Updates to Loan Level Reporting Improve Look and Feel, Add Data Points

Several reports in Loan Level Reporting, the Freddie Mac Gateway® tool to report homeowner payment activity each month for the current accounting cycle, have been revamped to be more user-friendly—and more useful. Driven by our product and servicing operations teams as well as client insights, the changes give the reports an easier-to-view appearance and include new data points for added searching and filtering capabilities.

All the following reports have an updated look and feel, and are available in Excel, PDF and CSV formats. Here are details about the changes and enhancements, which became available on June 26, 2023:

Transfer of Servicing (TOS) Liquidation Report

What It Is: A cumulative view of all loans within the transfer population that were liquidated the month prior to the transfer of servicing (TOS) effective date.

What’s Different: An updated report title and verbiage in the Note section are joined by enhanced searching and sorting capabilities. New columns for Transferor Servicer Number and Transferor Name in the report table allow Servicers to filter transfers instead of viewing them one section at a time, and loans can be sorted by Transferor Servicer Number and Freddie Mac Loan Number.

New Report:

Old Report

P&I Recast Report

What It Is: A cumulative view of loans with a recast exception event due to a principal and interest (P&I) constant change during the accounting cycle.

What’s Different: The updated appearance makes it easier to view the prior P&I and new P&I for loans where a large curtailment has been applied to the interest-bearing unpaid principal balance (UPB).

New Report:

Old Report:

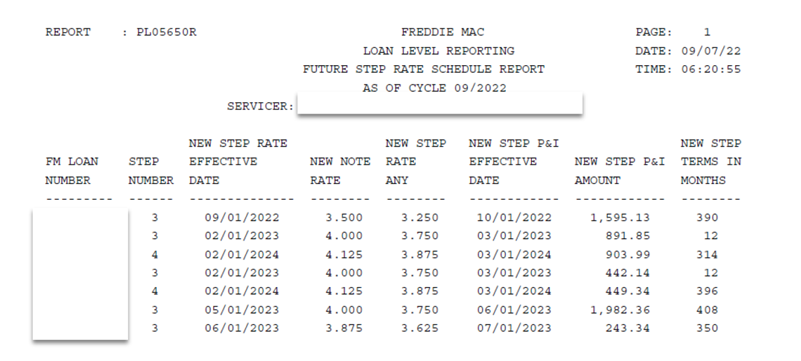

Step Rate Schedule Report

What It Is: A report including all loans with future step rate schedule information.

What’s Different: The existing Step Rate Notification Report and Future Step Rate Schedule Report contain similar data. To eliminate redundancy and consolidate information, the two reports have been merged into a single report called Step Rate Schedule Report. An enhancement updates the order of the columns to be more logical and user-friendly, and the Servicer Loan Number column has been added. Finally, the Freddie Mac Loan Number now appears in every row to allow downloads to be sorted accordingly.

New Report:

Old Report:

Negative Principal Reduction Report

What It Is: A cumulative view of loans that had a curtailment reversal or negative principal reduction amount in the accounting cycle greater than the allowable threshold of $3,000.

What’s Different: A new column lists the ending UPB as of the current cycle, and the Negative Principal Processed Date column has been renamed to Processed Date.

New Report:

Old Report:

Notification of ARM Loans Net Yield Adjustment Report

What It Is: A monthly report available 45 days prior to the scheduled payment change date of an adjustable-rate mortgage (ARM) loan. It identifies loans that have net yield rates that are scheduled to adjust.

What’s Different: The New Note Rate field has been added to denote the loan rate, and the heading now includes the accounting cycle during which the ARM net yield was adjusted.

New Report:

Old Report:

These updated reports allow for an easier-to-understand view of a mortgage portfolio. Loan Level Reporting users can use the new reports by logging into Freddie Mac Gateway. To request access, contact your Access Manager administrator or submit an Access Request form.