Total MI® is the Total Package for the Tri-Party Workflow

MI Provides Affordability to Homebuyers and Helps Freddie Mac to Manage Risk

Through our mission, Freddie Mac is dedicated to providing affordability in the housing market. Mortgage insurance (MI) is a critical component in assisting homeowners to afford homes when they are unable to make a 20% down payment. Our charter allows Freddie Mac to purchase low-down-payment loans with MI, since MI helps protect against credit default risk—an age-old form of credit risk transfer (CRT). CRT, simply put, is our process of sharing risk with third-party participants, in this case our vetted and approved mortgage insurers.

Total MI Digitizes the Workflow Among Mortgage Insurers, Servicers and Freddie Mac

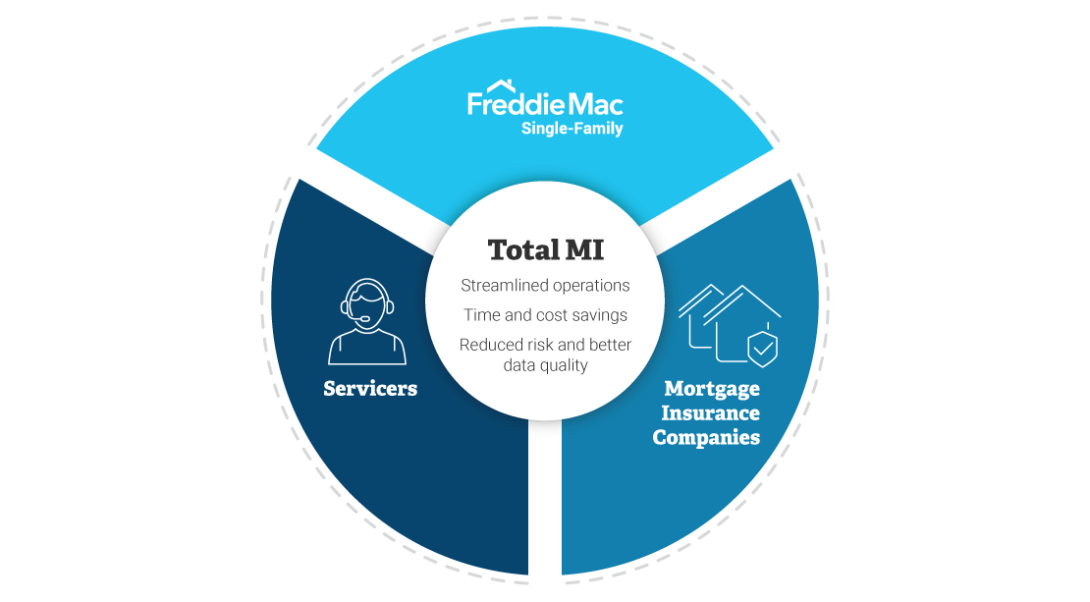

The pandemic has taught us that digital workflows are paramount to effective collaboration. Total MI is a new name to our Reimagine Servicing® initiative. It’s a suite of solutions currently in design to facilitate the tri-party workflow between our mortgage insurance companies, our Servicers and Freddie Mac – resulting in better execution of mortgage insurance policies.

Total MI will enhance efficiency through digitizing and automating three core MI processes: reconciliations, claims and cancellations. The solutions will come to market through an agile roadmap starting next year. Each Total MI tool has a unique launch timeline when they will be accessible through both a web-based user interface via Freddie Mac Gateway® and by direct integration through application programming interfaces (APIs).

Total MI Reconciliations: A more consistent and reliable process to verify MI details for newly funded loans and loans with data corrections.

Total MI Claims: A streamlined workflow that supports accurate and timely claim filing and processing for non-performing loans that have a foreclosure sale date or other claim trigger.

Total MI Cancellations: An efficient channel to confirm the MI status for performing loans, which drives accurate and timely claims processing.

Total MI Supports Reimagine Servicing®, Benefiting the Entire Housing Value Chain

My colleagues and I are excited about the future launch of Total MI for our mortgage insurers and our Servicers. Both are pivotal stakeholders to Freddie Mac, and we’re committed to developing solutions to strengthen our relationships and make doing business with us easier. In other words, we have been listening and we are taking action.

As part of our mission to Reimagine Servicing, Freddie Mac is launching Total MI to streamline the processes critical to servicing loans with mortgage insurance—to the benefit of our mortgage insurers, our Servicers and the housing market.” Cecelia Raine, Vice President of Servicing Strategy and Integration

Mortgage insurers will gain additional insight and control with B2B integration and a more customized approach to the claims process. Servicers will experience increased transparency throughout and more modern and simplified processes across the board. As a result, we expect to see reduced costs, better data quality, and fewer curtailments and supplemental claims. We see Total MI as a win for the tri-party workflow and a win for our affordability and credit risk management initiatives, which is a win for the housing market as a whole.