Single Women are the Fastest Growing Segment of Homebuyers. So Why Do So Many of Them Still Feel Homeownership is Out of Reach?

Single women are buying homes more than ever, consistently outpacing single men two to onepdf for the past several years. Still, many single women head of household renters feel homeownership is unattainable, according to recent Freddie Mac data. What’s driving this trend, and how can the housing industry help break down barriers?

Historical Disparities and Sociological Traditions Have Created a Confidence Gap

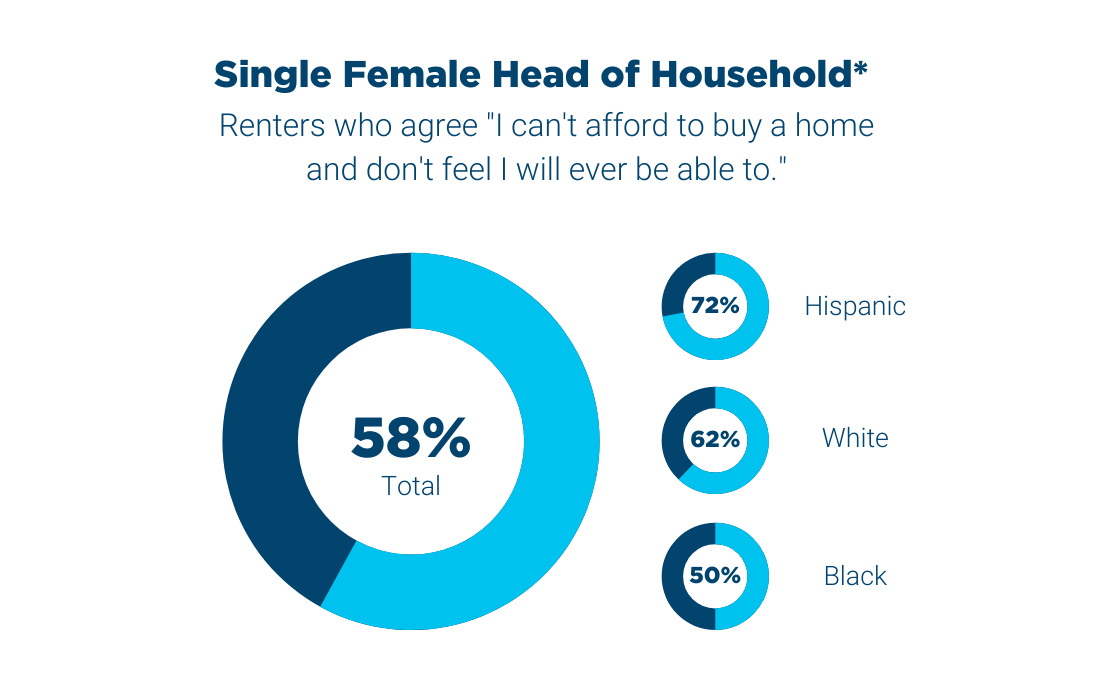

The number of single women homebuyers has risen 30% since 2010(Opens a new window). In the U.S.’s 50 largest metro areas, single women account for ownership of 5.2 million homes(Opens a new window) versus 3.6 million for single men. Despite these impressive statistics, nearly 60% of single women head of household renters surveyed feel homeownership is indefinitely out of reach.

Much of it comes down to single women’s perception of their financial confidence about the homebuying process.

