The Homeownership Rate: Are Demographics Destiny?

Overview

Today, the homeownership rate is less than 63 percent, the lowest rate in half a century. It has been declining for over a decade and experts are projecting it will continue to keep falling—perhaps even below 60 percent.

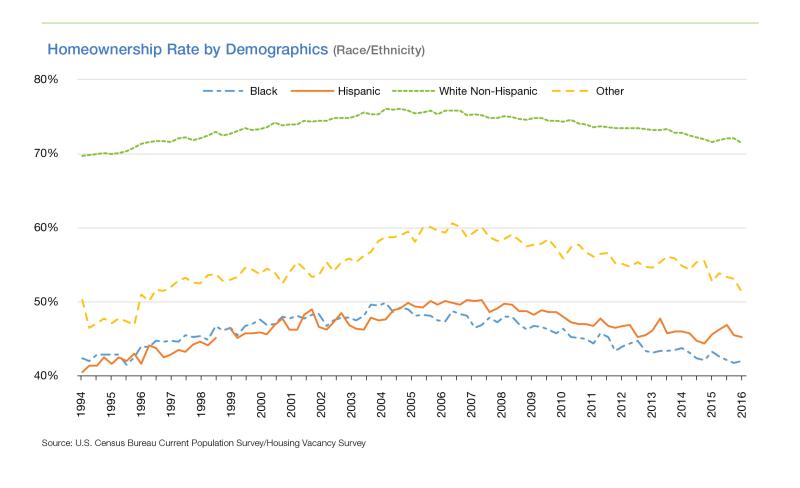

This decline in the homeownership rate has triggered debate among housing experts. Of particular concern is the pronounced drop in the homeownership rate in demographic groups that historically have had lower-than-average homeownership rates. For instance, the homeownership rate among African Americans spiked briefly during the housing boom, rising from a low of 41.2 percent in Q3 1995 to a high of 49.7 percent in Q2 2004. Since then, African Americans have given back virtually all those gains; their homeownership rate has fallen eight percentage points to 41.7 percent.

How to forecast homeownership

All forecasts rely on the future looking a lot like the past in important ways. Projecting the future homeownership rate is no exception. For homeownership, projections rely primarily on historical differences in the homeownership rate across age and demographic groups. When the experts combine today’s differences in homeownership rates with Census projections of the growth of each age and demographic, they project a flat to slightly declining national homeownership rate for the next ten years followed by a sharper drop in later decades.

Two features of the Census projections account for this pattern of future homeownership: the increasing age and increasing diversity of Americans.

Older age groups have higher homeownership rates, and America is getting older, a factor that will prop up the homeownership rate for a decade or so. Counterbalancing the influence of aging on the homeownership rate is the projected increase in demographic diversity. Historically, white non-Hispanic households have recorded the highest rates of homeownership. African American, Asian, and Hispanic households have had homeownership rates 18 to 28 percentage points lower than non-Hispanic whites.

In the U.S., non-Hispanic whites comprise 73 percent of the Baby Boom generation. In contrast, Millennials are much more diverse—only 59 percent of Millennials are non-Hispanic whites. As the Baby Boom generation inevitably leaves the stage, the future America will come to look more like the diverse Millennials. And, if historical demographic differences in homeownership rates persist, this increased diversity eventually will drive the homeownership rate significantly lower.

Is this future inevitable?

If we are to believe the experts, the future looks bleak for homeownership. The national homeownership rate is expected to grind lower, and demographic differences in homeownership appear to be ineradicable. Contemplating this future, we are reminded of Scrooge’s question: “Are these the shadows of the things that Will be, or are they the shadows of the things that May be only?”

We believe the projections of the experts may be overly pessimistic — these are “things that May be only.”

There are reasons to be skeptical about the accuracy of any projection of future homeownership rates. For one thing, the future of housing finance has yet to be sorted out. No one knows when a consensus on these complex issues will be reached in Congress, but whatever choices are made will surely influence the future path of homeownership.

Another source of uncertainty is the future behavior of the Millennials. They may finally commence to marry, start families, and buy homes at the faster pace posted by previous generations. This catch-up has been predicted many times by many analysts.

Most important, the factors accounting for the lower homeownership rates of non-white demographic groups may be overcome. The income and education gaps that are responsible for some of these differences may be narrowed or eliminated as the U.S. becomes a “majority minority” country. And the mortgage market may shift in ways that chip away at the remaining gaps—the ones that can’t be explained by income or education and that highlight constraints on access to credit.

Today's mortgage market is designed for mass production to reduce costs. As the population becomes more diverse, borrowers that don’t fit smoothly into today's mass production mortgage industry will come to comprise a larger and larger share of the potential market. More potential home buyers may live in multi-generational households or have credit histories that cannot easily be traced by today’s methods. In the future, it will become increasingly expensive to overlook this expanding group of potential borrowers. Profit-oriented financial institutions will be motivated to find better ways to serve them. Perhaps it will actually occur.