Loan Product Advisor Specification v5.4.00 Preview

Soon we’ll be publishing the newest system-to-system (S2S) specification for Loan Product Advisor® (LPASM), version 5.4.00. Updates to LPA include enhancements to help you make smarter decisions with minimized risk, stay up to date with industry standards and expand your underwriting capability to fulfill more homeownership opportunities.

With the publication of v5.4.00, we’re announcing the retirement of LPA specification v5.2.00, effective March 2025. Upgrading to the latest version will help you capture and send required data with minimal workarounds to achieve the most accurate LPA feedback response.

Here’s a glance at what’s coming with v5.4.00:

LPA Feedback Response Updates

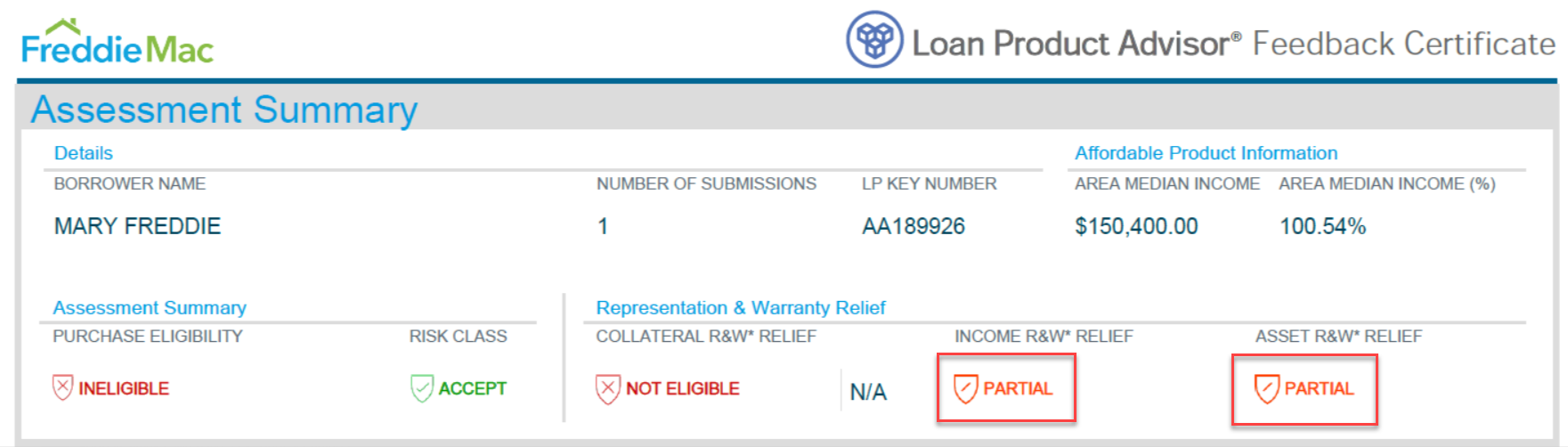

NEW: Partial Shield for Income and Asset R&W Relief Fields

To identify eligibility more clearly for both asset and income representation and warranty (R&W) relief, the Income R&W Relief and Asset R&W Relief fields under the Representation and Warranty Relief section of the Assessment Summary will be updated to display a new value of “Partial” when portions of the income are eligible for relief. The indicators previously only displayed “Eligible” or “Not Eligible,” and partial R&W relief could only be identified in messaging.

UPDATED: Eligibility Shield Colors

The shield colors in the Assessment Summary and Representation & Warranty Relief sections are being updated to make Eligible more visible and Not Eligible more intuitive so you can easily determine if your loan meets Freddie Mac requirements and/or is eligible for R&W relief.

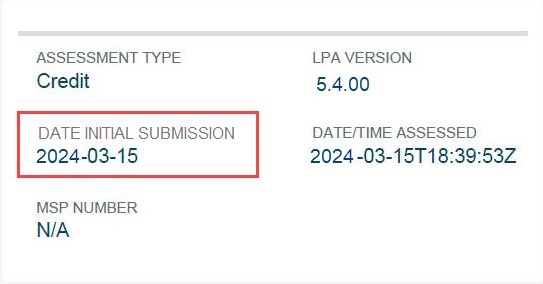

NEW: Initial Submission Date

As requested, LPA will display the date of the initial submission in the Date Initial Submission field in the Transaction Details section of the feedback certificate, replacing the Created Date Time field currently being displayed.

