Loan Product Advisor Specification v5.3.00 Preview

We know you want to originate more loans, turn more qualified borrowers into homeowners and do it efficiently with minimal risk. That’s why we’re continuously improving our tools and technology to back you up in your borrowers’ homebuying journey.

We’ll soon be updating the Loan Product Advisor® (LPASM) specification to version 5.3.00 to include enhancements that will promote affordable product eligibility, support accessory dwelling units (ADUs) policy expansion, provide functionality improvements and more.

With the implementation of LPA specification version 5.3.00, we’re announcing the retirement of LPA specification versions 5.0.06 and 5.1.00, effective March 2024. By upgrading to the latest version, you can capture and send required data with minimal workarounds to achieve the most accurate LPA feedback response.

Here’s a preview of what’s to come:

LPA Feedback Response Updates

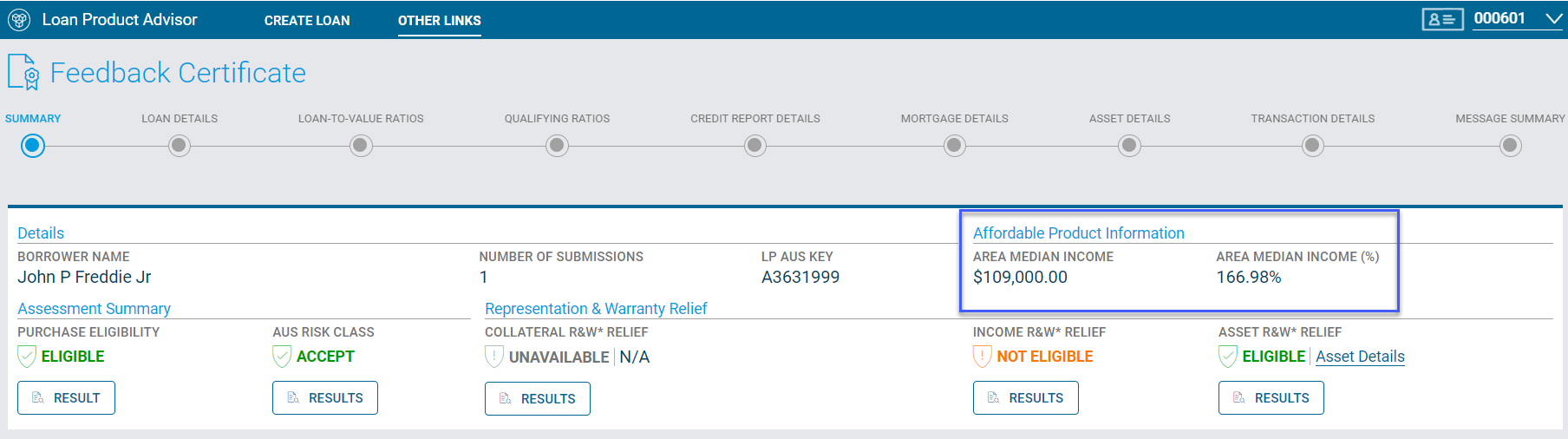

Affordable Product Information Section

The area median income (AMI) and the borrowers’ total qualifying income as an AMI percentage will be new values shown on the LPA Feedback Certificate to provide quick access to information that will help you better understand the loan’s affordable product eligibility.

