eClosings: The Myth of “All or Nothing”

From restaurants abandoning the paper menu for a QR code to doctors’ offices replacing paperwork with online forms—the COVID-19 pandemic has rapidly digitized the traditional paper processes of our everyday lives. While the pandemic may end one day, the demand for paperless and contactless transactions is here to stay.

The Digital Demand

A recent Finastra survey(Opens a new window) found that 81% of the consumers they surveyed wanted an option to electronically sign loan documents. This showcases the increasing demand from borrowers wanting to upload, receive, and sign documents digitally. For tech-savvy borrowers, this experience is consistent with their day-to-day online experiences.

eClosings can result in a better overall closing experience for both borrowers and lenders. Borrowers experience a more seamless and convenient closing, while lenders experience operational efficiency and customer satisfaction improvements.

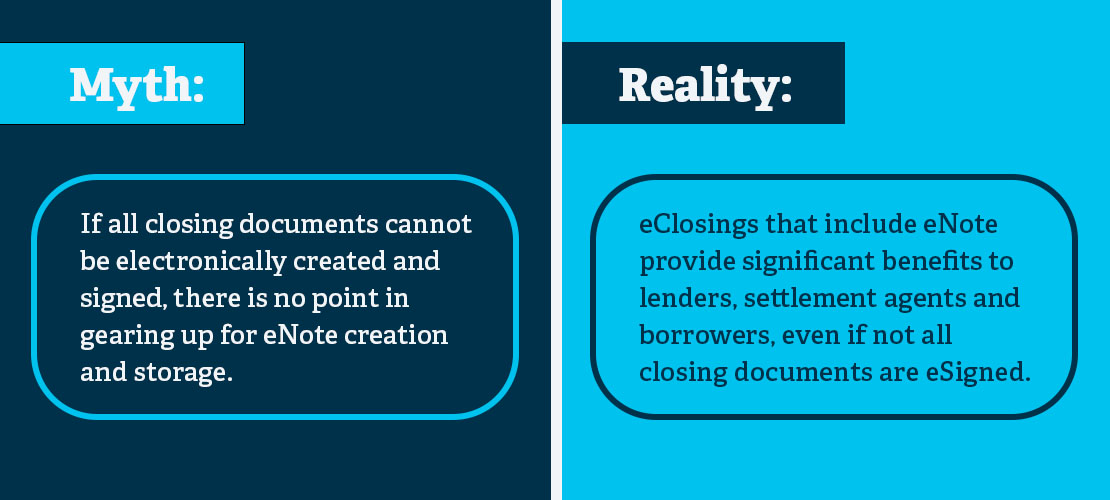

However, some lenders are not taking advantage of these efficiencies. There is still the misconception that an eClosing must be a fully digital closing with all electronically signed documents. Full digital closings require electronic notarization (eNotarization) and electronic recordation (eRecording) support. Unfortunately, since the adoption of eNotarization and eRecording is not uniform across all jurisdictions, these lenders are deferring their eClosing implementation.

Adopting eClosings Doesn’t Have to Be an ‘All or Nothing’ Approach

There’s room for flexibility when it comes to adopting eClosings. There are two eClosing options that combine the use of paper and digital documents to help you scale your eMortgage production:

- Hybrid eClosing: closings using a combination of digital documents with eSignatures and paper documents with wet signatures. With hybrid eClosings, jurisdictional or practical limitations around notaries and recording processes are not a real barrier to adoption of eNote (electronic promissory note) technology. Borrowers can eSign the closing documents that do not require notarization and recordation, and wet sign the ones that do.