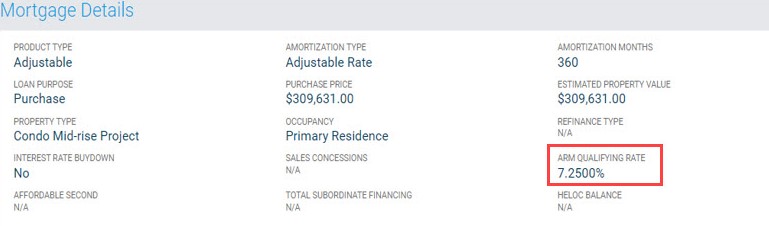

NEW: ARM Qualifying Rate

LPA will display the interest rate used to calculate the adjustable-rate mortgage (ARM) qualifying principal and interest payment rather than the Qualifying Rate Percent provided in the Request file to show the actual percent used to qualify the borrower in the LPA assessment. This value will be displayed in the Mortgage Details section in the ARM Qualifying Rate field.

NEW: Truework as an AIM Service Provider

Coming in Q2 2024, Truework will be added as a new asset and income modeler (AIM) service provider to verify income and employment using payroll data, expanding your options for where you source your data. This will be available for all active versions of LPA.

LPA Request File Updates

NEW: Enumeration Enabling Settlement / Closing Agent Purchase Credits

Based on feedback, we’re adding a new enumeration of “ClosingAgent” to Unique ID (UID) 187.50 Purchase Credit Source Type Other Description to capture situations where a closing or settlement agent pays costs related to the transaction.

NEW: Data Requirements for Lender Grants

LPA will require a breakout of lender or non-originating lender grant amounts reported by the borrower as assets. Users must enter the portions(s) of the grant to be used for the down payment and/or closing costs. If the grant won’t be used for either purpose, values of “0” must be delivered.

To support this requirement, UID 11.00 ASSET_DETAIL/Funds Source Type will accept a new enumeration of “NonOriginatingLender.” Two new data points, UID 12.50 lpa:Gift Grant Closing Cost Amount and UID 12.60 lpa: Gift Grant Down Payment Amount have been added to accept the breakdown of a lender- or non-originating lender-provided grant.

NEW: Truework as an AIM Service Provider

To leverage Truework as your service provider, you’ll be able to enter the new enumeration “TRWK” in UID 493.00 lpa:RequestedDocumentVendorIdentifier. This will be available for all active versions of LPA.

REVISED: Lender Credits Data Collection Change

We’re making it easier to deliver the LPA Request File by aligning our collection of total lender credits with industry standards. You’ll be able to deliver the total lender credits amount in two new data points: LPA v5.4 Request File UID 123.00 Closing Adjustment Item Type = “LenderCredit” and UID 123.10 Closing Adjustment Item Amount.

With this change, we’re retiring the “Lender” enumeration for UID 185.50 Purchase Credit Source Type since it will no longer be valid.

REVISED: Data Points Required for Conventional Loans Only

- HMDA Data on URLA: Any Home Mortgage Disclosure Act (HMDA) data provided on the Uniform Residential Loan Application (URLA), Freddie Mac Form 65, in “Section 8. Demographic Information” must be passed through to LPA. Supporting HMDA data points will be required for conventional loans only. Previous versions of LPA didn’t limit HMDA data delivery to a specific mortgage type.

- SCIF Homeownership Education Data: When Freddie Mac dictates that the borrower(s) must complete homeownership education to qualify for the offered loan or loan program, applicable supporting data points need only be supplied for conventional loans.

- SCIF Borrower Language Preference Data: Similarly, any data provided by the borrower on the Supplemental Consumer Information Form (SCIF), Freddie Mac/Fannie Mae Form 1103, in the “Language Preference” section, now needs to be delivered only for conventional loans.

CLARIFICATION: Military Service Data

Borrowers identify their military affiliation under URLA in “Section 7. Military Service.” In previous versions of LPA, the data points and values did not clearly correspond to each response in the section’s fields. To simplify the requirements for providing these data points, we have adopted the conditionality that aligns with the rest of the industry.

CLARIFICATION: FHA Loan Lender and Sponsor Identifiers

To comply with Federal Housing Administration (FHA) loan requirements specified in the Developer’s Guide for Total Scorecard, v4.07, November 28, 2023, we’ll update the LPA v5.4.00 Request File Conditionality Details, Format and Implementation Notes for identifying lenders, depending on the role(s) they are playing in the transaction.

COMING SOON: Condominium Project Identifier

Users will soon be able to include a new condo project identifier, provided by Condo Project Advisor®, in the LPA submission to accurately determine the condo project status.

LPA Specification v5.2.00 Retirement

Effective March 2025

Version 5.2.00 of the LPA specification will be retired effective March 2025. New submissions after this date will need to use a more recent version to process.

This communication is a preview of the business benefits of the coming changes. If you have any questions about the changes announced in this preview, please contact your Freddie Mac representative, or call the Customer Support Contact Center (800-FREDDIE). Full technical details will be announced with the LPA Specification Bulletin publishing on March 7, 2024.