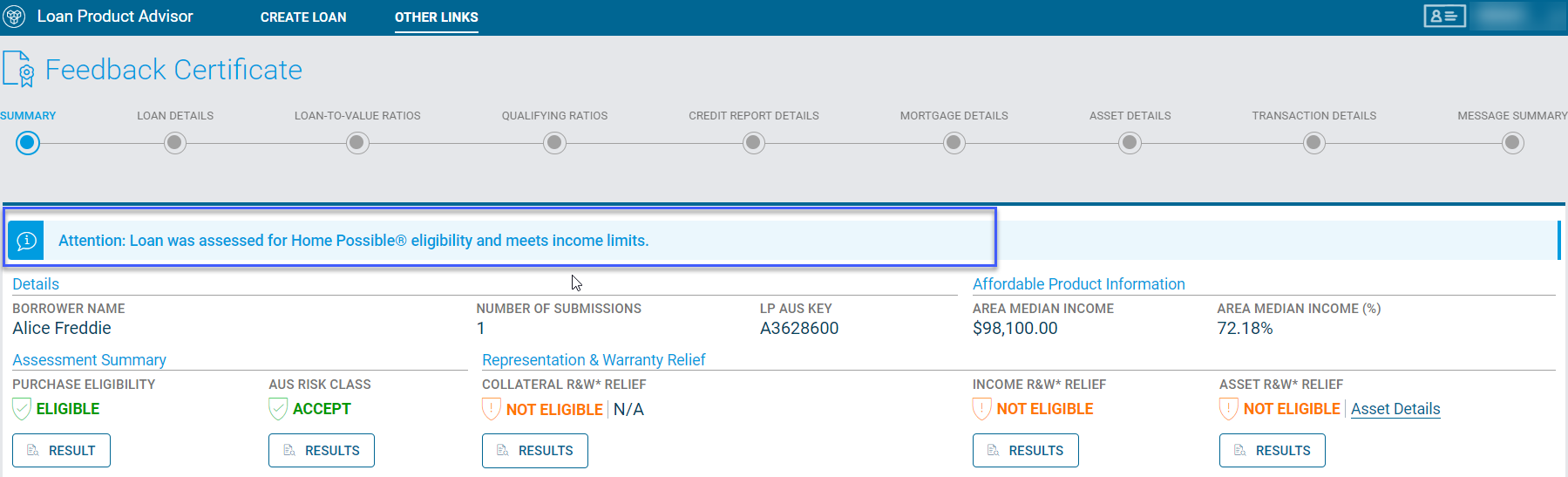

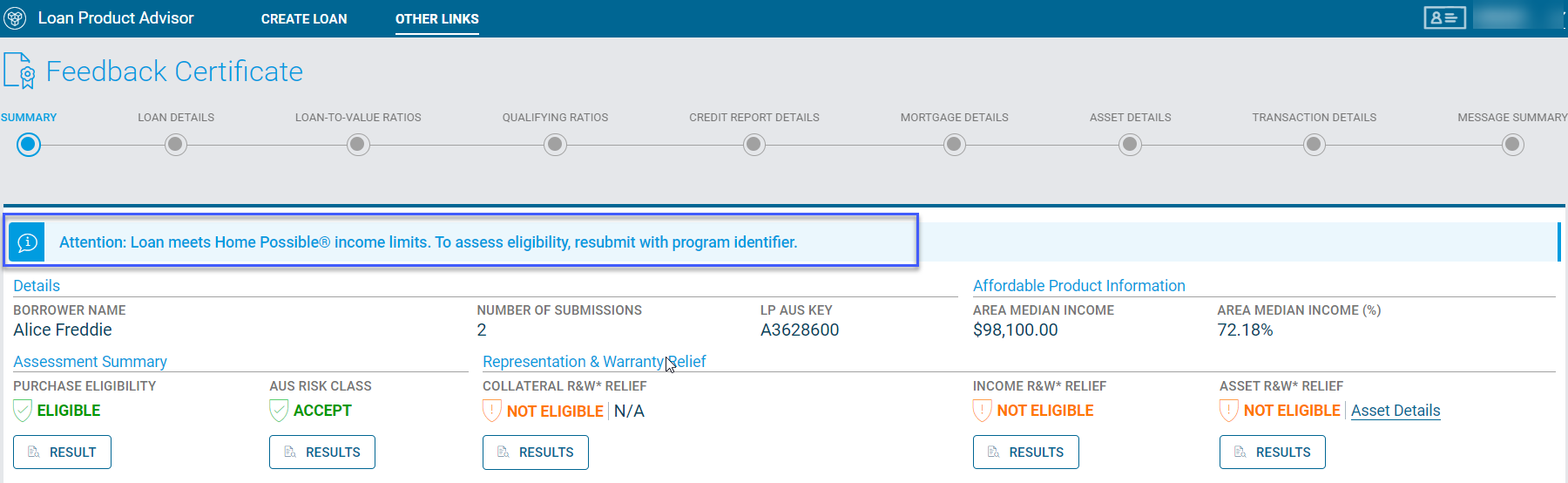

Freddie Mac Home Possible® Eligibility Banner

To help you originate more affordable loans, this new banner will appear at the top of the LPA Feedback Certificate and will either indicate if the loan was submitted as a Home Possible mortgage and meets income limits or if the loan was not submitted as a Home Possible mortgage but may be eligible because it meets income limits.

If the loan was submitted as a Home Possible mortgage and meets the Home Possible income limits, you'll see this banner:

