(e)Sign of the Times: How Digital Closings Are Revolutionizing Loss Mitigation

When PHH® Mortgage implemented electronic signatures (eSign) into their servicing operations, they were impressed by the level of tangible benefits that swiftly followed. Processing loan modifications via eSign saves them 25 minutes per loan and eliminates up to $60 in overnight postage fees compared to traditional closings with paper documentation, while also reducing their carbon footprint.

In addition, eSign provides more confidence in quality control as it mitigates user errors on both sides. Employees don’t have to undergo tedious, time-consuming loan reviews that often still result in oversights, and the digital workflow assures accurate data entry while prohibiting unauthorized rate, term and other changes. For their part, homeowners don’t have to worry about missing a signature or forgetting to send back a page or two of their closing packages. In short, eSign is becoming a game changer to streamline default management.

Add This Innovative Solution to Your Digital Toolbox to Foster a Competitive Edge

PHH Mortgage first considered eSign several years ago after a successful roll out of Robotic Process Automation (RPA), when they sought other ways to use technology to optimize their servicing operations. They landed on eSign after they heard about its potential to facilitate and simplify the loss mitigation process, providing speed of resolution for lenders and for homeowners.

“We jumped on this because we knew it was going to make our lives easier and the customer experience better,” says Jason Shane, Director of Modification Administration for PHH Mortgage. “Nobody wants to wait for documentation to come through the mail, they want to get it now.”

Single-Family Seller/Servicer Guide (Guide) requirements allow the purchase of loans that have been settled via eSign from industry stakeholders and permit electronic loss mitigation documents. However, whether due to hesitancy, allocation of resources, unfamiliarity with the technology or misperceptions about the process and benefits, the servicing industry at large has been slow to adopt eSign.

But at PHH, eSign is improving the quality assurance (QA) process and reducing back and forth corrections, allowing them to settle modifications more quickly and get loans performing again. Additionally, since pull-through rates are improved for borrowers who may not return agreements or disengage after submitting incorrectly executed agreements, a smaller percentage of loans continue into default, and fewer homes go into foreclosure or become Real Estate Owned (REO) properties. Freddie Mac expects to see an increase in the number of Trial Period Plans completed and final documents being executed due to eSign—a major benefit to minimizing credit losses.

In addition, pairing eSign with Resolve®, Freddie Mac’s integrated default management solution, removes even more friction from the loss mitigation process, because Servicers get near real-time workout decisions and the data they need to speed up mortgage assistance. This could be particularly relevant in disaster situations when a borrower unable to retrieve documents from their home could still receive mortgage relief via their phone or tablet.

Though its adoption is still in its early stages, the impact of eSign is already palpable. Based on promising results from organizations like PHH, the technology is poised to become an industry standard. Servicers who integrate eSign into their self-service portals and online experience will have a marked advantage over those who resist change and will undoubtedly struggle to compete in the future digital landscape.

A Thoughtful, Customer-Centric Approach Eases Adoption

Despite the predicted benefits, staff at PHH knew they were venturing into relatively unchartered waters and realized eSign has some logistical challenges. “Different regulations exist across the country, and even when the governor decides at the state level, the counties need time to catch up,” Shane explains. “From a recording perspective, we knew that was going to be a challenge, so it’s best to start slowly.”

In addition, struggling homeowners, especially those in foreclosure, may be reluctant to engage in an unfamiliar process during an already anxiety-ridden situation. Generational differences in comfort levels also exist between legacy borrowers who closed on their loans years ago and prefer paper documentation and younger homeowners accustomed to digital signing in other areas of their lives.

