Three Ways Longer Commutes Are Affecting Homebuying

Freddie Mac

How are homeowners taking on today’s difficult mortgage market? One way is by making different choices to afford their commuting costs, including exploring lower cost areas, according to recent research. Like generations before them, young Americans are keeping peripheral areas alive and flocking to the suburbs and exurbs, where housing is more affordable.

This trend in suburban homebuying also indicates a cascading series of compromises in the interest of beginning to accumulate long-term wealth. And it affects the majority of essential workers: 62 percent find it difficult to find affordable housing “close to work,” meaning a commute of 25 minutes or less, according to new research from Freddie Mac.

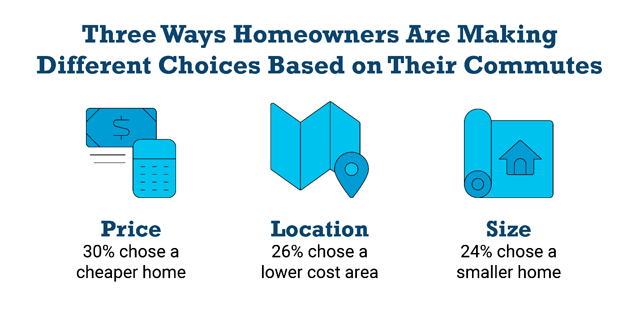

What aspects of their search have been affected? Here are three ways homeowners are making different choices based on their commutes:

- Price — 30% chose a cheaper home

- Location — 26% chose a lower cost area

- Size — 24% chose a smaller home

Addressing the Trends

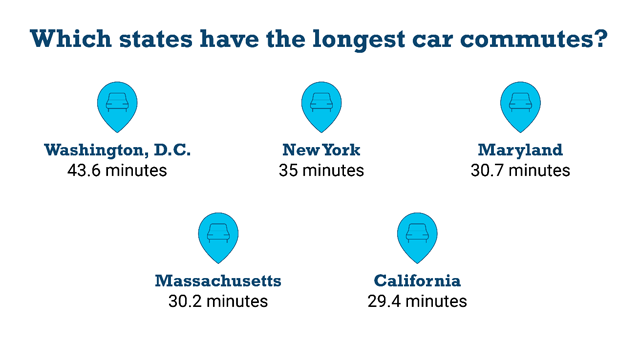

But what does this migration mean for homebuyers and the real estate professionals and lenders serving them? The average commute has risen four minutes since 1990 and in more populated and urban areas, roundtrip commutes are upwards of an hour. A 2016 U.S. Census Bureau commuter survey reported that Washington D.C., New York, Maryland, Massachusetts and California lead the way when it comes to average car commutes. But those states are also among the most expensive states when it comes to median home listing prices.

While exploring lower cost regions can provide buyers with more affordable housing options, it can also drive up their commuting costs. As homebuyers explore housing in more affordable regions, lenders and mortgage professionals can help guide them through the process by factoring in the time, gas, tolls, parking and public transportation associated with commuting.

Now that the older end of the millennial market is looking to settle down, choosing to explore homes in surrounding areas has proven to be an opportunity to start their journey as owners, as well as being an unexpected sign that they may not be so different from generations before them.

Statistics: 2019 Freddie Mac report based on an April 2019 Harris Poll Consumer Omnibus

Subscription Center

Get and stay connected with Freddie Mac Single-Family. Subscribe to our emails and we'll send the information that you want straight to your email inbox.