Freddie Mac and Fannie Mae Publish Implementation Timeline and Supporting Documents for Revised URLA and Updated AUS Specifications

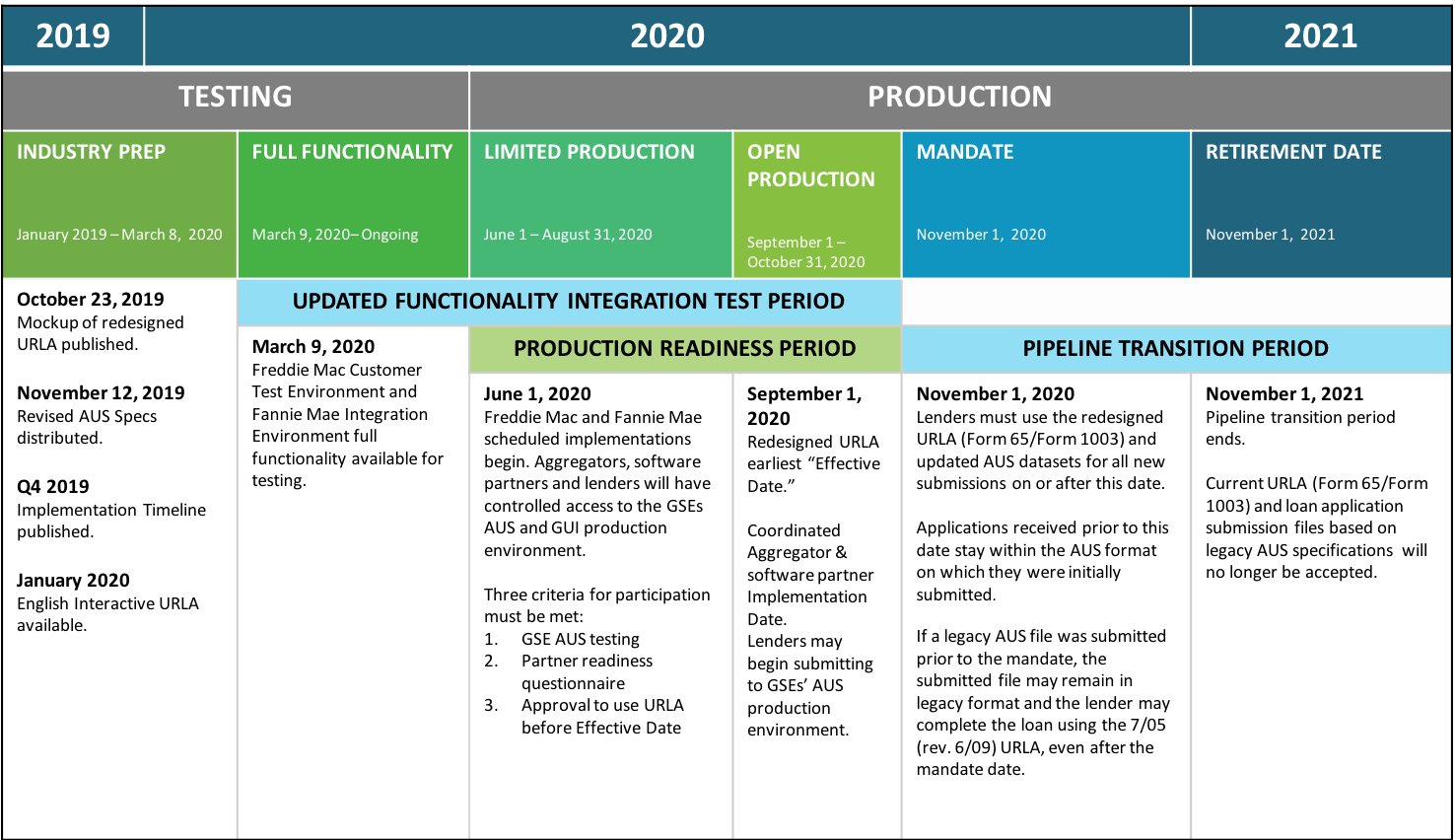

Freddie Mac and Fannie Mae (the GSEs) have published the revised implementation timeline for the redesigned Uniform Residential Loan Application (URLA) and updated automated underwriting systems (AUS). The new mandate date for the use of the redesigned URLA and AUS specifications is November 1, 2020.

URLA Implementation Timeline

The implementation timeline includes six segments that are described in detail below.