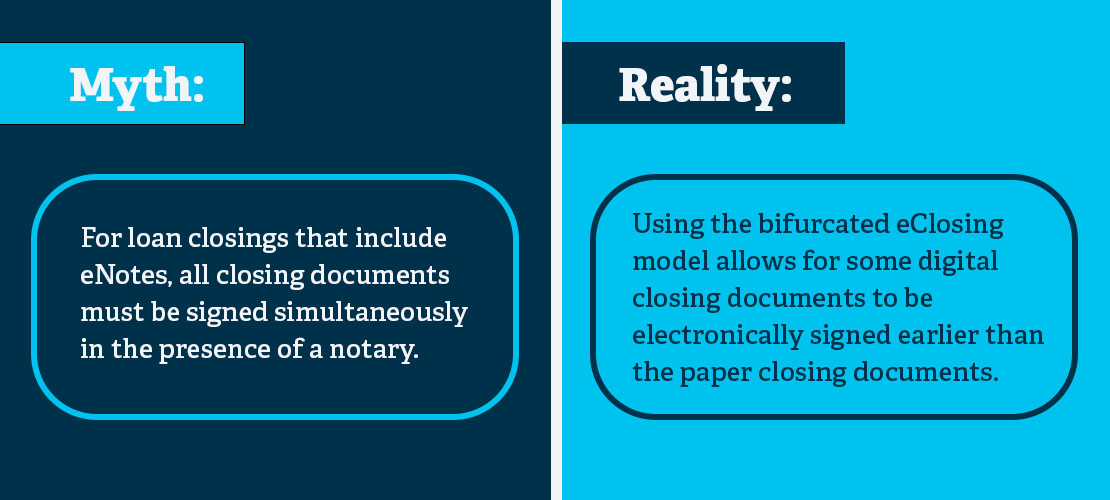

- Bifurcated eClosing: closings where some digital closing documents (which may include the eNote) are eSigned early, with a later closing time scheduled for paper documents to be wet signed.

Both options can be a great starting point in your eMortgage digital adoption process, but there are also common myths tied to them that can still create some hesitancy to adopt. Let’s look at these and address them to help alleviate any hesitations.

Hybrid eClosings

The benefits of hybrid eClosings involving an eNote include:

- Faster closing appointments for consumers (typically 30 minutes or less).

- Reduced risk and improved productivity for settlement agents and lenders due to fewer signing errors and associated follow-ups.

- Reduced document processing and handling, and warehouse line costs.

- Faster investor delivery and investor funding, thanks to electronic delivery of eNote and automated certification.

- Reduced delays in loss mitigation activities as the risk of losing the note is eliminated and so is the need for lost note affidavits.

Bifurcated eClosing

This is a workable model that can provide flexibility for the borrower, allowing them to review and eSign closing documents before meeting with the other participants (lender, title insurers, settlement agents, attorneys, etc.) in the closing process. This streamlines the closing process, making it easier and faster for all parties involved.

Many lenders have adopted this model as it enables them to successfully scale their eMortgage production, regardless of the settlement agent’s readiness to conduct eClosings. This model is especially useful in times when the mortgage market shifts to more purchase transactions, in which the settlement agent is often selected by the borrower’s real estate agent.

Some caveats should be noted:

- The early signed eNote may have a note date on the date of signing but would not be considered “delivered” to the lender until all paper documents are wet signed.

- The note date would need to match the date set forth in the security instrument provision defining “note”.

- There may be state-specific directions on the timing of document preparation and delivery (e.g., “escrow” states in the West).

- Federal regulation, such as the TILA/RESPA Integrated Disclosure (TRID) rule, contain timing limitations on certain required disclosures which must be complied with.

- System/process controls should be built to ensure the settlement agent is clear on which loan documents will be eSigned versus which documents will be wet signed.

- The borrower should not wet sign a previously eSigned note or other document to prevent double signing and confusion. However, the borrower should be able to obtain or be provided a copy of whatever they have signed.

“eEverything” as the Future

eMortgages are proving to be vital in the efforts to digitize the mortgage industry. In 2021, there were more than 590,000 eMortgages registered on MERS eRegistry(Opens a new window), representing a growth of 28% when compared to 2020. More than 130 lenders have already completed their eMortgage implementation and are ready to offer eClosings as an option to their customers. Thanks to the efficiencies it offers, some lenders are now originating a significant percentage of their production as eMortgages. Soon, it will be the norm for lenders to offer “eEverything" as the default to meet the growing demand of their borrowers.

Implementing hybrid eClosings can be your first step in this digital closing movement. With the hybrid eClosing options provided, scaling your eMortgage production has never been easier. To make sure you don’t fall behind, Freddie Mac is here to help jump-start your journey. Learn more about Freddie Mac’s role in supporting hybrid eClosings(Opens a new window) and your eMortgage(Opens a new window) adoption.