From Necessity to Longevity: SouthState Bank’s Road to “e”

SouthState Bank has recently proven that they’re a leader of the digital evolution of the mortgage industry through eMortgages. Propelled by the COVID-19 pandemic and the rapidly changing market, they sought to take advantage of digital solutions previously available to continue business and turn more borrowers into homeowners, all while trying to meet the pandemic safety demands from their clients and employees.

Now that most of the world has surfaced from the pandemic, SouthState Bank’s digitization efforts, which were born out of necessity, now open the door to new opportunities for faster and more accurate processes, increased productivity and most importantly, an enhanced borrower experience. Today, 50% of their loan volume delivered to Freddie Mac is eMortgages. That’s a significant feat for an organization that up until three years ago processed all loans traditionally, with no “e” component.

SouthState Bank is sharing their story of challenges, accomplishments and insights to encourage more lenders to join the movement to digitize the home mortgage lending process using eMortgages.

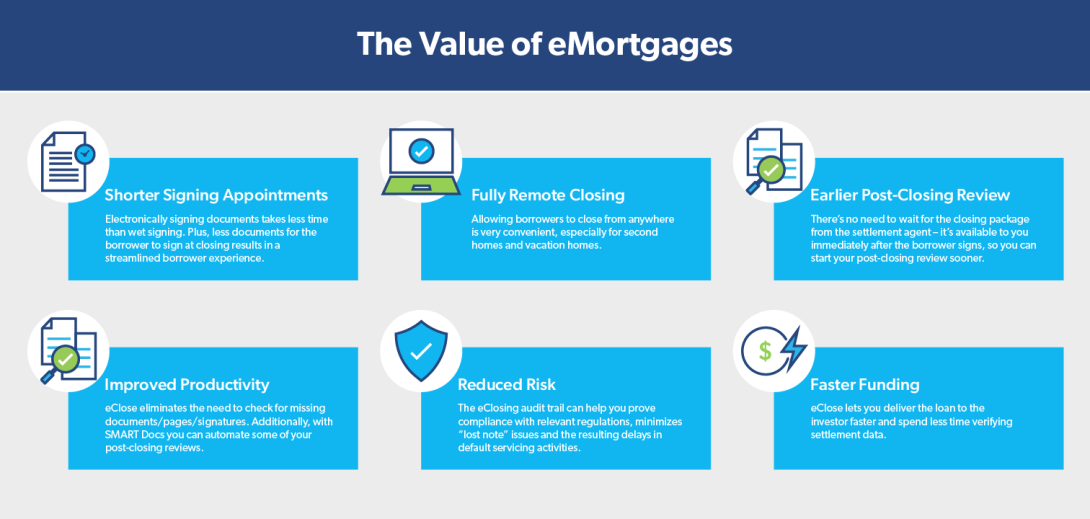

eMortgages: Increased Effectiveness and Efficiency

There are significant benefits to eMortgages that prompted SouthState Bank to allocate resources into the adoption journey.

Establishing Faith in eMortgages One Step at a Time

Step 1: Pushing for Remote Online Notarization (RON)

Implementing eMortgages into SouthState Bank’s everyday operations began with a small but impactful step—having the desire for a more digital closing experience with RON as an end goal. The mandatory safety precautions implemented to prevent in-person interactions during COVID-19 created an opportunity to start introducing this technology. It also helped familiarize staff and partners with the idea of digital components in the mortgage lending process.

Step 2: Implementing Hybrid eClosings

In the fall of 2021, when safety mandates became more relaxed, the bank took the leap into the adoption journey and set their sights on hybrid closings – those that use a combination of paper (requiring in-person wet signings) and electronic documents (leveraging electronic signings). SouthState Bank partnered with Blend as their Point of Sale (POS) provider to start leveraging this digital component.

Though not yet creating a fully digital experience, this step slowly introduced eClosings to business operations, starting with in-house loans. This allowed SouthState Bank to manage from a post-closing perspective, establishing a process that fit their operations model. It also helped their employees overcome the learning curve by working with actual loans to see the benefits of a hybrid closing firsthand. Once the best processes for their organization was established, SouthState Bank expanded the hybrid closing option to agency business with a goal to hybrid close on all loans where possible.

Step 3: Introducing eNote

Expanding on hybrid closings and eClosings, SouthState Bank delved into the fully electronic mortgage process by incorporating eNotes. They signed up with eOriginal, a loan compliance management solution, integrated it with Blend and started originating and delivering eMortgages to Freddie Mac.

Challenges on the Path to Adoption

With change, there’s inevitably a learning curve and resistance. SouthState Bank accounted for challenges in adopting eMortgages with a phased approach in introducing electronic components and processing in-house loans first to get their employees comfortable. Once they expanded externally and started working with client loans, they faced a new set of challenges.

Breaking Habits and Promoting Education

Settlement agents and attorneys were two groups that SouthState Bank noticed were resistant to change. Both groups were used to traditional procedures such as delivering the closing disclosure through paper packages – which can make the process more susceptible to delivery issues and errors.

Since these groups were accustomed to traditional methods, they were hesitant to adopt unfamiliar processes that could make their jobs easier. This mindset can have a negative effect on the borrower experience, especially for borrowers who already know the ease and efficiency of a digital closing with electronic components; settlement agents, attorneys and lenders who are unfamiliar with or hesitant to embrace digitization may fail to live up to borrower expectations.

Expecting the Unexpected

SouthState Bank also noticed that lenders usually favor eMortgages when all goes as planned, such as when electronic signatures are accepted and digital documents are delivered as expected. But when there’s a slight hiccup, it can be difficult to pivot and troubleshoot at the last minute, especially in the closing period when some documents are already signed. Lenders scrambling to find a last-minute solution because of changing circumstances in one eClosing may have a misguided view of eMortgage technology.

