Intel on the 5 L’s: The 2022 Forecast for New Housing

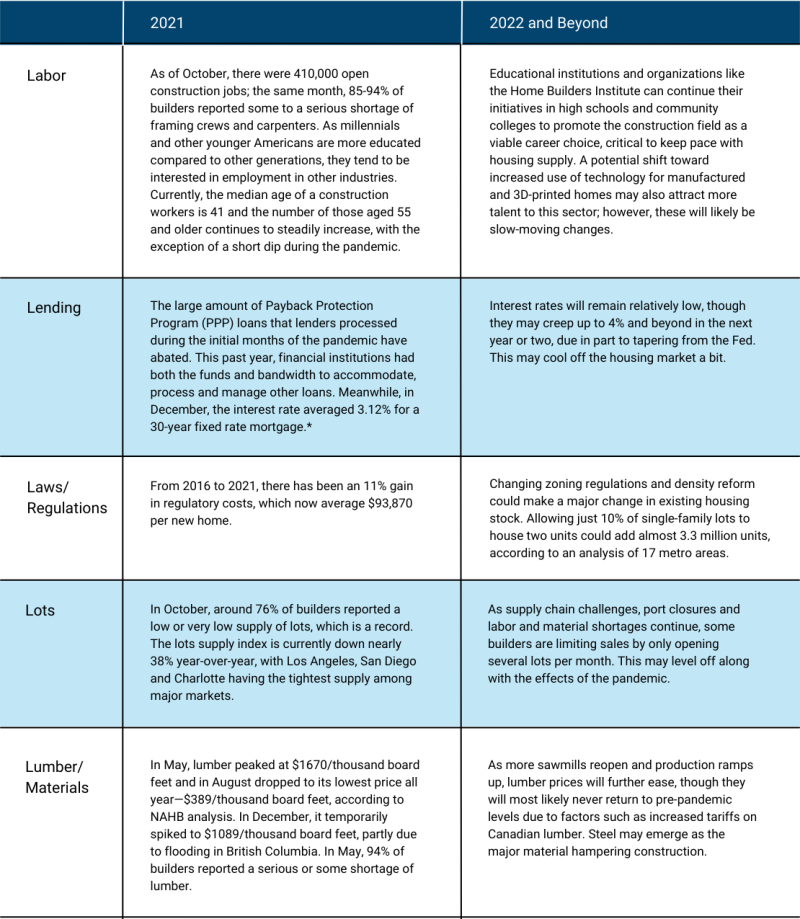

Labor, lending, laws, lots, and lumber. These catalysts sparked the country’s ongoing housing woes, especially the frustratingly slow and historically low rates of new construction. And the pandemic has only exacerbated their effects.

According to Freddie Mac research, there is a current deficit of 3.8 million homes. The massive shortage of construction workers that started after the Great Recession has been compounded by the extremely high prices of lumber and other materials. These in turn are affecting builders’ required loan amounts to fund new construction, increasing purchase prices on homes and negatively impacting affordability. To add to that, current zoning laws often mandate large lot sizes for single-family construction, meaning that fewer houses can be built on one location.

“These factors—the 5 L’s—represent longstanding issues that cannot be easily resolved; since the early months of the pandemic, purchase demand has been strong due to low mortgage rates, while supply has been constrained because of labor and materials shortages,” according to Freddie Mac senior economist Rama Yanamandra.

“In 2022 we expect mortgage rates to rise which will likely impact demand, giving the housing industry an opportunity to continue to explore solutions for the challenges facing the market.”

However, there have been promising signs. 2021 saw 1.1 million single-family home starts, a 11% growth rate from 2020, making it one of the most prolific years since the Great Recession. We asked our top economists to share the status of the 5 L’s—a term coined a few years ago by housing industry economist Dr. Robert Dietz—and what we might expect in the coming year:

As the new year brings ongoing issues and new challenges and the subsiding effects of the COVID-19 pandemic may lead to an upturn in the industry, it remains to be seen how these five factors will affect the construction of new homes and the housing supply moving forward.

*According to Freddie Mac Mortgage Rates from December 16, 2021.

Sources:

National Association of Home Builders (NAHB)

Record Share of NAHB Members Report Labor Shortages (NAHB)

Median Age of Construction Worker In Line with National Average (NAHB)

Fed sees three rate hikes in 2022 and speeds up its taper of bond purchases (Bankrate)

Regulatory Costs Add a Whopping $93,870 to New Home Prices (NAHB).

A Modest Proposal: How Even Minimal Densification Could Yield Millions of New Homes (Zillow)

Builders Report Worst Lot Shortage Ever (NAHB)

Home Lot Supply Index Continues to Decline, Reaches New Cycle Low in Q3 (Builder Online)

New Home Lot Supply Index: Third Quarter Data Hits a New Low (Zonda)

Homebuilders are constructing fewer homes … on purpose (Marketplace)

Record Number of Builders Report Material Shortages (NAHB)

Steel and roofing materials shortage hamstrings construction industry (Supply Chain Dive)