Better Understanding of Credit Can Help Close Racial Homeownership Gaps

The homeownership gap between white and some minority groups in the U.S. is distressing for its pervasiveness and persistence. According to the Urban Institute, the white-Black homeownership gap is now 30%--larger than the 27% gap that existed in 1960 before the Fair Housing Act of 1968.

The subprime mortgage crisis disproportionately affected Black homeowners as new mortgage originations declined while foreclosures and other reversals in homeownership increased, wiping out gains in Black homeownership rates.

Many forces combined to create the racial disparity in homeownership. It’s critical for the housing industry to continuously and collaboratively work toward dismantling the homeownership barriers challenging aspiring Black and Hispanic homebuyers. Lenders can play a critical role: One way is through credit awareness and education.

Our new study examines the role of credit attributes that are likely used by lenders to originate new mortgages and the extent to which credit, as compared to other factors, contributes to the white/minority disparity in new mortgages. The findings might surprise you.

Uncovering Racial Barriers Within Credit Attributes

Using credit bureau data, the study tracked a group of consumers likely to not be homeowners in 2012 to find out how their credit profiles, among other factors, influenced their decision to obtain a home mortgage by 2018.

We then used various techniques to see if the data could explain the racial/ethnic gap in rates of transition to new mortgages. The average FICO score in the sample was 668. The study found that within the sample, Blacks were one half, and Hispanics two-thirds, as likely as whites to transition to mortgage ownership.

But how could the data explain this broad disparity? Here are some noteworthy findings:

- While many factors went into the decision to enter mortgage ownership—age, income growth, marital status, local unemployment rates, local house prices—consumers with lower and missing credit scores or inadequate credit histories were less likely to acquire new mortgages.

- Gender, household-level debt (including student loan debt), and education level played less of a role in the transition to a mortgage.

- Blacks and Hispanics are more likely than whites to have low credit scores, insufficient credit histories, no credit scores, delinquencies, and high debt liabilities, making them less likely to transition into new mortgages.

- The relationship between mortgage inquiries and entry into mortgage ownership appears to be much stronger for whites than for minorities, indicating that even when minorities show a strong interest in mortgage ownership, they are not transitioning at the same rate as whites.

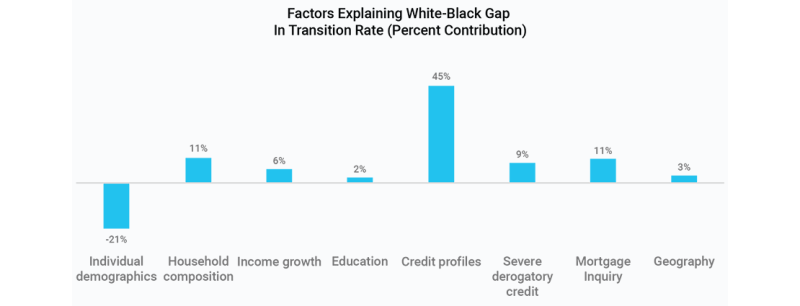

However, credit profiles were the biggest contributor to the racial/ethnic gap in the transition rates. Credit profiles contributed 45% to the white-Black gap in transition rate into new mortgages (see FIGURE 1).

These findings add a deeper, more nuanced understanding to the racial homeownership gap, which was previously often attributed to differences in income/wealth and household characteristics. Now, with a better understanding of the role of the actual measures of credit risk used by lenders to account for racial disparities in the rate of transition to new mortgages, the lending industry can build a roadmap to help address homeownership gaps.

Becoming Part of the Solution

A 2019 Freddie Mac survey showed that, of renters who plan to purchase a home, 20% of low income and 16% of middle-income renters said they had low confidence in their knowledge of building credit.. An even higher percentage—26% and 19%, respectively—lacked confidence in their knowledge of managing personal finances and credit.

The mortgage industry has an opportunity to help educate and guide future borrowers in strengthening credit for homeownership.

A better understanding of the role of credit is an important first step in the homebuying process. This can help first-time homebuyers, particularly in the wake of COVID-19 and resulting financial uncertainty.

Lenders need to start early in educating borrowers about their credit score by helping them:

- Understand what goes into their credit score, so they know where to focus their efforts.

- Clarify misconceptions about how high their credit score needs to be so they don’t assume a mortgage is out of reach.

- Understand how to build and maintain strong credit, such as obtaining one or two credit cards and paying them on time.

- Explain the importance of pre-qualification.

- Understand how to resolve credit disputes.

- Find financial education programs for low- to moderate-income individuals in minority communities.

Credit counseling and education can go a long way to help minority groups close the homeownership gap by putting them in a better position to qualify for a mortgage. And just as importantly, it can help them sustain their mortgage to build wealth and ride out the next economic crisis.