Industry Prep

On January 1, 2019, the Freddie Mac customer test environment (CTE) and Fannie Mae Integration Environment began accepting MISMO v3.4 loan application submission files in their AUSs from directly integrated customers. These test environments remain accessible. Revisions based on the latest URLA changes and specification updates will start being applied to the test environments soon. Details about the updated URLA documents and AUS specifications referenced below are provided in the joint GSE announcements published on August 8, 2019, October 23, 2019, and November 12, 2019. Many of the AUS specification updates were made in response to customer feedback from early testing.

| INDUSTRY PREP |

| January 2019 – March 8, 2020 |

|

PURPOSE: Provide industry with the information needed to prepare for the implementation of the redesigned URLA and updated AUS datasets. MILESTONES:

WHO: All participants in the loan application process INDUSTRY ACTIVITIES:

Work with each GSE to obtain updated certification/validation test cases |

Full Functionality Testing

The GSEs encourage directly integrated lenders and software partners to complete preparations for accessing the AUS test environments and/or continue integration testing now through March 9, 2020 when the AUS test environments will be fully provisioned with capabilities supporting the November 2019 specifications.

| FULL FUNCTIONALITY TESTING |

| March 9, 2020 - Ongoing |

|

PURPOSE: Provide industry with a dedicated period to test with GSE AUSs, including GUIs, that reflect AUS specification revisions published in November 2019 MILESTONE: March 9, 2020

WHO: Directly integrated lenders and software providers INDUSTRY ACTIVITIES:

Loan Officers and their teams undergo training on the redesigned URLA and accompanying supporting processes and procedures |

Limited Production

This phase can be thought of as a “test and learn” period. The GSEs will begin accepting the MISMO v3.4 loan application submission files in production on a limited basis. Aggregators, software partners, and lenders will have controlled access to the GSEs’ AUS and GUI production environments. Controlled access will be granted upon validation of prerequisites and completion of a readiness questionnaire. Only participants in the Limited Production phase will be allowed to use the redesigned URLA.

| LIMITED PRODUCTION |

| June 1 – August 31, 2020 |

|

PURPOSE:

MILESTONE: Entry to the GSEs’ production environments must be scheduled with the GSEs starting on June 1 through August 31, 2020, and is contingent upon meeting GSE Limited Production entry requirements as defined below WHO: Any AUS directly integrated customer who has demonstrated technical and operational readiness to the GSEs INDUSTRY ACTIVITIES: In order to enter Limited Production directly integrated customers must:

|

Open Production

Starting September 1, 2020, all lenders may submit the MISMO v3.4 loan application submission files to the GSEs’ AUS production environments and begin using the redesigned URLA.

| OPEN PRODUCTION |

| September 1 – October 31, 2020 |

|

PURPOSE:

MILESTONE: Industry participants may enter production on a date of their choice any time between September 1 and October 31, 2020 WHO: Any industry participant who is ready and did not enter production during the Limited Production period INDUSTRY ACTIVITIES:

|

Mandate and Start of Pipeline Transition Period

Starting November 1, 2020, all lenders must submit the MISMO v3.4 loan application submission files to the GSEs’ AUS production environments and use the redesigned URLA.

| MANDATE AND START OF PIPELINE TRANSITION PERIOD |

| November 1, 2020 – October 31, 2021 |

|

PURPOSE:

MILESTONES:

WHO: All industry participants INDUSTRY ACTIVITIES:

|

Retirement Date

On Nov. 1, 2021, the current URLA (Form 65/Form 1003) and loan application submission files based on previous AUS specifications will no longer be accepted.

| RETIREMENT DATE |

| November 1, 2021 |

|

PURPOSE: Set deadline on and after which the 7/05 (rev. 6/09) URLA, MISMO v2.n AUS datasets, and DU v3.2 Flat File will no longer be accepted or supported MILESTONE: November 1, 2021 WHO: All industry participants INDUSTRY ACTIVITIES:

|

URLA/ULAD Supporting Documents Published with this Announcement

The following Freddie Mac-specific documents will be published at a future date:

- Loan Product Advisor v5.0.06 Test Case Binder.

The GSEs are on track to publish the interactive (fillable) PDF version of the updated redesigned URLA in early 2020.

Additional Information

We are committed to helping our customers and other industry stakeholders understand and adopt the updated redesigned URLA and AUS specifications. We will continue to work closely with lenders and technology solution providers to assist them throughout the implementation process.

The documents referenced in this announcement, as well as other supporting materials, can be accessed on Freddie Mac’s URLA web page or Fannie Mae’s URLA web page.

If you have questions about the redesigned URLA, AUS Specifications, or supporting documents, please contact your GSE representative or email [email protected] or [email protected]