5 Key Insights on Going Digital

As 2022 kicks off a new year of innovation and collaboration through industry events, we’ve been able to hit the ground running to address eMortgages and the benefits of going digital. In the first few months of the year, I had the opportunity to attend MBA, MISMO & ALTA's Digital Closing & eMortgage Bootcamp, the Simple Nexus User Group Conference, Digital Mortgage Processes, eClosing Conference organized by North Carolina Secretary of State’s office and MBA’s Technology Solutions Conference. As part of these conferences, I shared my top five insights with lenders and other industry participants on integrating eMortgages into your business.

1. If you look at adoption in terms of electronic closings (eClosings), we have come a long way.

In 2021, the industry originated 590,336 eMortgages (source: MERS eRegistry(Opens a new window)), representing a 28% YOY growth. More than 90% of the United States population lives in a county that supports eRecording, with remote online notarization (RON) laws passed in 39 states.

Just as the COVID-19 pandemic has changed the day to day in our personal lives, many lenders were also forced to adapt quickly to the changing environment across the mortgage industry. To date, more than 140 lenders have implemented eMortgage technology. With growing support for eMortgages from warehouse lenders, aggregators, investors and settlement agents, you too can be a part of that number, and Freddie Mac is here to assist you through the process.

Hybrid eClosings with eNote can be conducted in all states and is a rewarding first step in a lender’s paperless closing journey.

2. If you’re not offering eClosings, you’re likely missing out on offering a convenient and fast closing option for your borrowers.

While many lenders have already rolled out eClosings that include eNote, a large amount are also offering eClosings that do not include eNote. So, what do eClosings mean exactly for your borrowers?

The answer is simple – not only will borrowers have more time to review and understand the documents, but they’ll also experience faster closing appointments, less follow-up calls related to missing signatures and they’ll have the option to remotely close from a location of their convenience.

3. Most successful eClosing lenders started with hybrid eClosings that included eNote.

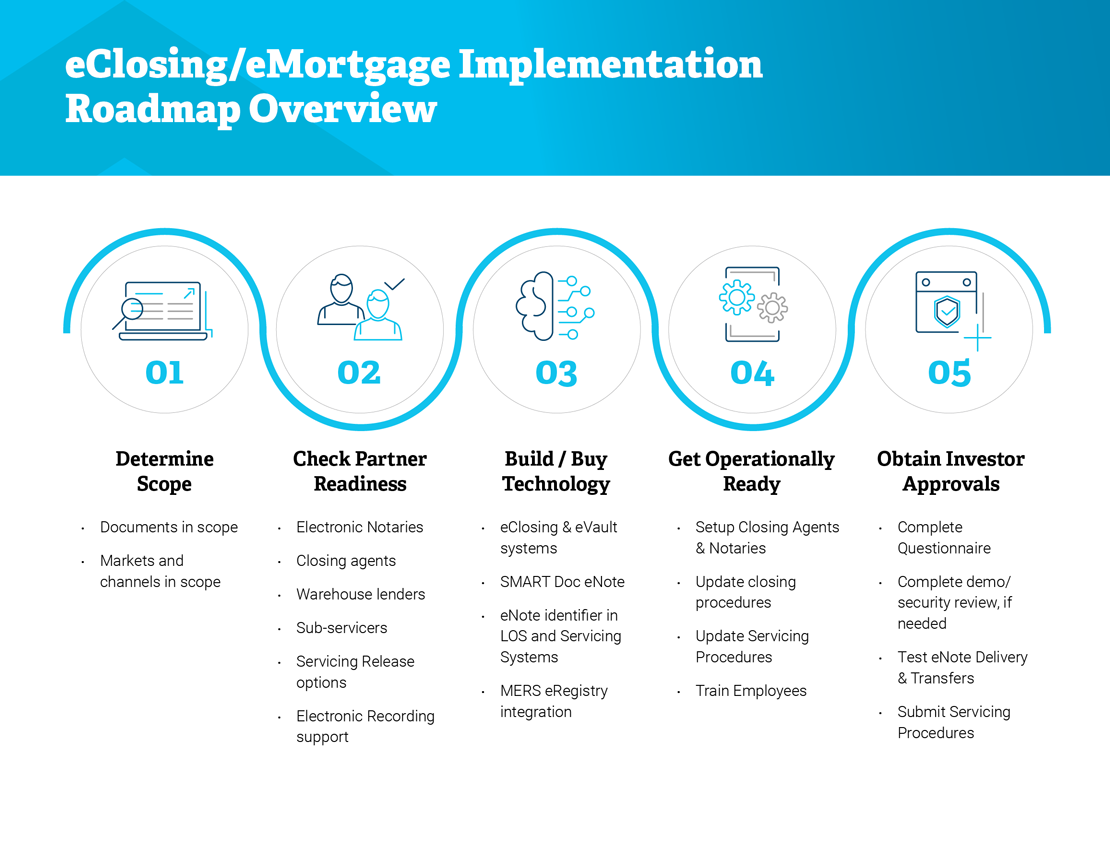

4. Freddie Mac's eClosing/eMortgage implementation roadmap(Opens a new window) will guide you through a high-level overview of the process.

5. We have an eMortgage team that is willing to assist lenders in the process.

The Freddie Mac eMortgage Team and I are here to support you at every step of your digital closing implementation process. Whether it’s getting over initial hurdles or problem solving once you’ve started, we’ve got you covered. Don’t delay – contact us today.

Start Delivering Today

Ready to get started? For more information please reach out to the Freddie Mac eMortgage team at [email protected] or click the link below.