Hispanics Are Having a Positive Effect on Homeownership Rates but Challenges Remain

By the Numbers

Despite the growth, the rate of homeownership among Hispanics – 45% – is 26 percentage points below the rate for whites (71%), based on 2015 data, according to a Freddie Mac report. The gap is expected to narrow as Hispanics have been the only ethnic demographic group to raise their homeownership rate each year since the 2015 housing recession, according to a new report.

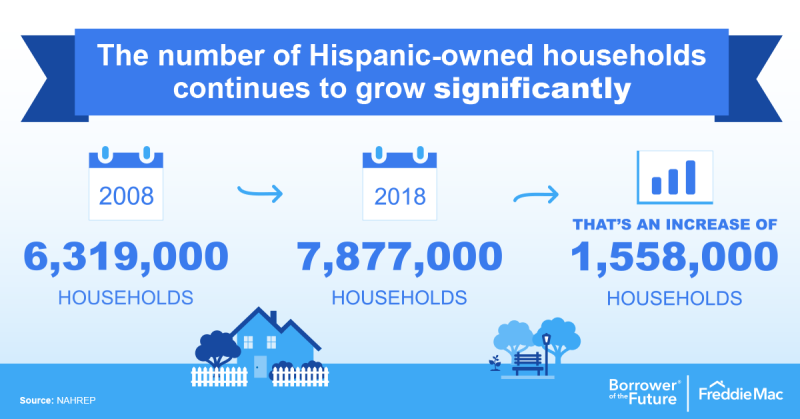

Hispanics have accounted for 62.7% of net US homeownership gains over the past decade. Approximately 485,000 new households were formed by Hispanics in 2018, accounting for more than a third of total U.S. household formations. Other key findings:

And the growth is steady—Hispanic homeownership in 2018 was at 47.1%, up almost 1% from both 2017 and 2000.

New Mexico and Texas had the highest rates of homeownership, but in every other state (besides California) where more than 30% of the population is Hispanic, their rate of homeownership is above 50%. It is projected that 56% of all new homeowners will be Hispanic by 2030 as household formation, income trends, age, and consumer sentiment will continue to drive the rate of homeownership, according to the report.

Challenges Remain

Despite the household growth, some Hispanics face significant roadblocks to homeownership. As with the population as a whole, a lack of housing opportunities due to a shortage of skilled construction labor, a dearth of affordable housing in many areas and credit-related challenges for some have prevented some Hispanics from getting a mortgage.

According to the report, the primary obstacles for Hispanic consumers to getting a mortgage are:

- Insufficient credit score.

- The inability to afford a down payment.

- Insufficient income for monthly payments.

Ways to Address

Lenders and other mortgage professionals can help borrowers address the above potential barriers with:

- An online educational site with tools and information for prospective homebuyers.

- Low down payment options for qualified borrowers.

- Automated assessments for borrowers lacking a credit score.

- A self-employed borrower income verification solution.

- An industry-standard site with a Spanish-language mortgage glossary and free translated mortgage homebuyer documents.

Also, Hispanics are active users of the internet, and they use smart phones to shop, bank and pay bills more than any other U.S. demographic. Lenders should consider leveraging digital and mobile marketing strategies to effectively engage this group as Hispanic homeownership continues to grow and shape the market.

If you haven’t already, make sure to subscribe to get timely access to industry research and insights.