Raising Down Payment Cash: What Your Borrowers Should Know

Many prospective homebuyers find saving for a down payment to be the biggest challenge they have to overcome, but their perception of this obstacle may not match reality.

Homebuyers in recent years have pursued more unconventional ways to raise down payment cash, and most of them put down considerably less than 20 percent, according to recent Freddie Mac research.

If mortgage professionals can get this message across, they may be able to grow business with borrowers who would otherwise continue to rent.

Misconceptions Deterring Potential Homebuyers

Despite the availability of affordable lending solutions, confusion surrounding down payments is leaving a lot of people overly pessimistic about being able to afford a home. Consider these findings from our recent survey of individuals planning to purchase a home in the next three years:

- Nearly one-third of people thought they had to put more than 20 percent down.

- If a 20 percent down payment was required, 70 percent couldn’t buy a home in the next three years and nearly 30 percent could never afford one.

These assumptions contradict reality.

The median down payment was 13 percent for all homebuyers and seven percent for first-time homeowners, according to the National Association of Realtors

Less Reliance on Savings

Another common misconception among aspiring homebuyers is that a down payment needs to come from personal savings stemming from earnings, retirement accounts or inheritances.

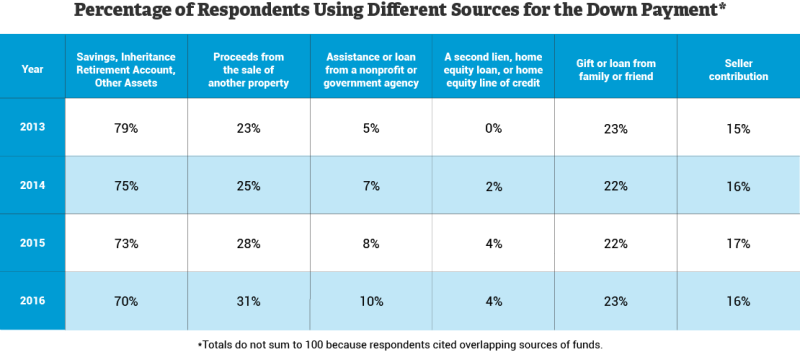

While savings is still the most frequently tapped source of cash for down payments, the number of homebuyers who used this means of funding fell by nearly 10 percent in recent years, according to the government’s National Survey of Mortgage Originations (NSMO) (See table below.)

One possible explanation for the diminishing role of savings in funding down payments is that home prices have outpaced wage gains, making it increasingly difficult for people to set aside money to put down on a home.

More Help from Government, Non-Profits

As fewer homebuyers used savings for their down payments, the number of people who put money down with assistance from nonprofit and government agencies doubled, with 10 percent of all mortgage holders having checked it as a funding source in 2016.

Nonprofit and government assistance programs support mostly moderate- to low-income borrowers, including first-time homeowners or buyers who haven’t owned residential property in the last three years.

Promoting the Opportunity of Homeownership

Funding a down payment is and has always been a barrier to homeownership, but these findings indicate it’s not as onerous as people perceive it to be. The “20 percent down” myth still sidelines potential borrowers who may qualify for a mortgage today or in the near future, versus years down the road.

What’s also clear is that a lot of aspiring buyers aren’t aware of ways they can afford a home, including options for low down payment loans and other mortgage products requiring qualified borrowers put as little as three percent down.

Herein lies an opportunity for lenders to better educate potential borrowers about ways to raise down payment cash aside from savings. If they can succeed, they stand to grow business with people who don’t yet realize that the dream of homeownership is within reach.

The NSMO is a component of the National Mortgage Database (NMDB®) program managed by the Federal Housing Finance Agency (FHFA) and the Consumer Financial Protection Bureau (CFPB). Findings are based on a sample of about 6,000 mortgages per quarter from loans newly added to the NMDB.