Outstanding Outcomes: One Lender’s Journey of Pushing Process to the Edge

Change is hard. And it can be uncomfortable at first. But what if a change in process could mean tangible benefits to your organization? More business. Greater efficiency. Reduced fallout from origination to closing without introducing additional risk.

When it came to income assessment for self-employed borrowers, nbkc bank, a Kansas City, Kansas-based bank, ran into many challenges. By leveraging technology and changing behavior and process, nbkc was able to turn those challenges into a competitive advantage.

The Competitive Lending Landscape

It’s not breaking news that today’s lending environment is very competitive. Rising costs and shrinking margins have lenders scrambling for ways to save money and get more from finite resources. Successful lenders find ways to differentiate themselves from their competition. For nbkc, that opportunity was the growing self-employed borrower segment.

Solving for the Self-Employed

Self-employment is an arrangement of work that differs from traditional full- or part-time employment and can include freelance work, gig work, platform work and non-employer firms.

The self-employed are a quickly-growing segment of the U.S. workforce, and while lenders strive to serve this market, assessing income is an obstacle. Beyond the time-consuming, manual calculations, tax data isn’t as clear cut as with a W-2 tax statement, and income is often buried in business structures like S-Corporations. The information on which a lender bases a borrower’s pre-approval can turn out to be inaccurate or incomplete, causing various problems – including loan fallout.

In the recent past, when a self-employed borrower visited nbkc for mortgage financing, it triggered falling dominoes of angst and contributed to delays in the process for loan officers, underwriters and especially borrowers.

“The ability to clearly communicate the mortgage process and to quickly complete a loan is what matters most,” said Chris Hendrix, loan originator manager at nbkc. But loan officers at nbkc knew that income assessment of self-employed borrowers required combing through income tax documents, with underwriters spending hours reviewing and manually calculating income.

“Loan officers knew that working with self-employed borrowers could be complex and time consuming.”

“Loan officers knew that working with self-employed borrowers could be complex and time consuming,” Hendrix said. “They often had it in the back of their mind that those loans might not be worth pursuing.”

For self-employed borrowers, the entire process could be one big headache. If they had gone through it before, they knew the mountain of paperwork they would need to dig up and provide. They may have even dealt with the disappointment of losing a loan because of their qualifying income changing during underwriting. For first-time self-employed borrowers, the document-heavy and time-consuming process could be a real surprise – one that might even discourage them from the process all together.

Photo courtesy of nbkc

For nbkc investor specialist Tamara West, the last-minute scramble to help self-employed borrowers was all too real. “We’d regularly find ourselves scrambling at the eleventh hour to get the borrower to closing after we’d told them they were good to go. They’d say, ‘I told you this was complicated,’ and then we’d have a customer who thought we weren’t listening to them. It was happening five to 10 times per month.”

nbkc worried the complicated borrower experience would negatively impact their referral business. So, they set out to simplify loan origination for self-employed borrowers, while helping their loan officers become more confident about pre-approvals and making their underwriters’ jobs easier – all while reducing risk. The answer for nbkc: technology.

Digitization in a World of Paper Documents

Driven by a desire to innovate, nbkc leadership knew there had to be a solution to help them validate self-employed income. Optical character recognition (OCR) was a buzz term at the time and they believed using OCR to read and parse tax return data could help.

With a focus on leveraging technology to improve the borrower experience, West was tasked with finding the right solution. She evaluated several OCR tools and found that they varied in thoroughness. nbkc ultimately settled on LoanBeam’s OCR solution. The technology extracts and reads tax return data at a 99.7% accuracy rate, helping to reduce the need for manual data input and human error. It also helped flag missing documents to reduce eleventh hour or redundant asks of borrowers and the potential for loan fallout.

Changing Minds and Changing Behavior

Loan officers and underwriters can be creatures of habit. nbkc’s employees were no different. Introducing a new process, especially early on, was going to have challenges. The trick was to find a few loan officers who were willing to try something new, recognized the value of a shift in process and who could become champions of the technology. Getting some “wins” and socializing them was the key.

The loan officers who were using the technology saw that it could save them time – they no longer had to manually input tax return information and that difficult income calculation was done for them well before underwriting. However, there were still some trust issues to work out about the income calculation – for both loan officers and underwriters.

