Breaking Barriers: Closing the LGBTQ+ Homeownership Gap

Freddie Mac

Research shows there is a strong desire for homeownership among LGBTQ+ borrowers. While finding a welcoming community to buy a home is a top concern for LGBTQ+ homebuyers, many such neighborhoods are in areas with less affordable housing. A deep understanding of these challenges and others facing prospective LGBTQ+ homebuyers can help housing professionals form strategies that better serve this demographic, creating equal footing on the path toward homeownership.

A Snapshot of the LGBTQ+ Potential Buyer

A recent Freddie Mac survey underscores a group that’s mobile and values the stability of homeownership, but is disproportionately not buying homes. The study includes both current owners and renters and breaks down key findings according to age group, ethnicity and LGBTQ+ identity.

Here are some key findings characterizing the current state of LGBTQ+ homeownership:

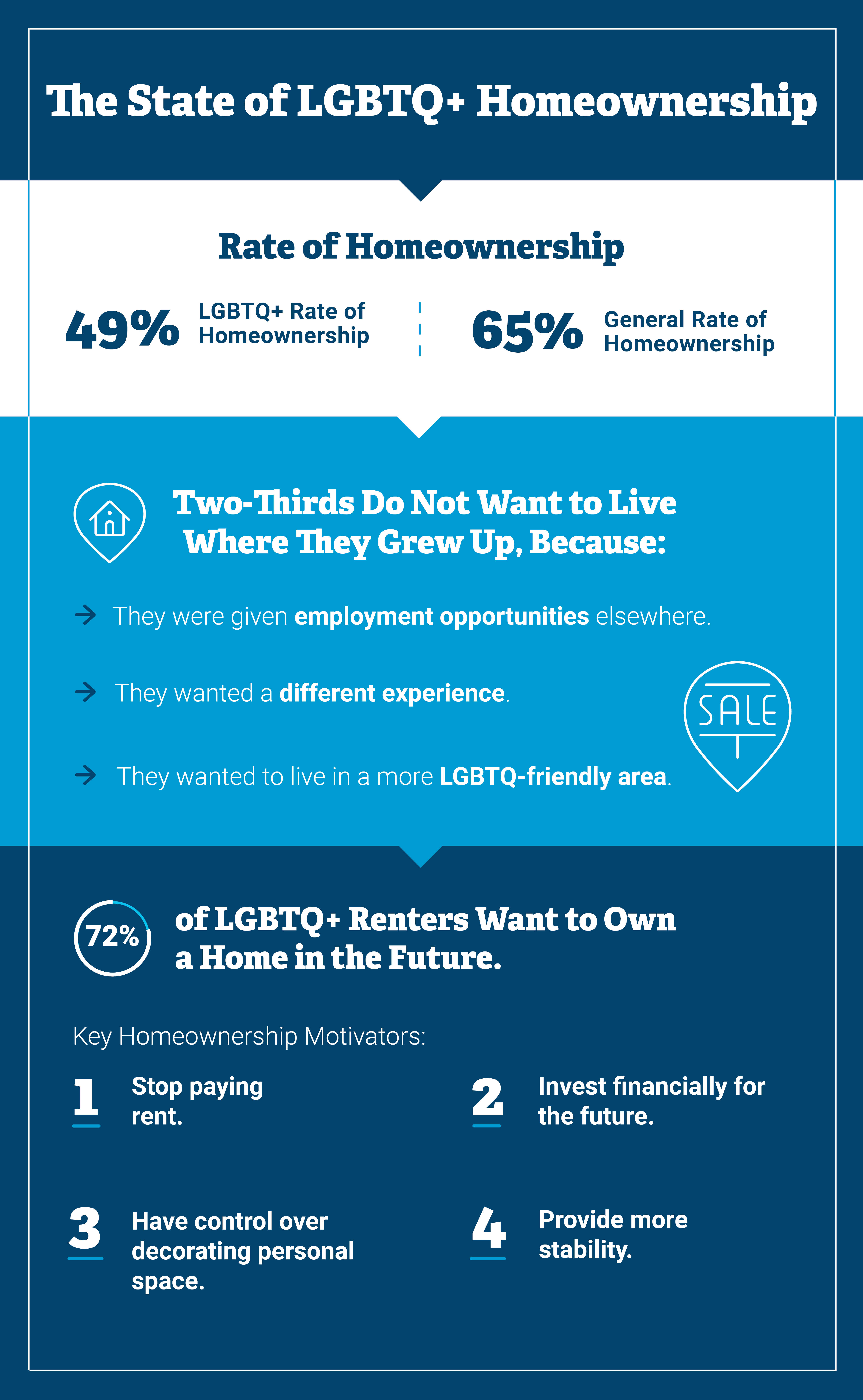

- Overall LGBTQ+ homeownership is 49%, significantly lower than the U.S. general population homeownership rate of 65% shown in the U.S. Census.

