4 Moments that Led Citizens Bank to Make More Loans

There’s no better feeling than seeing an investment you’ve poured significant resources into pay off with instant results. It’s a feeling Citizens Bank (Citizens) recently experienced when they chose Loan Product Advisor® (LPASM) as another automated underwriting system (AUS) option for their retail origination channel. On the first day LPA was up and running, they immediately saw opportunity with loans getting an Accept despite not getting approval in other AUSs.

In this tight market, every approval counts. With LPA, Citizens saw an opportunity to grow their business, stay competitive and offer their loan officers more options and flexibility with another path to more potential approvals.

Citizens was already achieving great results, but they decided LPA could help them turn it up a notch. So, what led them to that decision? And how did they implement it successfully? Here are four moments on their implementation journey that led Citizens to increase loan approvals by launching LPA.

Moment #1: Seeing an Opportunity to Better Serve Their Community and Employees

Citizens’ mission puts their customers employees first, do that, they prioritize growth. With the amount of technology advancements available today, it’s hard decide which implement where allocate limited resources enable that To get most return on investment, Citizens wanted would positively affect in some way, tying back mission.

That’s LPA came – it was a way help make difference communities give them competitive boost. This realization from close collaboration between Freddie Mac representatives, including ongoing strategy conversations, information sharing analyzing benefits could provide. offers retail loan officers at new access digital solutions cut costs reduce documentation burden. can then be more strengthen business growth strategy. Most importantly, they’re using tools expand credit provide borrowers with tailored options. Today’s are often familiar than one AUS. knew implementing channel originators means grow skills advance careers while also helping recruit top talent. It’s win for all parties involved organization, serve.

Moment #2: Success was Contingent on an All-Hands Approach

In the corporate world, a “hothouse” is an intense deep-dive session to align key stakeholders and expedite major decision-making. Through this exercise, Citizens and their loan origination system (LOS) provider engaged with Freddie Mac to capitalize on an opportunity: successful LPA implementation. This two-day hothouse is what officially brewed excitement and fast-tracked Citizens’ LPA journey.

With cross-functional representation from the three organizations, participants went through the loan journey from the very beginning of when the borrower first fills out the loan application, all the way to the end when the loan gets sold to Freddie Mac. Everyone was hyper-focused on Citizen’s LPA implementation. The hothouse was about having the right people at the right time to provide immediate answers to accelerate success. And if any takeaways were determined, the right people were held accountable to follow through with tasks.

After this exercise, Freddie Mac account executives set up reoccurring meetings with the project teams from Citizens and their LOS provider to keep the project moving forward and answer any questions or concerns in a timely manner. Outside of the meetings, lines of communication were kept open across all parties, encouraging transparency in the implementation journey. On the Freddie Mac side, technical integration managers with deep knowledge about LPA functionality and integration were also included during discussions to conduct demos and troubleshoot. These practices helped Citizens adhere to and streamline their project timeline.

Training sessions were also offered to Citizens’ staff on how to most effectively use LPA. Because Citizens hadn’t previously used LPA, much of their staff wasn’t very familiar with it. Specialized training from the Freddie Mac Customer Education Services team really helped Citizens staff better understand how to get the most out of LPA and prep them to start running it on loans they were getting. The technical integration team at Freddie Mac also stepped in to help Citizens conduct testing to make sure that nothing in their technology system was impacted with the addition of LPA. At the end of it, staff at Citizens was excited to begin integrating and using LPA.

Moment #3: A Single-Click Dual AUS Submission Model Provides a Better Perspective

Getting a full view of options on a loan played a critical role in Citizens’ decision to implement LPA. Their LOS through their third-party provider allows users to run application data through a dual AUS solution to receive multiple views of purchase eligibility – including LPA’s – on every loan, with a single click. This makes it much easier and faster for Citizens’ originators to make loan decisions. The multiple views also help with Citizens’ mission to offer their customers the best loan option possible. Citizens now runs the dual AUS capability in both origination channels:

“When choosing an AUS, pricing is not the only thing that matters,” explains Deb Jones, Senior Vice President, Director of Mortgage Capital Markets. “In this tight market, efficiency, speed and the quality of assessments an AUS produces matters too – and LPA best executes all of those things, which makes implementing LPA an overdue value add for us at Citizens Bank.”

Moment #4: Notable Results Early On

As of September 2024, Citizens had been running LPA on loans for six months and has seen significant results.

