Going to New Depths with eMortgages

Although eMortgages (loans with eNotes) have been around for several years, the industry hasn’t shown much of an appetite for closing loans electronically and originating eMortgages. But adoption is gaining, as lenders push to get loans across the finish line faster in a bid to provide borrowers with greater speed and convenience.

In 2023, eMortgage registrations account for close to 7% of all residential registrations in MERS systems, up from 5% in 2021. From a Freddie Mac standpoint, 16% of lenders approved to deliver eMortgages to Freddie Mac have delivered >=25% of their loans with eNotes.

Understanding the Difference: eMortgage, Hybrid eClosing, Complete eClosing, Remote Online Closing

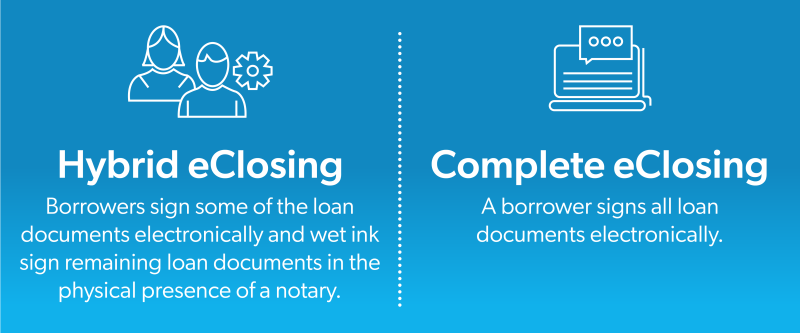

An eMortgage is a mortgage with an electronic promissory note and other electronic closing documents. Most eMortgage originations are done by hybrid e-closings but purer versions exist:

- Hybrid eClosing—borrowers sign some of the loan documents electronically and wet ink sign any remaining loan documents in the physical presence of a notary.

- Complete eClosing—a borrower signs all loan documents electronically, either in the physical presence of a notary, or as allowed in a growing number of states, via a secure video hookup with a remotely located notary who digitally stamps the loan documents (called a “remote online closing").

A Call for All Things Digital

When eMortgages were introduced in the early 2000s, the industry was in a lending boom, with borrowers unused to doing business online. Then came the financial crisis, followed by a wave of new regulation, put this technology on the backburner.

But today, consumers want an end-to-end digital mortgage process. similar to the way they can buy goods and services online or use an app to pay friends and family. Research backs up this shift in sentiment:

- Two-third of borrowers surveyed said that availability of an online portal for signing and notarizing document influenced their decision to work with a particular lender. (https://static.icemortgagetechnology.com/pdf/ebook-borrower-insights-survey-2023.pdf)

- 65% of borrowers surveyed were offered and used the option to sign electronically sign documents. (https://static.icemortgagetechnology.com/pdf/ebook-borrower-insights-survey-2023.pdf)

The Bonus of Paperless

Beyond improving the consumer experience, eMortgages replace a paper process with a digital one, slashing document processing and handling costs. For starters, lenders pull up digital notes and other electronically signed documents instead of paying settlement agents to ship them paper copies of the documents.

With eClosings, the process stops automatically if there’s any missing signatures or documents, saving the lender and settlement agent time on the back end. The resulting electronic audit trail also makes it easier for lenders to prove regulatory compliance.

Funding and Delivery Transformed

The technology enabling eMortgages can drastically collapse investor delivery and funding times. A lender can transfer an electronic note and other electronic closing documents in seconds, versus the one to two days it usually takes currently.

Certification and funding happen just as quickly, shaving off another two to four days. In 2023, lenders that deliver eMortgages via Freddie Mac cash window have saved on average of four days on delivery time, fast-tracking turnaround on warehouse lines and bolstering liquidity.

Digitally embedded loan data always travels with an eMortgage, as it changes hands among stakeholders. Absent the need for manual entry, loan data quality stands to improve while employees pivot to more critical responsibilities.

Growing Support

With the benefits of eMortgages squarely in focus, some 44 states and Washington, D.C, have passed laws to support remote online notarization, providing another option for electronic notarization of loan documents. Also, more than 2,400 counties, covering close to 95% of the country’s population, allow for registering mortgages electronically, or e-recording.

Getting into the Game

An eMortgage is undoubtedly pro-borrower beyond the convenience factor, a shorter time to close can make a lot of difference for homebuyers competing against rival bids in today’s tight housing market.

As with most technology, early adoption trumps the perfect setup for electronic loan closings. Watching the horizon, in this case, means falling behind competitors who offer borrowers something today.

Learn more about Freddie Mac’s role in expanding eMortgages and remote or hybrid closings.