Mortgage Technology Trends: Robotic Process Automation

The COVID-19 pandemic has caused significant health and economic challenges, but it has also forced innovation and accelerated mortgage industry digitization. Nearly 90% of banking and lending executives said that the pandemic is proving a powerful catalyst for digitization of their firm’s mortgage processes, and 85% describe their efforts at mortgage process digitization prior to COVID-19 as aggressive or very aggressive.

One emerging technology to watch—robotic process automation (RPA)—can help increase efficiency and reduce risks.

What is Robotic Process Automation?

RPA can be thought of as keystroke-level human task emulation. The software robot (bot) is programmed to take over routine and manual tasks and perform them at a faster pace and with a reduced error rate. This happens when the bot is provisioned with relevant system permissions and is programmed with a set of instructions for execution.

RPA is best suited to tasks that are high in volume, low in complexity, performed in a stable systems environment, and are executed with consistent, sequential steps.

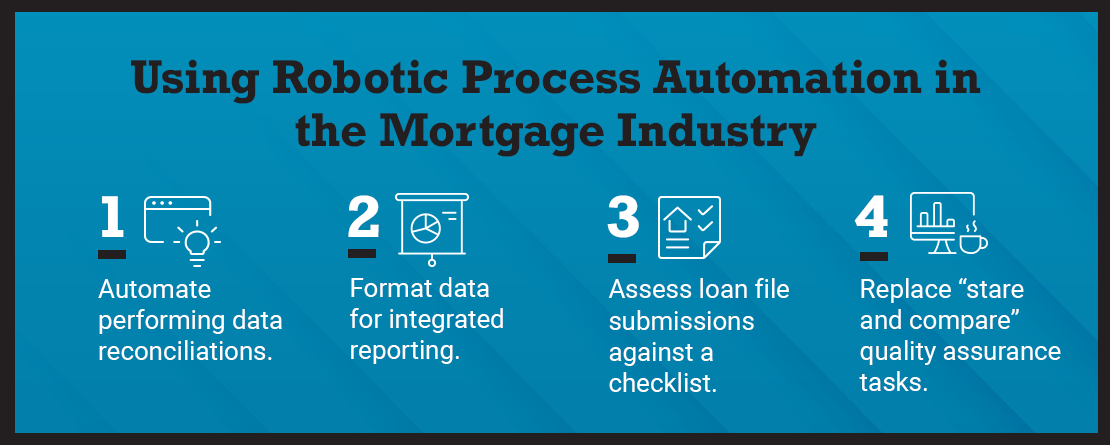

Using Robotic Process Automation in the Mortgage Industry

In the mortgage industry, RPA can be used to automate performing data reconciliations, formatting data for integrated reporting, assessing loan file submissions against a checklist, and replacing “stare and compare” quality assurance tasks.

When considering how to use RPA, it is helpful to consider the business benefit, which may be:

- Increased efficiency.

- Reduced risk.

- Increased quality.

- To perform tasks without having to queue up and perform development in legacy applications.

Freddie Mac began using RPA to process credit memos submitted via email. The bot scans the mailbox for new submissions, performs a quick quality control verification of the content, and creates appropriate journal entries based on the information provided. We’ve also used the technology across the enterprise from training attendee tracking and bulk invoice submission to expired contracts processing and multi-source data aggregation.

Learn more about Freddie Mac technology and solutions.