Mortgage Assumption Capability Available in Loan Product Advisor®

A mortgage assumption allows a successor in interest or permissible transferee to take on the balance of the original homeowner’s existing loan without any change to the mortgage terms. For example, if an adult child inherits a deceased parent’s home, they may choose to assume responsibility of the existing mortgage with an assumption. Another common example is for an ex-spouse to remain in their home after a divorce, while maintaining the current mortgage and removing the other ex-spouse as a co-borrower, easing the home transferring process during a stressful time. For Servicers, the credit underwriting process for an assumption has been a manual one—until now.

As of August 5, 2024, Servicers now have the option to use functionality in Loan Product Advisor® (LPAsm) to assess creditworthiness for assumptions of Freddie Mac conventional mortgages, as described in Single-Family Seller/Servicer Guide (Guide) Section 8406.4(d). This new capability may help Servicers streamline their credit underwriting processes for assumptions.

New User Role in LPA Automates Credit Underwriting for Assumptions

The new assumptions feature in LPA offers several key benefits, including:

- Streamlined process, especially for organizations without trained underwriters or origination departments (e.g., Servicers that aren’t also Sellers).

- Greater efficiency, as the tool automates aspects of the credit underwriting process.

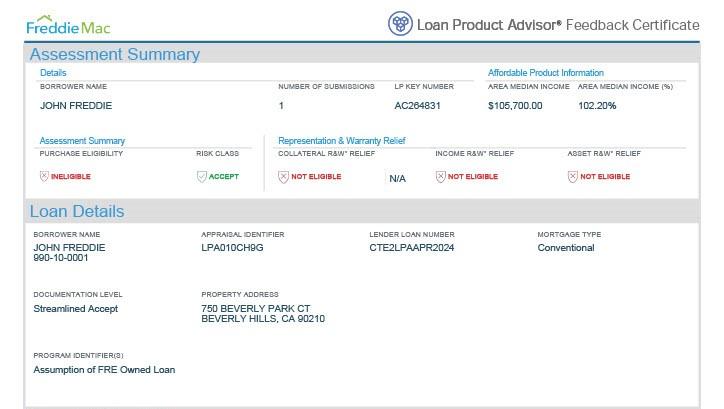

- Clear confirmation, since LPA’s feedback certificate provides a clear risk assessment that Servicers may use in their assumption decision.

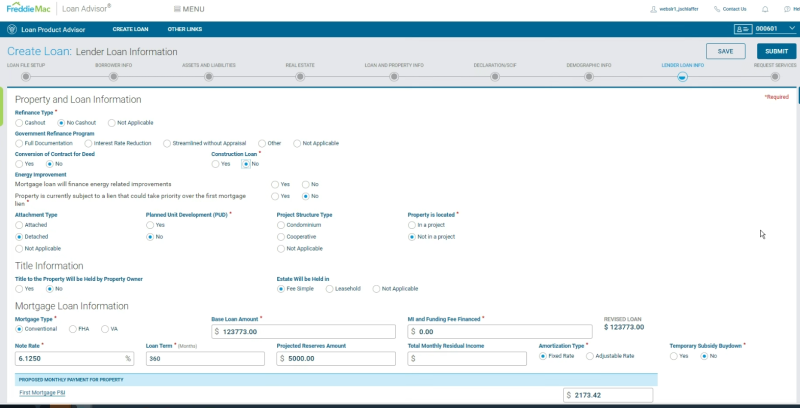

To take advantage of this new capability, Servicers need access to a new user role in LPA, LPA GUI Servicer. Once users have access, they can log into the Loan Advisor® single sign-on portal and use the Loan Product Advisor® user interface (UI) to request credit underwriting for assumptions. When submitting an assumption for assessment in LPA, users must select the “no cash-out refinance option” and “Assumption of FRE Owned Loan” loan program identifier (LPI).

Servicers with existing Access Manager administrators can provide user access to the new role. Servicers not set up to use Access Manager can submit a Get Started form to get registered and start managing user access to Freddie Mac tools and applications in Access Manager, or reach out to the Customer Support Contact Center (800-FREDDIE).

Enhancement Adds Efficiency

This opportunity provides Servicers the option to leverage LPA for credit underwriting on assumptions, but it’s not an expansion or change to Freddie Mac’s existing transfers of ownership or mortgage assumption requirements. While it was announced in Bulletin 2024-8, its usage is optional and not mandated by the Guide. However, using LPA may make the assumption process faster and more efficient for Servicers who choose to use this option.

For more information, refer to the job aid and online training.