January 5, 2022

Credit Fees in Price Updates

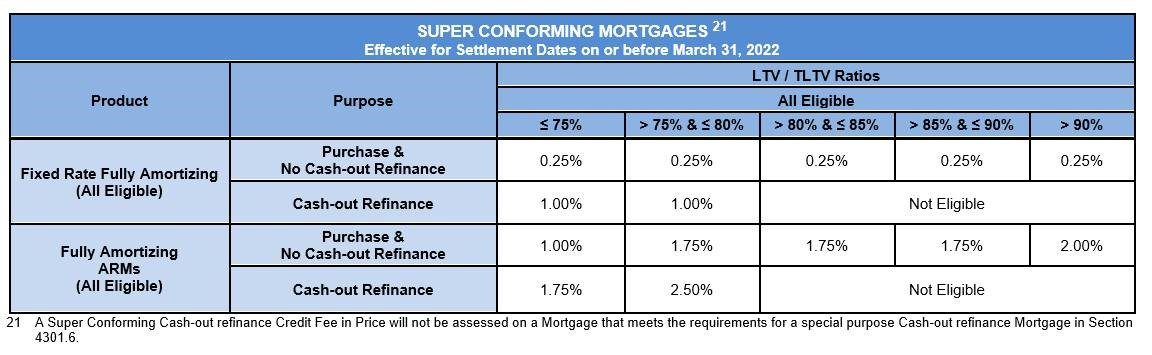

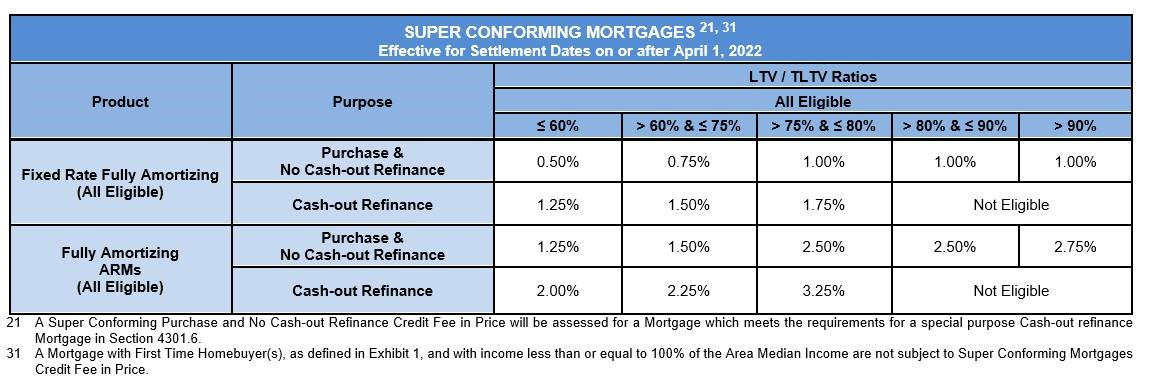

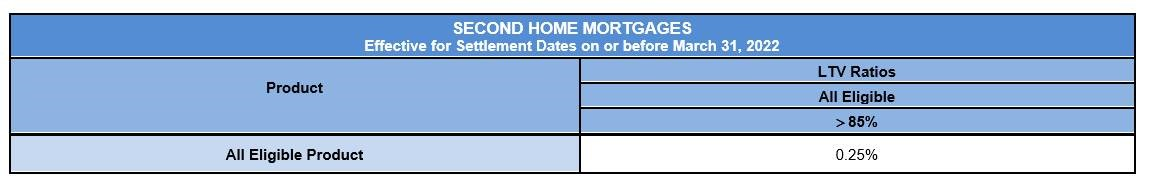

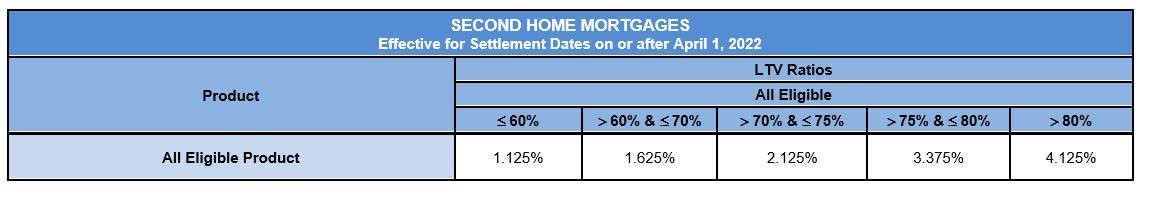

Today, we are announcing changes to our Credit Fees in Price for super conforming mortgages and mortgages secured by second homes. We are making these updates in light of the significant increase in the 2022 loan limits and under the guidance of the Federal Housing Finance Agency (FHFA). These updated fees are effective for mortgages with settlement dates on and after April 1, 2022.

There are two additional updates for super conforming mortgages, including:

- First time homebuyers with income less than or equal to 100% of the Area Median Income are not subject to Super Conforming Mortgages Credit Fee in Price.

- Clarifying that a special purpose Cash-out refinance mortgage will be assessed the Super Conforming Purchase and No Cash-out Refinance Credit Fee in Price.

Exhibit 19, Credit Fee in Price(Opens a new window), will be updated to reflect these changes with a future Single Family Seller/Servicer Guide Bulletin.