- Among LGBTQ+ renters surveyed, 72% want to own a home in the future. Millennial and Gen X renters are significantly more interested in buying (52% and 48% respectively) than Baby Boomers (29%).

- Two-thirds of all respondents said they do not live in the same area where they grew up. Top reasons given were employment opportunities, wanting a different experience, and being in a more LGBTQ+-friendly area.

- The top four motivators for renters wanting to buy a home were to:

-

- Stop paying rent.

- Invest financially for the future.

- Have control over decorating personal space.

- Provide more stability.

- There is a strong correlation between marriage and homeownership—73% of married LGBTQ+ couples own compared to 41% of non-married couples and 35% of singles.

- Of those surveyed, 24% were the parent of at least one child. Homeownership rates are higher among parents (64%) than non-parents (45%), and 90% of respondents who plan to have children in the future say they would want to own a home.

What Does the Community Value When Choosing a Home?

- The most commonly cited preferences in a community were lack of LGBTQ+ harassment/violence, low violent crime rate, and feeling they belong in the neighborhood. Forty-two percent said having anti-discrimination laws and protections were very important. According to the study, gay men are more likely to live in urban areas; the lesbian and gender-expansive communities are more dispersed, while the bisexual community has higher numbers in suburbs.

- The vast majority plan to buy a single-family house, with the most important attributes being value price for the quality of the home, low neighborhood crime rates, and a neighborhood considered to be LGBTQ+-friendly.

How the Mortgage Industry Can Help Close the Homeownership Gap

LGBTQ+ homebuyers look for many of the same characteristics in a home as all homebuyers with one glaring exception—some fear not being accepted into a community because of their sexual orientation or gender identity. Forty-six percent of LGBTQ+ renters fear discrimination, according to the Freddie Mac survey.

However, living in a more welcoming community—particularly one with legal protections from discrimination—presents affordability problems for some future borrowers. A recent Zillow study found that the home prices in the areas with explicit legal protections for the LGBTQ+ community are about 63% higher than areas with no protections.

Players across the housing ecosystem can work to bring more LGBTQ+ homebuyers into the fold through greater awareness and sensitivity, starting with addressing these key barriers:

Discrimination

Nearly half of LGBTQ+ renters fear discrimination in the future homebuying process, according to the Freddie Mac survey. While only 4% of survey respondents reported experiencing discrimination during the homebuying process, the fear still exists.

In a recent survey of its members, the National Association of Gay and Lesbian Real Estate Professionals (NAGLREP) said 30% believe a concern about housing discrimination keeps LGBTQ+ renters they know renting. Furthermore, 75% of NAGLREP members believe housing discrimination is a major concern.

Real estate agents can play a key role in building a trusting relationship. Of the 65% who used an LGBTQ+-identified or LGBTQ+-friendly real estate agent, 57% said that the agent’s LGBTQ+ or LGBTQ+ ally identity influenced their decision to work with the agent, according to the Freddie Mac survey.

Affordability

Worries about having enough for a down payment, the high cost of living where they live, not being able to afford a monthly mortgage, and credit issues are front and center for LGBTQ+ homebuyers. And 63 % of NAGLREP members said that their LGBTQ+ clients are very or extremely concerned about the affordability of housing in their desired area, according to the NAGLREP survey.

Mortgage professionals who provide guidance on affordable resources such as housing counselors and an understanding of affordable mortgage options and other alternatives can help allay these concerns.

For example, 56% of NAGLREP members indicated that over the next year, a sizeable number of their LGBTQ+ clients will make a major home renovation. Mortgage professionals should explore new flexible lending solutions that make it easier and more cost-effective for homeowners to finance renovations, repairs and improvements.

Financial education

As with many new homebuyers, there’s a need for more financial education in this group. Of LGBTQ+ renters interested in owning, 29% didn’t know how much of a down payment is required and 25% of them thought a down payment needed to be 20% or more, according to the Freddie Mac survey.

Furthermore, 63% of NAGLREP members said their clients are very or extremely concerned about their knowledge about the homebuying and mortgage process. And 24% of NAGLREP members said their clients are very and extremely concerned about the quality of credit history.

As they directly interact with first-time borrowers, lenders and other mortgage professionals have an opportunity to promote financial capability. And solid understanding of the mortgage process and credit scores through innovative financial education programs and tools can help future LGBTQ+ borrowers attain homeownership.

The Time is Now for the Mortgage Industry

Recent Supreme Court decisions protecting the LGBTQ+ community from job discrimination and recognizing same-sex marriage signal a more equitable climate in the U.S. The timing is good for all mortgage industry professionals to help the LGBTQ+ community toward homeownership—52% of renters with an interest in buying plan to do so within the next five years. Now is the time for mortgage industry professionals to provide solutions, resources and innovation that can breakdown barriers and enable homeownership.

Subscription Center

Get and stay connected with Freddie Mac Single-Family. Subscribe to our emails and we'll send the information that you want straight to your email inbox.