Why Tech Tools Are the Secret to High-Performing Mortgages with Low Defects

According to data from the Mortgage Bankers Association (MBA), mortgage production costs have doubled in the last decade, from $5,300 to $10,600. Since purchase loans have a 36% higher incidence of defects compared to refinance mortgages due to factors like missing paperwork, clerical errors and credit discrepancies, loan quality management is especially crucial in today’s purchase-heavy environment; income collection and verification alone represent a third of loan defects.

Moreover, as purchase applications have slowed due to increasing mortgage rates and still-growing home prices and lenders originate fewer loans, any errors or gaps in the data are intensified during this competitive environment of compressed margins and shrinking volumes.

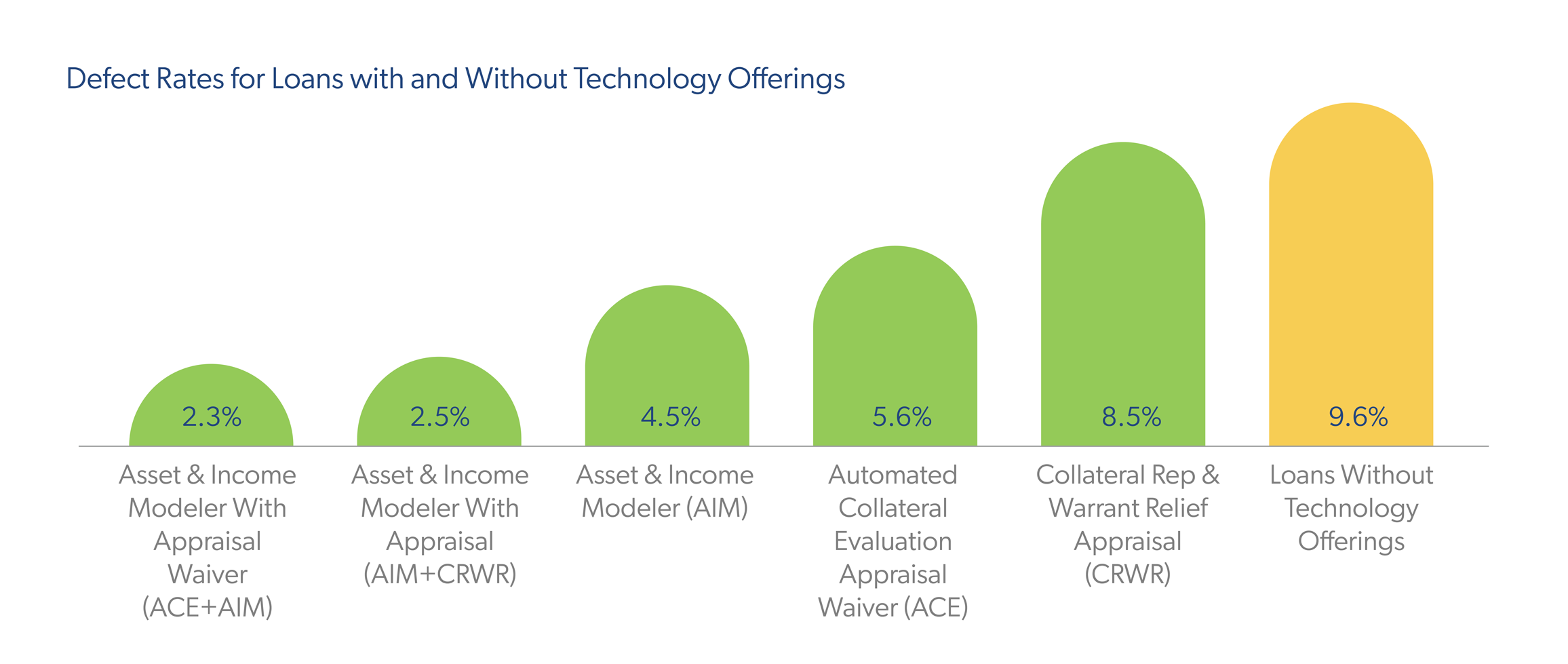

Freddie Mac’s Market Research team recently conducted a study, "Digital Innovation Drives Loan Quality", on the effects of automation on loan quality. While results and benefits can vary depending on lenders’ individual volume, size, operational practices loan characteristics, mortgages originated by lenders leveraging Freddie Mac digital tools are on average four times less likely to have defects than those originated without these technological offerings. Maintaining a preemptive focus on quality can help prevent loan defects and future defaults, so now is the time to allocate resources and implement a robust combination of technology and process improvement.

An Investment in Tech Addresses Loan Risk

It’s expensive and time-consuming to identify and reconcile loan errors on the back end. So, while there is a requisite investment associated with proactively implementing new technology to prevent errors, these costs are offset by the long-term savings obtained from quality assurance.

Beyond the decreased potential that a loan will become delinquent, other key potential benefits of tech-driven mortgages include more effective cost management, higher upfront quality, greater secondary market purchase eligibility, fewer repurchases and data errors and reduction of risk.

On average, lenders with high usage of tech offerings originated loans that were $1,700 less costly, had a seven-day shorter loan production cycle time and showed 40% fewer loan defects than lenders with a lower usage.

Good Data Drives Quality—in the Short and Long Term

Digital solutions are an integral part of a loan’s quality cost—the factors associated with avoiding defects including quality control (QC), planning, testing, training, verification, error correction and repurchasing. The costs of poor quality can reach 10% to 15% of total sales, and that number creeps up even further for less profitable organizations.

Confidence in application data is the foundation for high-quality loans. Income calculation is the number one issue driving repurchases, including debt-to-income (DTI) ratio over 45%, self-employment or supplemental income beyond the Schedule C, and maintaining multiple businesses. Mitigate these risks by building quality into the process and eliminating variables through digitization and innovation.

Ready Your Strategy to Face Market Headwinds

Freddie Mac technology solutions can reduce defects, position loans as a more attractive purchase option and help them perform better over time. Loans originated by lenders leveraging automated collateral evaluation (ACE) and Loan Product Advisor® asset and income modeler (AIM) have a defect rate of 2.3%, compared to 9.6% for loans without this technology.

While AIM and ACE are still relatively new to the market, increased adoption could help drive overall improvement in loan performance. They may also help mitigate risk, including a predicted uptick in defaults that could arise from future home price depreciation in some regions.

With Freddie Mac automated solutions and process improvement practices, lenders can improve loan quality, no matter the market conditions. Learn more about our recent findings on the effects of digitization on loan performance and contact us to create a customized solution.