If the loan meets Home Possible income limits but was not submitted as a Home Possible mortgage, you’ll see this banner:

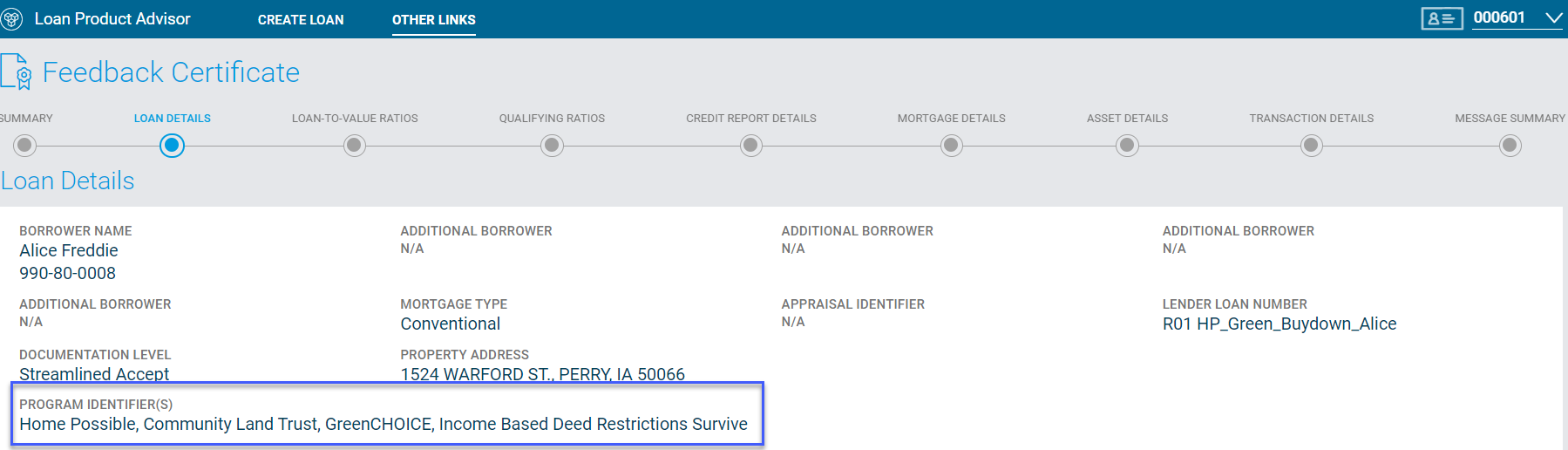

Program Identifiers

Currently, LPA only displays one offering identifier at a time in the Mortgage Details, even if multiple program identifiers were submitted. With specification version 5.3.00, the field name is being updated to “Program Identifier(s),” moving to the Loan Details section and will now be able to display up to seven program identifiers, making it easier for you to qualify more borrowers for affordable loans.

