Updated AMI Limits to Qualify More Borrowers

Reach more borrowers with more savings. The Federal Housing Finance Agency (FHFA) recently issued updated area median income (AMI) limits, which we use to determine whether a borrower’s annual qualifying income meets the income eligibility requirements for Freddie Mac Home Possible®, Freddie Mac Refi Possible® and Freddie Mac HFA Advantage® mortgages. We also use the AMI limits to determine whether a loan is eligible for the credit fee cap for first-time homebuyers or for certain Duty to Serve mortgage products as announced in Single-Family Seller/Servicer Guide (Guide) Bulletin 2022-22.

With the updated AMI limits, you’ll be able to offer even more flexibility and affordable lending opportunities to your clients. The new AMI limits apply as follows:

- Home Possible Eligibility: income must be less than or equal to 80% of the AMI for the location of the mortgaged premises.

- Refi Possible Eligibility: income must be less than or equal to 100% of the AMI for the location of the mortgaged premises.

- HFA Advantage Eligibility: lenders who participate in an HFA program should consult the HFA’s website for income eligibility and associated pricing of their HFA Advantage offerings.

- Credit Fee Cap: upfront credit fees for certain borrowers and affordable mortgage products are capped depending on the AMI% as described in Guide Exhibit 19A.

To support the updated AMI limits, on June 8, 2023, Freddie Mac will be updating Loan Product Advisor® (LPA℠), the Home Possible® Income and Property Eligibility Tool, the Refi Possible® Income and Property Eligibility Tool, the Area Median Income and Property Eligibility Tool and the Income Limits and Affordable Check application programming interfaces (APIs) with the new AMI limits. This means you may be able to offer Home Possible, Refi Possible and HFA Advantage mortgages to even more borrowers. As a reminder, the AMI limits for Home Possible mortgages apply as follows:

- If the mortgaged premises is located in a county where the AMI has declined and you submitted the loan before June 8, Loan Product Advisor will apply the higher 2022 AMI. This means the loan will remain eligible if there are no changes in the borrower’s circumstance, no changes in the property condition and the loan was originally an income-eligible Home Possible mortgage.

- If the mortgaged premises is located in a county where the AMI has increased and you submitted the loan before June 8, Loan Product Advisor will apply the higher 2023 AMI in determining possible income eligibility for Home Possible or Refi Possible mortgages.

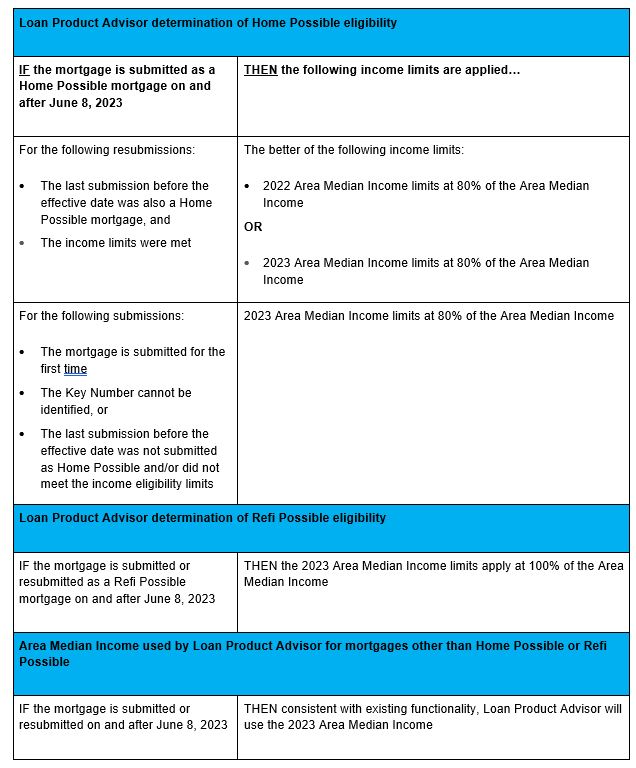

Loan Product Advisor will apply the updated AMI limits for Home Possible and Refi Possible mortgages as follows:

Additional Information

- 2023 AMI Spreadsheet: Includes AMI, Low-Income AMI, Very Low-Income AMI and highlights the amount of change from 2022 in addition to the number of tracts by county.

- 2023 AMI Counties by State Spreadsheet: Includes AMI, Low-Income AMI, Very Low-Income AMI and highlights the amount of change from 2022 in addition to the number of tracts by county, separated out by state.

- 2023 AMI with Tract Indicators Spreadsheet: Includes AMI, Low-Income AMI, Very Low-Income AMI and various tract indicators by county, in addition to a comparison to prior years.

- 2023 Median Family Income (MFI) Raw File: Raw MFI file with territories included.

- 2023 MFI Read Me File: File provided by the FHFA that explains the raw MFI file.

For More Information

- Contact the Customer Support Contact Center (800-FREDDIE) or your Freddie Mac representative.

- Read Single-Family Seller/Servicer Guide (Guide) Bulletin 2023-13.