Pre- and Post-Close Income Insights Increases Underwriting Efficiency and Confidence

In this challenging market, Freddie Mac understands that every loan counts when it comes to getting more borrowers into homes. That’s why we continue to evolve Loan Product Advisor® (LPASM) asset and income modeler (AIM) to provide you with tools to originate with ease and streamline the borrower experience.

Automate the Income Assessment to its Fullest Extent with Paystubs and W-2s

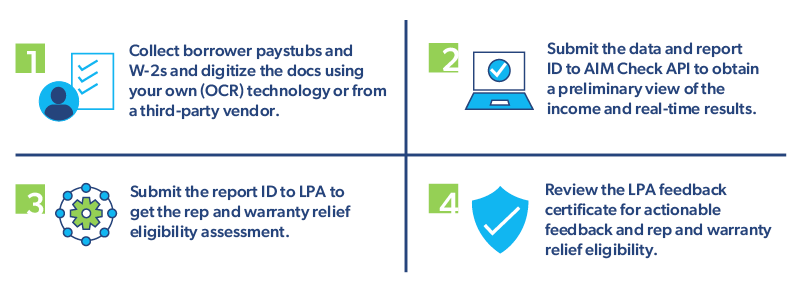

Single-Family Seller/Servicer Guide (Guide) Bulletin 2024-1 announced that AIM for income using employment data is expanding to include digitized paystub and W-2 data in the income assessment. We’re permitting more eligible income data sources and allowing more opportunities to automate the calculation work. This is another time-efficient method to get a robust income assessment and potential representation and warranty relief eligibility.

Integration with Freddie Mac’s AIM Check API is required to leverage this enhancement. This will give you an early view of the income calculation before submitting a full application to LPA.

Let’s look at how this offering works:

Improve Loan Quality Confidence for Closed Loans

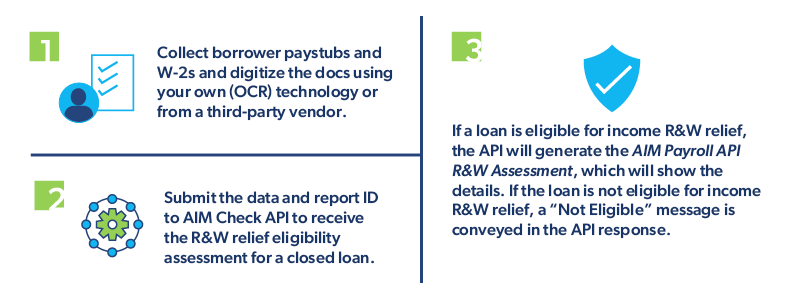

The API can also be leveraged on closed LPA loans to assess R&W relief eligibility when paystubs and W-2s are used in the income assessment. This update was announced in Bulletin 2024-10.

The process is slightly different for closed loans. Here’s how it works:

How to Get Started

- Integration is available to Freddie Mac-approved Sellers and verified service providers. Contact your Freddie Mac representative to learn more.

- Use your own OCR technology or a third-party vendor to digitize the data.

- Additionally, Gateless is the initial service provider integrated with AIM Check API and LPA to support the digitized paystubs and W-2s capability. Contact Gateless for inquiries.