Women “Opting Out” of the Mortgage Industry Can Significantly Impact Organizations

The advancement of women’s careers in the financial services industry may be showing signs of progress. Just recently, Citigroup announced that Jane Fraser will succeed CEO Michael Corbat in February, becoming the first women to lead a major Wall Street bank.

Yet some industry watchers say the advancement of women within the workplace is too slow for today’s competitive labor market and too scattered for the industry to reap the proven benefits of having more women in leadership roles. Women still make up less than 20% of the highest-level jobs that have profit-and-loss responsibility in American banking, insurance, and mortgage companies, according to the Harvard Business Review report, “Female Leaders on Reaching Financial Services’ Upper Ranks.”

Having too few women at the top is both a cause and an effect of women feeling disenfranchised with the industry. A recent Korn Ferry Institute study predicts that by 2030, the financial and business services sector will be short about 10.7 million workers globally. In a knowledge-based industry and in a country where women make up the majority of college graduates, mortgage and housing organizations cannot afford to lose women who opt out of the workforce. Prioritized focus should be on attracting, retaining, and promoting them.

In other words, mortgage companies should be asking themselves, “When women weigh the costs and benefits of staying versus leaving, which will they choose?”

Women Opting Out Hurts Business

Even though men and women enter the financial services industry in roughly equal numbers, according to the Harvard report, more women exit the industry mid-career—just as they’re ready for development into senior roles. This can potentially hurt companies since more women in executive leadership roles often yield greater results for organizations. For example, a recent McKinsey report found that companies “in the top-quartile for gender diversity on executive teams were 21% more likely to outperform on profitability and 27% more likely to have superior value creation.”

Investors and shareholders are recognizing the value of diversity and inclusion and are putting more pressure on companies to achieve it.

Organizations whose top leadership positions reflect the diversity of their customer base do a better job of understanding and meeting the needs of their customers.

One recent study from Oliver Wyman estimates that the financial services industry is missing out on a $700 billion revenue opportunity from better serving women as customers.

Why Women Choose to Leave

Many women face tough decisions when it comes to their careers. And when some choose to leave their jobs they also decided to exit the entire industry, citing that they believed the problems they encountered were so pervasive they’d find them at other financial services firms, according to the Harvard report.

Challenges that may lead to women to walk away from the industry include:

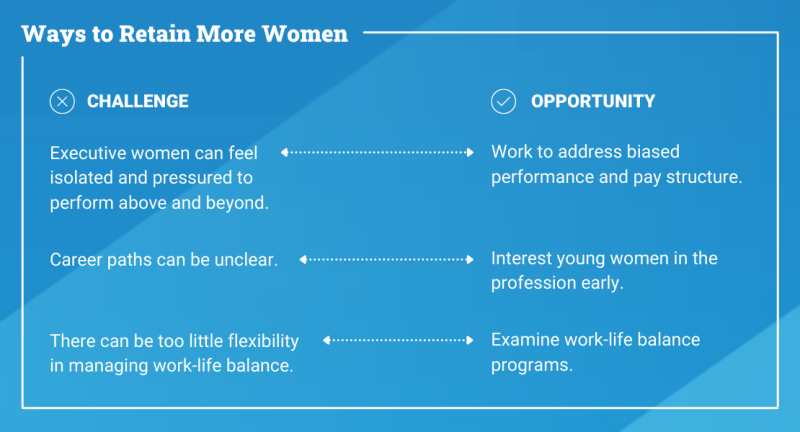

- A “boy’s club” atmosphere that many financial services companies can’t seem to shake. One woman interviewed for the report noted that while she’s comfortable being the only woman at a meeting, not all women are. Executive women can feel isolated and pressured to perform above and beyond when they feel they’re representing an entire gender.

- Unclear career paths. Having the right team of supporters can make a significant difference in one’s career. Because men are more likely than women to have a career support team, they often get ahead in greater numbers than women.

- Too little flexibility in managing work-life balance, particularly when they’re ready to raise a family.

To address some of these concerns, companies are leveraging benefits and career opportunity programs; however, there is more to do.

Ways to Retain More Women

Retaining more women and creating a path that steers deserving leaders into the ranks of senior management often means that organization need a compelling value proposition for women at all career stages. The Harvard report offers some helpful advice:

- Interest young women in the profession early and show them the many career path options available to them.

- Work to address potentially biased performance rating systems and pay structure.

- Use mentorship and sponsorship to help promising women with networking, career path, and advocacy support.

- Examine work-life balance programs and make sure women (and men) aren’t being punished for using them.

- Offer a re-entry path, such as a “returnship” program with skills-update training, for those who take time out for family.

- Review harassment policies—including scenarios involving harassment from external vendors and clients—and make sure they encourage transparency, open dialogue and trust. Show women that clear and decisive disciplinary will be taken against perpetrators no matter who they are.

Rebranding an entire industry and changing cultures takes time, but the mortgage industry needs to accelerate the pace of change in order to attract and retain the talent needed to help with the many challenges ahead. Proving that the industry is a place where women can thrive should be a top priority.