ARM Cash Program Prepares for New Commitment Process

Beginning on August 3, 2020, you’ll experience a simpler adjustable rate mortgage (ARM) cash commitment process that requires less data entry and provides greater price certainty at time of commitment. This was announced in the Single-Family Seller/Service Guide Bulletin 2020-18.

We’re enhancing Loan Selling Advisor® to provide you with a more streamlined, uniform pricing methodology that enables note rate contract pricing for ARM cash contracts consistent with fixed-rate pricing.

This new pricing methodology will not rely on weighted average coupon (WAC) pricing, weighted average contract level tolerances or assessing yield maintenance fees.

What’s changing?

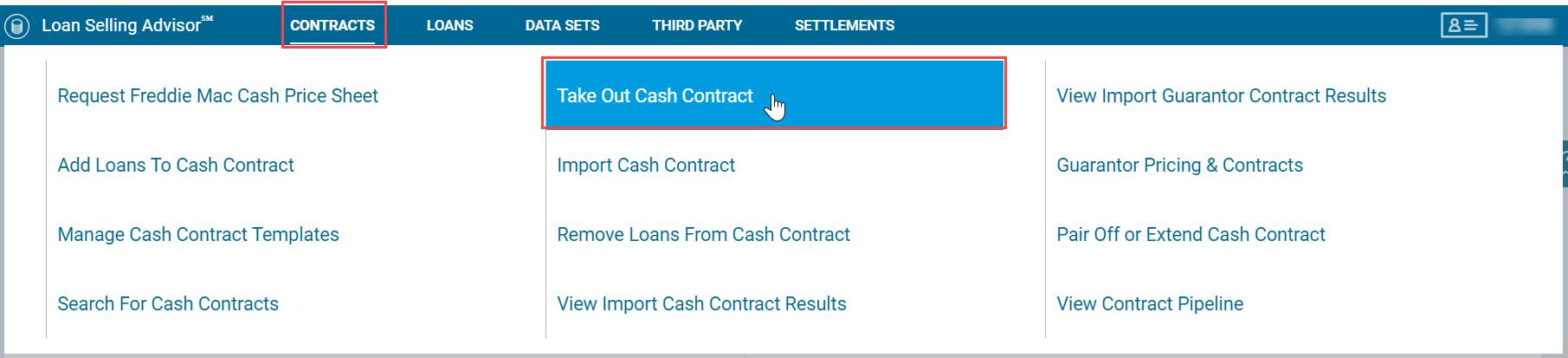

We’re enhancing the Loan Selling Advisor Take Out Cash Contract process. Specifically, the take out ARM cash contract screens.

We’ve updated the take out ARM cash contract screens to:

- Remove the “contract weighted average” section.

- Move the “contract interest rate” to the “contract information” section.

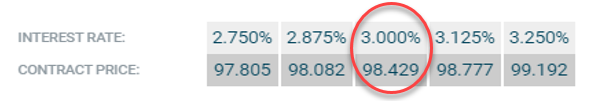

- Calculate and return pricing for the contract interest rate you specify (mid-point, defined by you) and the two interest rates above and below your specified interest rates (in .125 increments).

-

- If the contract interest rate is on a 1/8th (.125), then the contract interest rate range is 50 bps. For example, if the contract interest rate is 3.000%, the eligible interest rate range is 2.750% to 3.250%.

- If the contract interest rate is not on the 1/8th (.125), then the contract interest rate range is 37.5 bps. For example, if the contract interest rate is 3.100%, the eligible interest rate range is 2.875% to 3.250%.

- Rename “servicing fee during fixed rate period” to “servicing fee rate.”

- Change the “contract gross margin range” to read-only. This will now be determined by Loan Selling Advisor based on the contract product and servicing fee rate.

- Remove the “verify contract terms” screen, since weighted average terms will no longer be applicable.

- Update the associated contract terms on the contract confirmation and purchase statement.

- Remove the requirement for a single life cap per contract. If a cash contract product allows multiple life caps, like “5/1 1-year LIBOR ARM 2/2/5 or 6”, a single contract will allow both ARMs with a life cap of 5 and ARMs with a life cap of 6 to be allocated to the same contract.

What about your loan pipeline?

Loan Selling Advisor will automatically convert pipeline ARM cash contracts that expire on and after August 3, 2020. You’ll see the following:

- The contract details will be updated to no longer display the WAC terms and will display five prices for five interest rates.

- The weighted average contract interest rate will be the midpoint interest rate and the system will calculate the two hypothetical interest rates below and two hypothetical interest rates above (in .125 increments) that midpoint.

- The applicable contract price will be available for each interest rate.

-

- For example, prior to conversion, weighted average contract interest rate = 3.250%

- For example, after conversion, the eligible contract interest rate range will be 3.000% to 3.500%:

Will there be changes to the Loan Selling Advisor exports?

There will be no new or removed exportable data fields for the contract detail set Mortgage Industry Standards Maintenance Organization (MISMO) 3.0, pricing contract detail, or the summary data MISMO 3.0. The following existing exportable data fields will be null as weighted average contract terms will no longer be applicable:

- Contract weighted average interest rate.

- Contract weighted average gross margin rate percent.

- Contract weighted average fixed period servicing fee

- Contract weighted average months to next rate adjustment date

For contract products that will allow loans with a life cap of 5 or 6, the following data fields will export with comma-separated data (for example, “0.02000,0.02000”)

Please note: The following new contract data fields on the purchase statement will not be exportable at this time:

- Gross margin rate percent range.

- Months to next rate adj.

For more information, please review our detailed screen changespdf document.