How the Full Suite of Resolve® Digital Tools Can Add Synergy to Your Servicing Operations

Fifth Third Bank was already headed down a path of upgrading their loss mitigation workout and workflow options when they learned about new technology to streamline default management. “It was an easy decision when Freddie Mac approached us about automating the decisioning process with application programming interfaces (APIs),” says Glenn Meadows, Senior Vice President of Mortgage Loan Servicing.

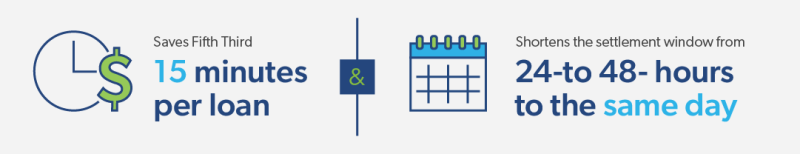

Resolve® is an integrated default management solution that offers a user interface and API technology to seamlessly connect Servicers to a decision rules engine, allowing for rapid, rules-based workouts. At Fifth Third, integrating the Resolve API suite has resulted in an average savings of 15 minutes per loan and shortened the settlement window from 24-to 48- hours to the same day.

Build Trust, Increase Efficiency and Manage Risk—in Any Market

Before implementing Resolve APIs, Fifth Third had been using Workout Prospector® for loss mitigation, which requires manual data input and decisioning and a bifurcated workflow. However, integrating the Resolve APIs with BITB™, a cloud-based, hosted, software as a service (SaaS) default mortgaging servicing solution, allowed Servicers to quickly receive decisions and identify foreclosure alternatives for distressed homeowners. Fifth Third went live with the Resolve APIs in March of 2021—an opportune time to automate as the pandemic increased their loss mitigation volume tenfold.

“Leveraging these APIs really streamlines the process for customers who reach out to advise us of a hardship situation,” Meadows says. “It helps build relationships, since customers trust that when they call you with a sense of urgency you are going to give them an accurate and timely decision about what to do to stay in their home.”

No matter market conditions, however, Resolve APIs drive down servicing costs by improving efficiency, consistency and Single-Family Seller/Servicer Guide (Guide) compliance, and provide faster processing with limited data errors. “The current environment is heavily regulated and having sound compliance practices in place is critical,” believes Meadows. “B2B solutions like Resolve help to ensure information used in the decision-making process is accurate and consistent—now is the time to act.”

Full Implementation Yields Maximum Impact

Resolve’s four APIs span the entire loss mitigation lifecycle. Going in on all of them, versus cherry-picking one or two, provides a logical workflow that eases the default management process. Investing in the suite also prepares an organization for the biggest digital impact as the APIs capabilities expand:

“Full integration of the APIs results in a one-stop shop for servicing retention and liquidation workouts,” Meadows points out. It also eliminates entering information into other systems to retrieve necessary info. Once a homeowners’ eligibility for possible workouts is confirmed, the property value can be determined. From there, Servicers can offer homeowners the most relevant solution to stay in their homes or, alternatively, ease the process of sale or foreclosure.

At Fifth Third, constant communication between BITB and Resolve leads to faster turn times in processing negotiated reviews. Communication on delegated and liquidation workouts is nearly instantaneous, as the two systems “talk” to each other in real time. Non-delegated and negotiation submissions feed directly to Resolve with data points and commentary, and the tool is checked every five minutes for status updates. They also added a workflow event that alerts the team to loans that require requested information or rationale to keep the mortgage relief process moving.

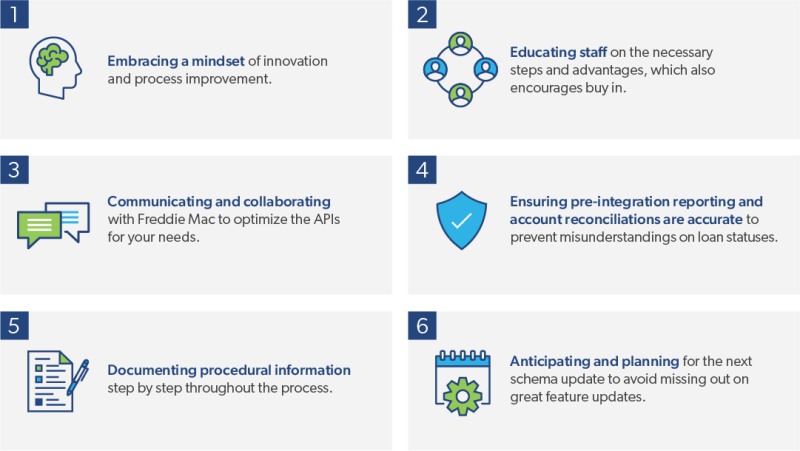

The benefits of using Resolve APIs are tangible and far-reaching. To make adoption as effortless a transition as possible, Meadows recommends:

Being an early adopter of all four Resolve APIs and having the opportunity to work with Freddie Mac to curate a tailored solution has made Fifth Third a firm believer in the technology and gives them a competitive edge. As Meadows puts it, “In an environment where you don’t know what’s coming next, leveraging solutions to help level the playing field empowers Servicers to do a much better job of making decisions quicker and more accurately.”

Learn more about how Resolve API technology can give your organization a seamless servicing lifestyle that goes beyond traditional loan servicing.