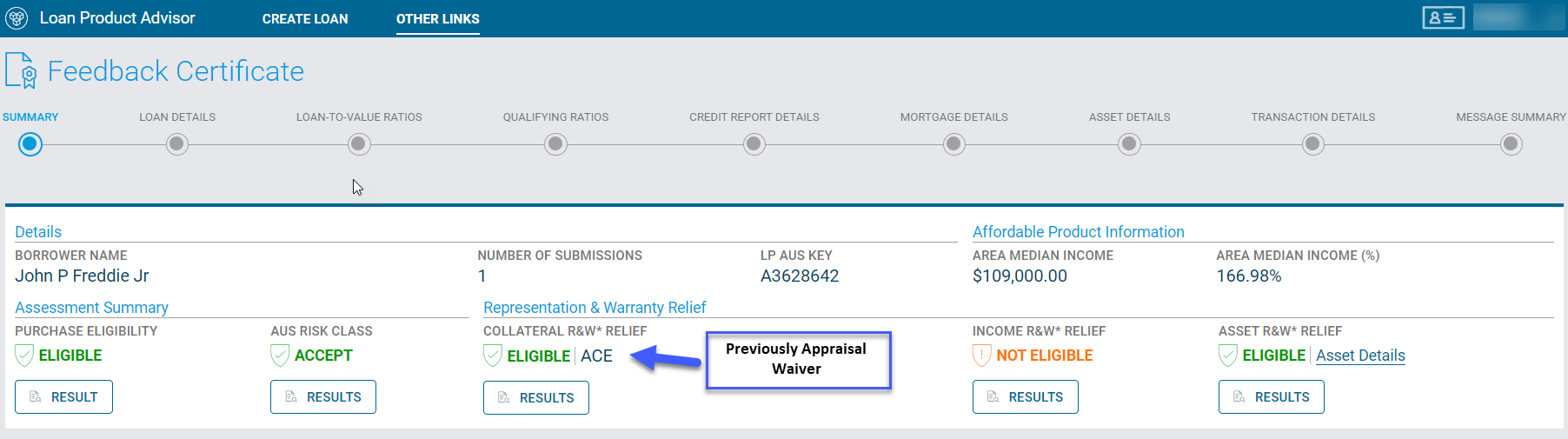

Collateral R&W Relief Description Updates

To help better identify eligibility for collateral representation and warranty relief (R&W), the Collateral R&W Relief Description Types in the Collateral R&W Relief section will be updated to display new values of rep and warranty relief that could be returned in the LPA assessment:

- ACE

- ACE+ Property Data Report

- Desktop Appraisal

- Hybrid Appraisal

- Traditional Appraisal

- Property Data Report (future enhancement)