Taking the Initial Plunge

The most difficult part of any journey is getting started. When it was time to transition to eNotes and eMortgages, SouthState Bank found getting established to process eMortgages accurately and securely to be the most complex part of the entire process. It involved conducting testing, onboarding with Mortgage Electronic Registration Systems (MERS®) and other operational tasks that once in place, would let them seamlessly incorporate eMortgages into their everyday business operations. Once the biggest lift was over, however, the benefits were crystal clear.

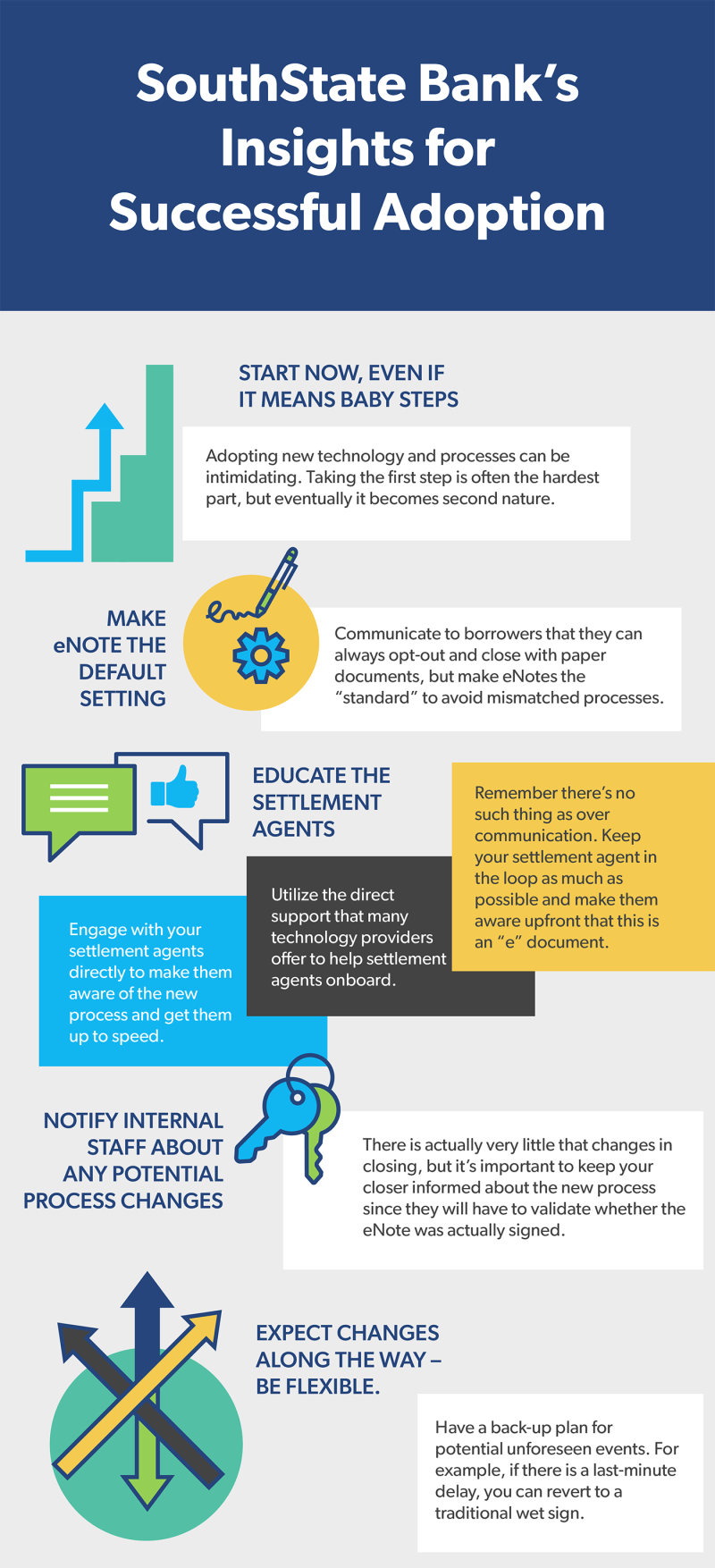

SouthState Bank’s Insights for Successful Adoption

Despite all the challenges, SouthState Bank was able to break through the obstacles they faced in implementing eMortgages. Here are their insights to encourage other lenders to get started:

The Future of eMortgages Starts Today

Today, an eMortgage is the default option for every loan at SouthState Bank. Through phased implementation and navigating resistance from external partners, they’ve proven the value of implementing eMortgages and are providing an overwhelmingly positive mortgage lending experience for all parties involved.

“At SouthState the implementation of the eNote had been a relatively simple change with huge benefits. By expanding our existing hybrid close to include an eNote, we not only greatly improved our delivery to the GSEs, we were also able to clean up some of our own internal processes and provide the borrower with a better experience and a gateway to a fully digital RON close,” says Shane Horan, Senior Vice President, Director of Mortgage Strategic Initiatives at SouthState Bank.

“The switch to eNote has been a no-brainer and those who are not looking to make that change will find themselves falling behind in the not-too-distant future.”

By sharing their story, SouthState Bank is playing their part in expanding the eMortgage ecosystem. This digital mortgage movement will continue to grow as the industry increasingly gains knowledge of and creates the demand for a future of “e.”

Don’t Fall Behind on the E-volution

For more information, visit our eMortgage webpage. Start your eMortgage implementation journey today by reaching out to the Freddie Mac eMortgage team.