How eMortgages and Digital Closings Are Creating a Better Mortgage Process

You’re dreaming of your family’s new home. But when you consider the approaching closing date, you feel overwhelmed by the process. You envision receiving a mountain of paperwork the day of your closing appointment and are anxious about not being able to review it carefully in advance. You worry about making mistakes or missing a signature on the important documents. In the wake of COVID-19, you may also feel less safe completing the closing or signing the necessary agreements in person. You can deposit a check and buy stock online, but you can’t sign your mortgage from the safety of your home?

This scenario is an increasing reality for homebuyers in the current housing market. However, innovative ways to safely and digitally retrieve, upload and sign the necessary documents are making this processes easier. The delivery of eMortgages and digital closings – also known as eClosings – is creating a better, more secure client experience during the mortgage process.

Digital as the Way

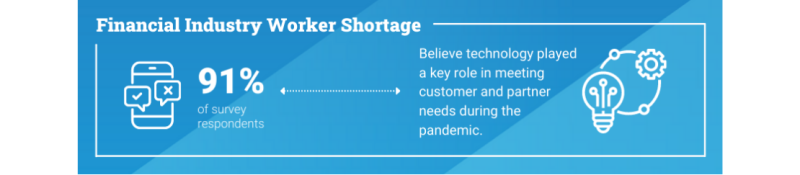

The need to ensure the health and safety of all parties involved in the transaction during COVID-19 health emergency has proven to be a powerful catalyst to the housing industry’s slow, steady move toward digitization of many housing processes, according to a 2020 research collaboration between Freddie Mac and Forbes Insights. The survey found that 91% believe technology played a key role in enabling their firms to meet the needs of customers and partners during this crisis.

And 85% say the experience they gained during this crisis is leading them to prioritize investment in technology and innovation.

Many companies are focusing on innovation and moving the mortgage closing experience online with eMortgages and digital closings. For example, Amrock, a national provider of title insurance, property valuations and settlement services, conducts tens of thousands of appraisals and mortgage closings monthly and has established a platform that reduces paper, streamlines workflows and creates efficiencies to improve the quality of the closing experience. A continued focus on growing their digital footprint helped Amrock to deliver more solutions during the challenges of 2020.

Digital Evolution Through Partnerships

While traditional pen and paper mortgage and closing processes have enabled homeownership for decades, manual steps can create inefficiencies and introduce opportunities for human error that contribute to increased costs and delays to the closing transaction. For example:

- Documents must be printed and shipped, increasing the risk of materials being lost or delayed in transit – which can severely affect turn times.

- The loan is finalized with a manual audit of the closing documents to determine that it meets title company, lender and municipal standards for recording the transaction.

“Transitioning from a traditional closing process to a digital one didn’t happen overnight,” said Julie Bryson, solution architect for Amrock. “We collaborated closely with our lender clients and have helped educate their team members and clients through training and communication efforts to make sure everyone was on the same page about the benefits of eMortgages and digital closings.”

Amrock started the transition to digital mortgage closings by performing extensive research that included business process mapping and technology analysis. The Amrock team established a feedback loop with lenders, technology providers and business process experts who had complementary goals and could lend expertise that would ensure their success.

New Approach Gains Momentum

After gathering insights and establishing a plan, they launched pilot eMortgage closings that were closely monitored to identify opportunities and make necessary modifications. Amrock focused on automating closings by critically assessing every step of the process with the objective in mind.

“While we knew we could handle a small volume of digital closings in the early stages of piloting eMortgages by guiding and handholding loans through the closing transaction, our team also understood that we needed to redefine our approach as we moved closings online at scale,” said Brian Hughes, CEO of Amrock. As a result, the Amrock team made digital closings part of their workflow as they continue to scale.

The Path Forward

The need for eMortgages is increasing. In 2020, eMortgage origination volume for Freddie Mac increased by more than 330% compared to the previous year. Companies that have realized the benefits are quickly embracing eMortgages. While the pandemic is pushing adoption even faster, this shift toward making the mortgage process smoother, safer and more efficient through eMortages and eClosings is likely here to stay. Companies like Amrock are surveying their clients and finding that homebuyers who have never participated in the traditional mortgage closing process tend to prefer and expect a digital closing.

Lenders need to deliver a more digital experience due to changing borrower expectations and the need to be competitive as other mortgage companies offer increasingly digital solutions. As more lenders embrace eMortgage systems, Freddie Mac is ready to meet the demand. Learn more about Freddie Mac’s role in expanding eMortgages and remote or hybrid closings.