Are Single Female Homebuyers on Your Radar? If Not, They Should Be.

While the housing market is no stranger to demographic shifts, a specific subsection of buyers has been on the rise for a while: Single females.

Single women are a growing force in homeownership. And according to an Urban Institute research report, women have proved to be credit-worthy buyers with lower serious delinquency (SDQ) rates–the percentage of loans 90 days or more past due–in comparison to single men. While lower SDQ rates are a testament to the reliability of single female borrowers, studies have shown that income inequality may affect their ability to qualify for a mortgage and save for a down payment. Lenders and other mortgage professionals would be well served to better understand the needs and perceptions of single female homebuyers as this segment continues to grow.

A Driving Force in Homeownership

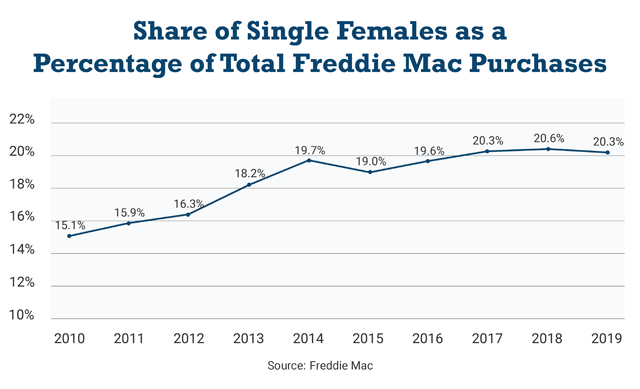

Among Freddie Mac customers, the percentage of homebuyers who are single females has risen 30 percent since 2010.

Another study found the increase to cross a range of age groups. Among younger baby boomers, divorced women are increasingly buying homes, and, for the silent generation, widowed women are moving into homeownership.

Even if less-than-ideal life circumstances have placed them there, these buyers are frequently in the home market for the first time. Beginning a new phase of life may put them in a place of empowerment and desire for agency over living choices. And among the next wave, millennial females are seen to be following suit.

Despite their increase in percentage as homebuyers, single females, particularly millennials, may experience difficulties when getting a loan. This is due in part because of pay inequality where women—when compared to men—may have lower incomes, resulting in greater difficulties in saving for a down payment or getting a lower interest rate for their mortgage.

While realtors would be wise to consider size, amenities and location that are more likely to be attractive to a female client, lenders should bear in mind how servicing these clients may differ from their traditional client base. In fact, single females tend to have lower SDQ rates than single males, according to a 2016 research report by the Urban Institute: Women Are Better than Men at Paying Their Mortgages.

Lenders and other mortgage professionals can approach this growing segment of homebuyers with options that are better aligned with their respective financial situations, including:

- An online financial educational site with tools and information for prospective homebuyers.

- Low down payment options for qualified borrowers.

- Automated assessments for borrowers lacking a credit score.

As single women continue to ramp up homebuying, lender and mortgage professionals can help address potential barriers to homeownership with a range of solutions and options that fit their finances.