"We’re seeing amazing results already, with only a few months into using LPA. LPA’s impact on the business has helped us get more loans out the door and more borrowers into homes,” says Deb Jones. “We already have plans in motion to continue to optimize the LPA experience and can’t wait to see what kind of growth that brings to our business."

To continue this successful run, Citizens is working on taking advantage of the Freddie Mac Home Possible® mortgage, and wants to start offering it to their borrowers. Citizens has a strong focus on affordability and having the option of Home Possible in their portfolio strengthens their ability to offer more affordable loans.

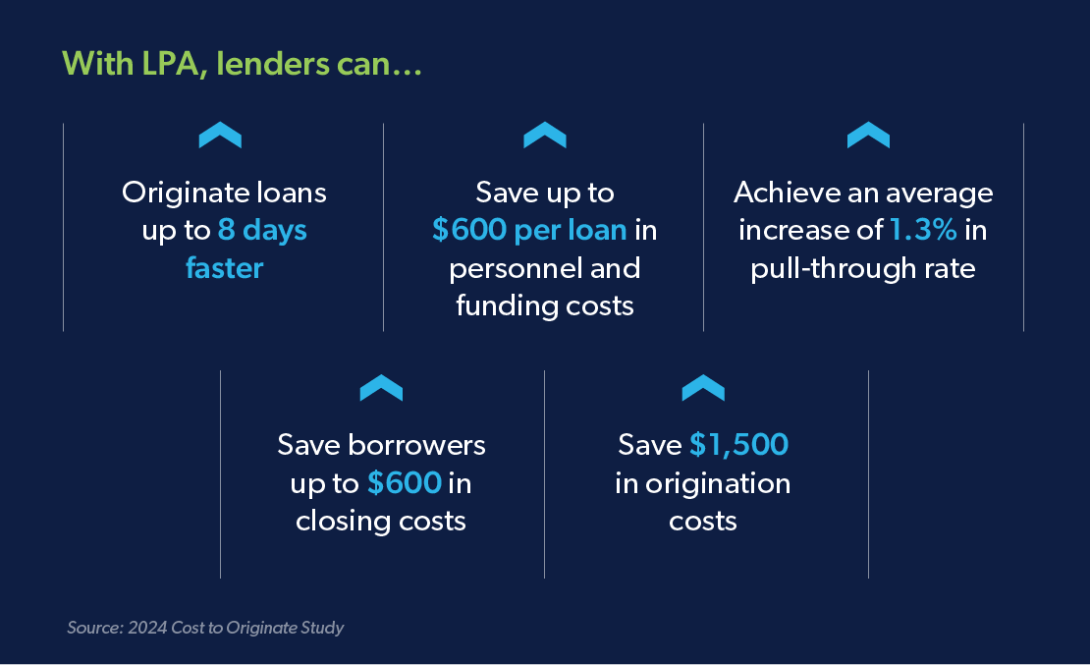

And they’re not stopping there – Citizens also has plans to implement LPA digital capabilities to speed up underwriting. Specifically, they have their eyes set on leveraging the asset and income modeler (AIM) to automate the income, asset and employment assessment. With the future addition of AIM, Citizens’ loans may be eligible for faster closings, as well as cost savings by eliminating the paper documentation burden. Loan quality can potentially be improved too by using verified data through an approved service provider. If they keep running down the path of using LPA digital capabilities at a high rate, Citizens is on track to start reaping the rewards of lower origination costs (as much as $1,500 less, according to our research).

Run LPA. Run with Opportunity.

Citizens shared their story to demonstrate the benefits of LPA implementation. If you’re on the fence about implementing LPA, just know that Citizens had the same hesitations and resource constraints. But also know that they were able to overcome them and prioritize opportunity and future growth with more flexibility. These four pivotal moments in Citizens’ journey with LPA reemphasizes that, to better serve the borrower and to boost your business, technology investment can go a long way. Now that the hardest part is done, Citizens has set themselves up for success when they continue to Run with LPA.

“Choosing LPA has only positively impacted our business. We’ve been able to streamline more processes, be more efficient and cut costs. Most importantly, we’re making more borrowers into homeowners and we’re doing it by providing the best possible loan option to them,” says Deb Jones. “We’re helping to set the standard of making sure all perspectives are being taken into consideration and that no opportunity gets left uncovered.”

If you want to Run with LPA as well and are looking to start your journey, or if you’re already using LPA and looking to optimize your experience, we’re here to support you through the process. Contact your Freddie Mac representative or the Customer Support Contact Center (800-FREDDIE) today.