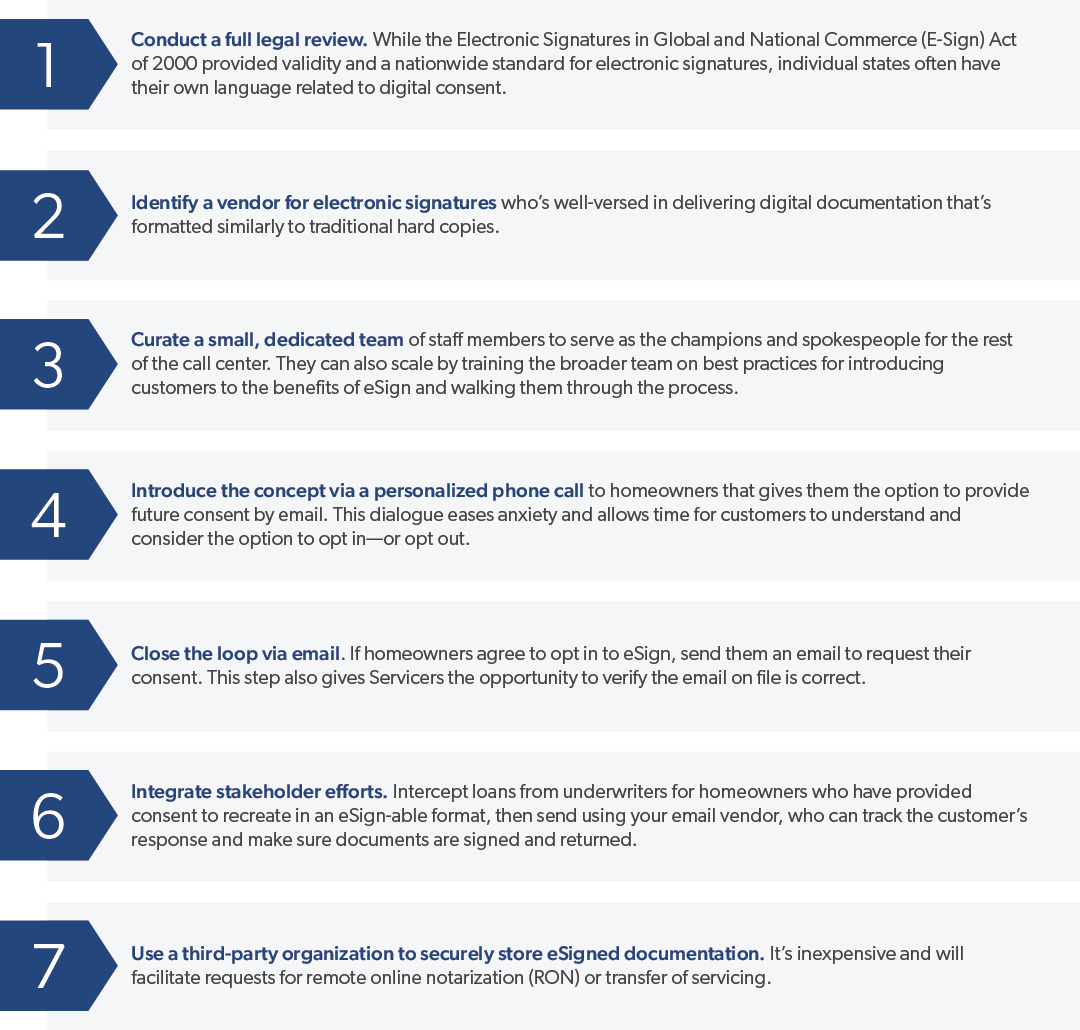

PHH’s Comprehensive Roadmap Has Led to eSign Success

As an early adopter, PHH learned that successful implementation of eSign takes a measured, hands-on, customer-focused approach, and the flexibility to smoothly navigate the inevitable bumps in the road. Any setbacks are surmountable—with a mindset focused firmly on research, education and the customer experience. This is how PHH suggests moving forward:

Small Wins—and Best Practices—Yield Big Payoffs

PHH admits that until eSign is more widely adopted by the industry, it may be more readily accepted for originations than for loss mitigation. Homeowners who originated their loans ten or 15 years ago may not be as familiar with the concept of a digital closing as ones who more recently purchased a home or refinanced—but that will organically change as new homeowners come into the mix and existing ones seek modifications or refinances. As they were undertaking this venture, PHH picked up some best practices for other Servicers to consider:

Change can be difficult and stressful—but so is money left on the table because of resistance or hesitancy. As PHH has discovered, eSign offers an attractive trifecta to the bottom line: optimization, cost savings and customer service.

Freddie Mac is committed to collaborating with Servicers committed to digitizing their lending operations via eSign, saving time and money while improving the homeowner experience. Learn more about using eSign for loss mitigation.