Just Released: New Area Median Income and Property Eligibility Tool

Last October, in response to the Federal Housing Finance Agency (FHFA) news release, Freddie Mac announced targeted pricing changes, including the elimination of upfront credit fees for certain borrowers and affordable mortgage products with specific limits on the borrower’s income as a percentage of area median income (AMI%).

As defined in the Single-Family Seller/Servicer Guide (Guide), the loan’s AMI% is the total income used to qualify the borrower(s) for the mortgage converted to an annual basis divided by the AMI applicable to the location of the mortgaged premises.

New Area Median Income and Property Eligibility Tool

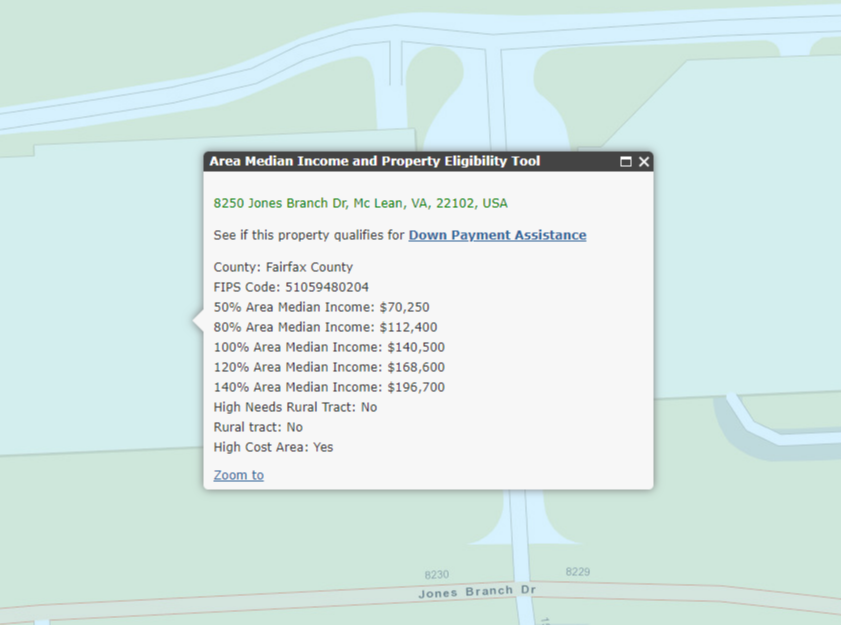

To help you determine whether a loan may be eligible for a credit fee cap, as detailed on Exhibit 19 and Exhibit 19A, Freddie Mac developed the new, map-based Area Median Income and Property Eligibility Tool*. When you enter a property’s address, the tool will return pertinent information, such as the AMI% for that location and whether your low- to moderate-income borrowers meet the AMI% requirements for certain Freddie Mac mortgage products. The tool’s data elements include:

- County Location

- FIPS Code

- 50% AMI

- 80% AMI

- 100% AMI

- 120% AMI

- 140% AMI

- High Needs Rural Tract

- Rural Tract

- High-Cost Area

Additionally, the Area Median Income and Property Eligibility Tool offers a link to an online resource that helps determine whether borrowers are eligible for down payment assistance.

Prior to delivering the loan to Freddie Mac, you’re encouraged to use the Area Median Income and Property Eligibility Tool in conjunction with the credit fee caps as described in Guide Exhibit 19 and Exhibit 19A, prior to loan delivery. This tool can assist you in identifying which loans may be eligible for a credit fee cap based on related attributes (e.g., AMI%, affordable mortgage product, property type, and first-time homebuyer). Final eligibility of the mortgage loan is determined by Loan Selling Advisor®.

Reminder: For eligible loans to be assessed the first-time homebuyer credit fee cap, Sellers must complete delivery requirements in accordance with Exhibit 1: Instructions for Completing the Borrower First Time Homebuyer Indicator in Loan Selling Advisor.

For more information contact your Freddie Mac representative or call the Customer Support Contact Center (800-FREDDIE).

*The Area Median Income and Property Eligibility Tool reflects the 2022 AMI limits provided by the FHFA.