Participating in the URLA Limited Production Period

Today with Fannie Mae, we published a joint announcement inviting lenders who meet specific criteria to participate in the Uniform Residential Loan Application (URLA) limited production period beginning August 1, 2020. During this period, lenders will be using the redesigned URLA (Freddie Mac Form 65) and updated Freddie Mac Loan Product Advisor® v5.0.06 specifications to originate loans in a controlled implementation.

Purposes of the Limited Production Period

The limited production period is designed as a “test and learn” in the production environment prior to the open production period beginning on January 1, 2021. The rollout is intended for a small, controlled number of experienced Loan Product Advisor v5.0.06 users to assist Freddie Mac in identifying and mitigating production issues before the start of the open production period. The limited production period enables testing of the following origination essentials:

- Redesigned Form 65 and data handoffs – Ensure that the redesigned Form 65 and Loan Product Advisor v5.0.06 request and response files can be exchanged successfully with all applicable business partners throughout the entire loan application and underwriting process.

- Verified software product outputs – Verify that lenders’ third-party software file submissions to Loan Product Advisor v5.0.06 return the expected feedback.

- Internal operational readiness – Confirm that all business units within lenders’ organizations are prepared to accept the redesigned Form 65 and use Loan Product Advisor v5.0.06 data.

Freddie Mac will begin the limited production period by granting a limited number of our clients access with others receiving access on a rolling basis. As each group successfully submits loan files in the production environment, successive groups may become larger and more frequent.

Lenders are not required to enter the limited production period with both Freddie Mac and Fannie Mae (the GSEs) at the same time; however, this may be the easiest implementation approach. If you deliver loans to both GSEs, you may contact your GSE-specific representatives for help with coordinating your access.

Participation Criteria

Organization Eligibility – Retail Channels

When the limited production period begins August 1, 2020, only retail channels of existing Sellers will be eligible to participate. Working with the retail channel will allow the GSEs to test the three capabilities outlined above in a controlled implementation. Lenders can begin testing with their remaining channels during the open production period as their business partners become ready.

We ask organizations that are not existing Freddie Mac-approved Sellers wait to use the redesigned form and Loan Product Advisor v5.0.06 until the open production period begins January 1, 2021.

Note: Freddie Mac representatives will begin reaching out to their clients to discuss their interest in participating, and to track implementation progress. If you believe you are a candidate for the limited production period but do not meet the participation criteria, please reach out to your Freddie Mac representative anyway.

Prerequisites

To participate in the limited production period, Freddie Mac Sellers (with Freddie Mac Seller IDs) must meet certain prerequisites, including:

Freddie Mac Loan Product Advisor® v5.0.06 System Testing

Direct Integration

If lenders are developing and implementing proprietary interfaces, they must successfully submit specified cases and Loan Product Advisor v5.0.06 technical requirements to ensure their point of sale (POS) and loan origination system software (LOS) have been approved by Freddie Mac. View our Freddie Mac-approved software partners. Successful completion validates that you are technically ready to begin submitting loan application files in the production environment.

Details about Loan Product Advisor v5.0.06 verification testing requirements can be obtained from the lender’s Freddie Mac account representative.

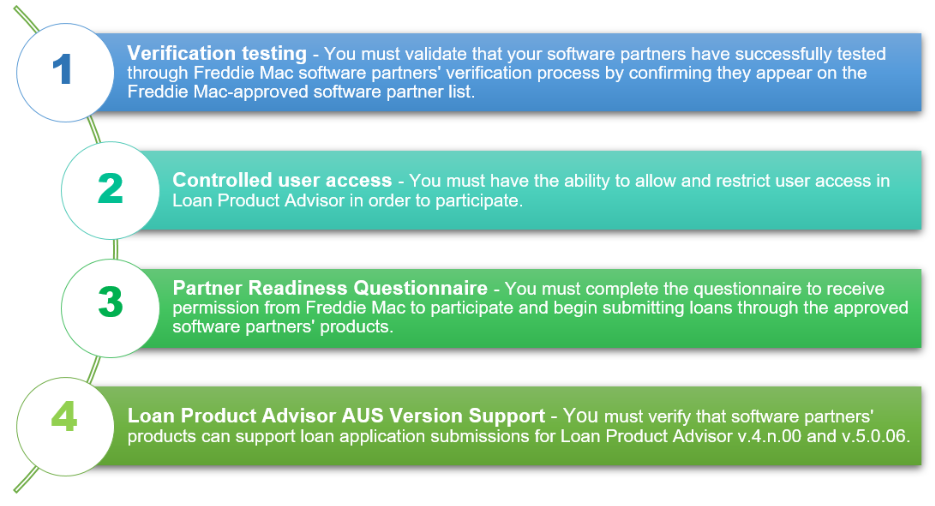

Lenders Working with Software Partners

Lenders using third-party software to submit loan files using Loan Product Advisor v5.0.06 can participate in the limited production period provided you meet the following requirements:

Partner Readiness Questionnaire

Note: Lenders must Lenders POS and LOS products must restrict user access to the new versions of Loan Product Advisor by individual clients or organizations within a client (e.g., channel).

The Partner Readiness Questionnaire provides a checklist for transitioning your internal origination organizations, front office, internal touchpoints, technology and external partners to the redesigned Form 65 and updated Loan Product Advisor v5.0.06 data, and that the readiness has been communicated to these partners.

Note: Lenders must develop contingency plans with their partners in case system issues arise.

The following table lists the sections included in the Partner Readiness Questionnaire:

|

Section |

Purpose |

|

Information about Freddie Mac Seller interested in participating during the limited production period. |

|

Questions about lender’s internal organizations, policies, processes and procedures to ensure readiness to support Form 65 and Loan Product Advisor v5.0.06. |

|

Checklist to ensure software partners’ products are Freddie Mac-verified and that you have tested with them and are ready to use their products for production. |

|

Checklist to ensure that service providers (e.g., credit reporting agencies, income/asset verification, doc prep, MI, quality management, due diligence, etc.) are ready to produce, consume, and submit loans based on the redesigned Form 65 and Loan Product Advisor v5.0.06 specification. |

|

Information for the GSEs about implementation. |

Freddie Mac will evaluate each participation request and communicate next steps for participation in the limited production period along with the process for using Loan Product Advisor v5.0.06 and the redesigned Form 65 prior to January 1, 2021.

Note: The GSEs will follow GSE-Specific processes when approving and notifying lenders for participation in the limited production period.

For Lenders Who Want to Participate

If you have any questions about the limited production period or are interested in participating, contact Freddie Mac as follows:

Complete the Freddie URLA/ULAD Limited Production Period Questionnaire Request Form or reach out to your Freddie Mac representative for more information.

The completed questionnaire must be submitted no later than July 1, 2020, for consideration in the first wave of the limited production period beginning August 1, 2020.

Note: Completion of the questionnaire does not guarantee entry in the limited production period (see the prerequisites)

The GSEs will grant access to additional lenders interested in participating in the limited production period on a rolling basis. If you want to start later in the limited production period take note of the schedule in the following table when submitting your completed questionnaire.

|

Participation Wave |

Deadline for Submitting Completed Questionnaire |

Potential Start Date |

|

1 |

July 1, 2020 |

August 2020 |

|

2 |

August 1, 2020 |

September 2020 |

|

3 |

September 1, 2020 |

October 2020 |

|

4 |

October 1, 2020 |

November 2020 |

|

5 |

November 1, 2020 |

December 2020

|

Additional Information

Access a complete implementation timeline and the supporting materials referenced on Freddie Mac’s URLA web page.

If you have questions about these updates, please contact your Freddie Mac representative or send an email to [email protected]