Emerging capabilities are making a big impact in the industry, arming housing professionals with the tools and technology to use data more efficiently and make more accurate predictions. The COVID-19 pandemic has—in addition to causing significant health and economic challenges—accelerated mortgage industry digitization.

Nearly 90% of banking and lending executives said that the pandemic is proving a powerful catalyst for digitization of their firm’s mortgage process, and 85% describe their efforts at mortgage process digitization prior to COVID-19 as aggressive or very aggressive.

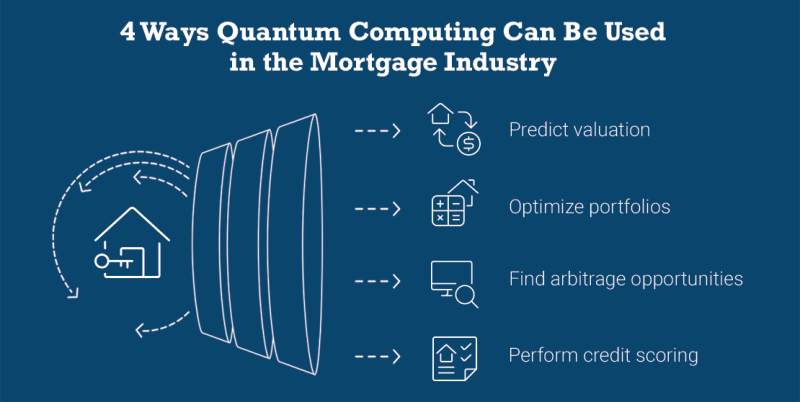

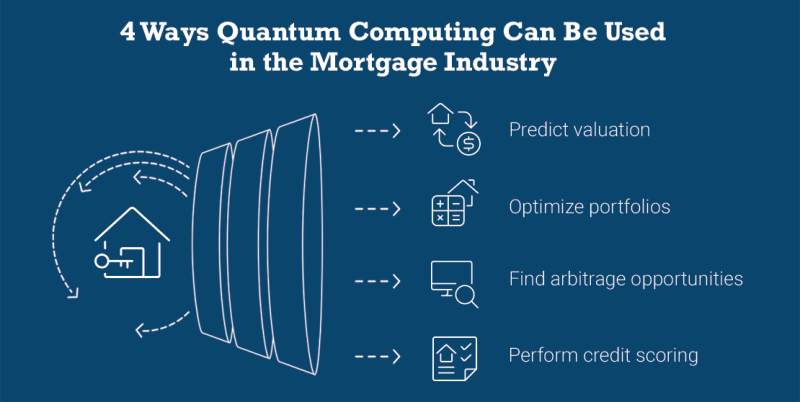

Quantum computing—working with other tools to improve housing and real estate predictions, optimize portfolios, perform credit scoring, reduce errors and more—is one of many important capabilities to watch.

Quantum Computing: Optimizing Predictions and Decisions in the Mortgage Industry

At the core, a quantum computer uses quantum mechanics so that it can perform certain kinds of computation more efficiently than a regular computer. Quantum mechanics is the body of scientific laws that describe the idiosyncratic behavior of photons, electrons and the other particles that make up the universe. The ability for these particles to hold several states at once is what makes Quantum Bits (QuBits) so powerful compared to the current standard Bits, which can only hold the state of “1” or “0.” It is important to note quantum computers are not intended to replace standard computers; they are expected to be a different tool used to solve complex problems. Also, many use cases utilize both a quantum computer and standard computer together to come up with the optimal solution.

How Is Quantum Computing Used in the Mortgage Industry?

Problems that require the best combination of variables and solutions are often called optimization problems. They are some of the most complex problems in the world, with potentially game-changing benefits. This is the primary focus of many modelers who are working on developing algorithms for quantum computing.

For example, autonomous vehicles currently have the issue of collecting and processing millions of data points from internal sensors, satellite images and other external data feeds. Volkswagen recently conducted an experiment to optimize traffic flows in Beijing, one of the most overcrowded cities in the world. The algorithm could successfully reduce traffic by choosing the ideal path for each vehicle. This type of immense computational work would take hundreds of years to perform with today’s computers.

Quantum computing also works closely with other technologies such as machine learning to enhance the ability to make decisions rapidly in a “human-like” method.

An example of this within the mortgage industry is Qindom, a Toronto-based startup that uses quantum machine learning in its real estate prediction and decision optimization engine.

Their proprietary AI technology underpins the value of residential properties, addressing the pricing opacity between supply and demand. Listing, text, image, geographic, and contextual information are fed into the engine, where synergy is created using quantum ensembling, deep neural networks and optimization methods. It is currently running in production in the greater Toronto area where the prediction accuracy claims to reach 96.35 percent within 10 percent error range of the sale price. For comparison, this performance is 30% better than current industry giants Zillow and Redfin

Beyond valuations, quantum computing can also be used to optimize portfolios, find arbitrage opportunities, and perform credit scoring. It isn’t clear as to when the hardware for this technology might be able to tackle these issues in a dependable way. However, modelers and designers are continuing to build the algorithms and think of clever applications for the technology that will no doubt affect the industries with whom we work.

While Freddie Mac has yet to embark on initiatives utilizing quantum computing, we continue to explore and educate ourselves on the emergent capabilities that may impact the mortgage industry. Additionally, we will monitor the quantum computing space for growth and high-impact mortgage applications.

Learn more about Freddie Mac technology and solutions.