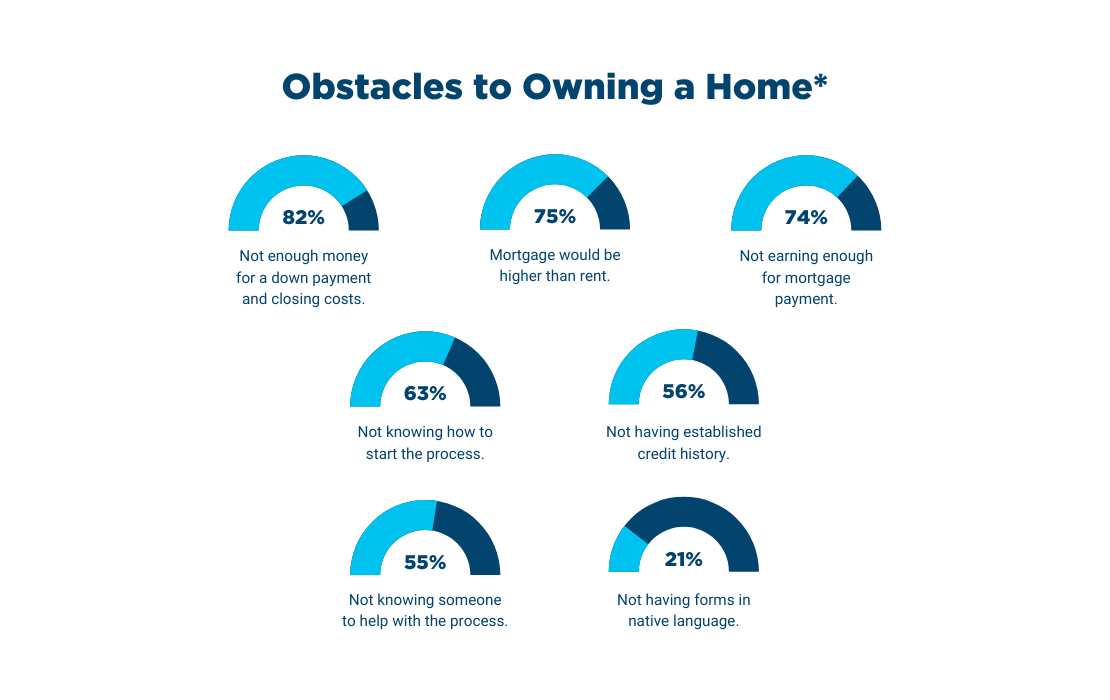

*AQ13. If you were considering buying a [different] home today, please indicate if you think the following would be a major obstacle, minor obstacle or no obstacle for you?

Base: 700 SFHOH renters; 431 White SFHOH renters; 167 Black SFHOH renters; 66 Hispanic SFHOH renters (note small base size)

Note: SFHOH” means “Single Female Head of Household,” which was the term used in the corresponding research. The more inclusive term “Single Women Head of Household” is used in this article.

While 78% of single women renters overall feel confident in their knowledge to build credit and 74% feel confident in their knowledge of managing credit and personal finances, less than half feel they are well-versed about the steps needed to purchase a home, including the overall process, types of mortgages, interest rates and terms, and applying for and securing a loan. These perceptions have been impacted by:

- A history of housing discrimination(Opens a new window).

- Women often leaving themselves out of long-term and big financial decisions, or perhaps even being excluded(Opens a new window) due to sexism, racism, tradition, or culture.

- Women feeling uncomfortable speaking up(Opens a new window), admitting what they don’t know or understand(Opens a new window), and navigating the negotiation(Opens a new window) process.

Financial Barriers Are Also at Play

Before the pandemic, only 59% of single women renters planning to buy a home reported feeling very or somewhat confident about the homebuying process; that lack of perceived confidence has only intensified. Women make 84% of what men do(Opens a new window) and are more often employed in lower-paying “pink collar” fields like hospitality, service and education—which were the first to shut down and the hardest hit during COVID-19. The 2020 recession is often referred to as a “she-cession” because of its disproportionate effects on women(Opens a new window), especially women of color, including an unemployment rate that’s been 2% higher than that of men and the effects of “invisible work” including housework, childcare, and caring for family members. Twenty-five percent of single women in Gen Z and younger say they will not recover financially within a year, if ever.

Other financial homebuying challenges result in concerns for single women. For example:

- 82% worry about having enough money for a down payment and closing costs.

- 75% say a mortgage payment would be higher than their rent.

- 74% don’t believe they earn enough for a mortgage payment.

The Housing Industry Can Play a Part to Boost Single Women’s Feeling of Competency

Despite their concerns, 60% of single women head of households say they earn enough to go beyond each payday, proving that a path to homeownership exists—with the right resources and encouragement. Anyone unfamiliar with required procedures needed to buy and finance a home—including single women—can take steps to proactively strengthen their comprehension and confidence. For its part, the housing industry can facilitate this process by:

- Recognizing that potential homebuyers come into the process at varying levels of knowledge and experience.

- Explaining terms, concepts, and steps in easy-to-understand (but not condescending) language.

- Offering financial education programs focusing on credit, down payment assistance, and mortgage options.

- Implementing marketing initiatives and outreach that go beyond the traditional nuclear family.

However, one size does not fit all with this demographic. They encompass a broad swath, from a millennial pursuing a career trajectory while building equity, to a single mom seeking space and a wealth-building opportunity for her and her children, to a baby boomer or Gen Xer purchasing her first house solo.