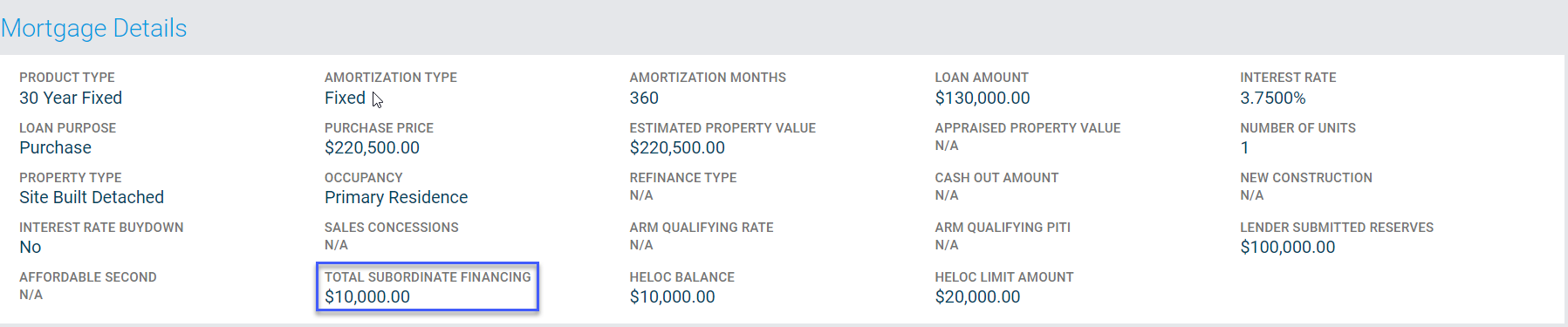

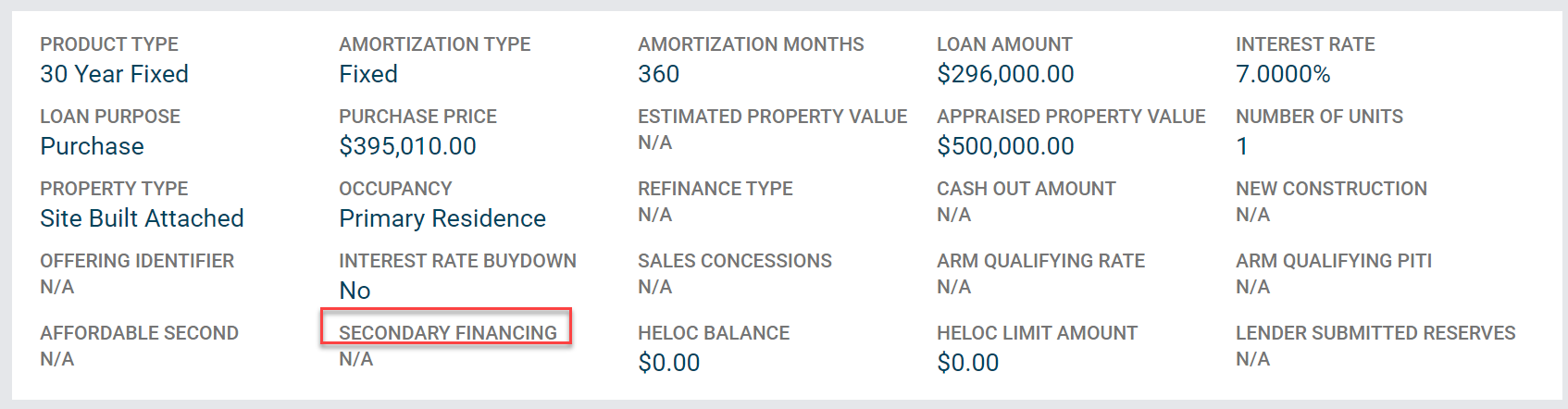

Subordinate Financing LPA Feedback Certificate Display

In the Mortgage Details section, the field name currently displays as "Secondary Financing." This label will be updated to "Total Subordinate Financing" to provide a more accurate description of the additional financing on the property.

For specification version 5.3.00, you’ll see Total Subordinate Financing as shown below:

For specification versions 5.2.00 and lower, you’ll continue to see Secondary Financing as shown below:

ADU Policy Expansion

Subject Properties with ADUs

LPA specification implementation notes will be updated to advise that the use of the Income Type “Accessory Unit Income” is only for ADU income generated by a subject primary residence. This update will also apply to previous LPA specification versions.

With specification version 5.3.00, you’ll be able to supply the number of ADUs on a subject property even if accessory unit income is not being used to qualify.

Functionality Enhancements

Liability Payment Includes Taxes Insurance Indicator

This field was previously indicated on the specification as being available for future use and will now be functional.

Adjust Requirement to Associate a Mortgage Loan to a Real Estate Asset

The LPA specification currently requires each real estate owned asset be linked to a mortgage loan/Home Equity Line of Credit (HELOC). With specification version 5.3.00, LPA will remove the requirement to associate mortgage expenses to properties that are no longer associated to the borrower.

Prior Specification Version Retirement

Effective March 2024

Versions 5.0.06 and 5.1.00 of the LPA specification will be retired in March 2024. New submissions after this date will need to use a more recent version.

Full details will be announced with the LPA Specification Bulletin targeted for March 21, 2023. This communication is intended solely as a preview of the coming changes. If you have any questions about the changes announced in this preview, please contact your Freddie Mac representative, or call the Customer Support Contact Center (800-FREDDIE).