the delivery conduit to directly integrate with Freddie Mac’s developer portal. Together, the trio collaborated through the planning, developing, testing and implementation to achieve optimal results.

Cenlar and BackInTheBlack began testing Resolve APIs with Flex Modifications. The direct B2B integration allowed BackInTheBlack to pull in critical data points like UPB, delinquent interest, property value and workout history from Freddie Mac into their platform. This data powered instant decisions on submitted Flex Modifications. Cenlar was able to get instantaneous eligibility decisions, get detailed rationale for an approval or denial and seamlessly move the case from trial through settlement without additional reporting to Freddie Mac.

“With this instantaneous decision, a Servicer can proceed with resolving a delinquency with the borrower, or take another course of action” says Pat Kopins, COO of BlackInTheBlack.

“I would say we've seen a reduction of about 10-15 minutes in processing time for underwriters on a per loan basis, which is a pretty good chunk of time. We're also seeing a reduction in rework due to defects as a result of less manual entry,” continues Cenlar.

Turning Time Savings into New Opportunities

The immediate benefits from real-time decisioning frees up time for staff because Resolve delivers data where Servicers need it, when they need it.

“It's better to have our valuable resources helping a homeowner – talking to them on the phone or working some other exception type processing – than laborious data input,” stated Cenlar in the podcast.

Evolving Capabilities Address Market Demands

The instantaneous decisions from API integration translate to faster workout decisions for struggling homeowners who need it. This is particularly important in today’s environment as it relates to COVID-19 policy changes – the foreclosure moratorium and term extensions for forbearance plans – which result in transitioning to a post-forbearance plan.

New APIs will be added to Resolve to provide essential functions and capabilities, leading to even more benefits. Resolve APIs recently expanded to include Payment Deferral and will eventually be enhanced to return a decision recommendation for all eligible workouts. The outcomes for Servicers, as well as homeowners and investors are unprecedented.

“The more we can automate, and the more types of workout options there are for the homeowner and give them relief faster, the better it is for everybody. It's really a win-win-win for the homeowner, the investor and for us on the Servicer side as well,” says Cenlar.

Get Started and Get Integrated

Early adopters like Cenlar have emphasized and demonstrated the benefits of taking the next step and propelling your business to a more automated model. Make the most of what Resolve has to offer by getting started with API technology. Visit the Resolve API web page for more information and to request to integrate with us.

“Resolve will allow the Servicer to deal with these much larger volumes, while allowing us to service our client and homeowner a lot faster and a lot more transparently,” concludes Cenlar.