Game-Changing Discovery

nbkc had already started to adopt Loan Product Advisor®, Freddie Mac’s automated underwriting system (AUS), into their process to take advantage of automated collateral evaluation (ACE) appraisal waivers. But, around that time, Freddie Mac also launched asset and income modeler (AIM) for self-employed. Integrated with LoanBeam’s technology – the only AUS-integrated solution of its kind – AIM automated nbkc’s manual borrower income calculation and gave immediate rep and warranty relief on its calculation.

To evaluate AIM for self-employed, West and her team tested it with every type of tax return and business structure they could get their hands on. “Our goal was to do everything we could to break it,” she said. “But we couldn’t.”

Successful testing alleviated concerns around the accuracy of the income calculation. “Underwriters were a big challenge,” said West. “They felt like they were losing control. It was important to involve them in the testing process. Once they tried it, saw they were coming up with the same figure and knew that Loan Product Advisor was providing income rep and warranty relief, they were OK with it.”

And once AIM for self-employed added the automation of the business and income analysis of the tax returns (another Loan Product Advisor-only integrated solution), nbkc’s underwriters had the confidence of business and income analysis rep and warranty relief without having to do the exhaustive review of business returns to determine the stability of income. This really helped get underwriters on board and sped up the approval process.

AIM for self-employed also empowered nbkc’s loan officers. They could confidently tell a self-employed borrower what his or her calculated income was earlier in the process without the worry of bothering clients with last minute paperwork requests or changing income calculations that could threaten deals.

“Being able to give the borrower our quick, confident decision relieves the anxiety for everyone and helps us win more business.”

“I can’t tell you what a gamechanger that is,” said Hendrix. “Being able to give the borrower our quick, confident decision relieves the anxiety for everyone and helps us win more business.”

It didn’t happen overnight, but slowly and surely, AIM for self-employed proved its value and loan officers and underwriters became more comfortable with the change in workflow and behavior.

Realizing their Competitive Edge

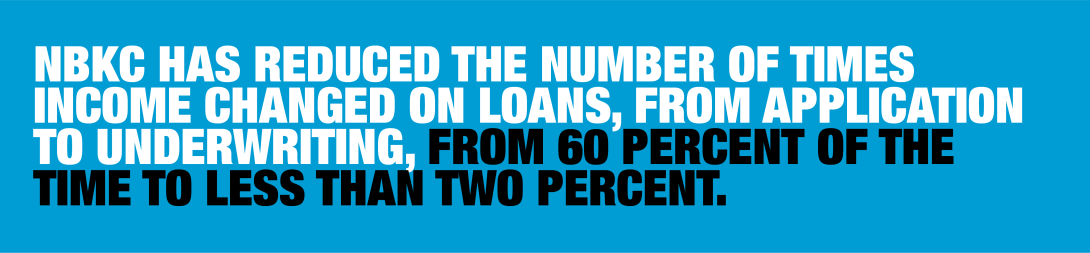

With the implementation of AIM for self-employed, nbkc has been able to reduce cycle times – from 33 days down to 22 days on conventional loans. Plus, the improved efficiency has led to lower costs – from employee time savings per file, reduced fallout and quicker delivery. They’ve also been able to insert an element of confidence into self-employed loans that they didn’t have before – nbkc has reduced the number of times income changed on loans, from application to underwriting, from 60 percent of the time to less than two percent.

“That was a huge win,” said West. “It’s a big deal to close a loan for a self-employed borrower faster, better and cleaner. And having the LoanBeam calculation integrated directly in Loan Product Advisor really helps. Our loan officers have gotten to the point where they don’t even look at LoanBeam directly anymore, they just run Loan Product Advisor and get LoanBeam’s final number.”

Happy Borrowers – The Real Win for Lenders

nbkc has harnessed the benefits of AIM for self-employed beyond the obvious cycle time and cost reductions. “We have a competitive advantage over lenders who are still manually validating self-employed income or are using inferior technology,” said West. “We can get it done faster and with fewer headaches, and we promote that benefit to potential borrowers whenever we can.”

“Automating the income calculation also delivers a better borrower experience. Self-employed borrowers who have been through the mortgage process are pleasantly surprised at how easy it is,” Hendrix said.

Online reviews show that borrowers are aware of the benefits and appreciate them. “We have reduced the anxiety for self-employed borrowers,” he said. “And that’s the real benefit.”

Learn more about better serving self-employed borrowers.