Neighborhoods, Market Areas and Market Conditions for Lenders

Appraisal reports provide a neutral, third-party assessment of a property's fair market value and condition. They can protect lenders from overlending, and help buyers and sellers agree to a fair sale price by identifying potential issues and providing an objective basis for negotiation.

The Single-Family Seller/Servicer Guide (Guide) Chapter 5605 outlines requirements for appraisal reports supporting loans sold to Freddie Mac. These appraisal reports must include market analysis that substantiates both the indicated overall market trend and market-derived adjustments for changes in market conditions.

This article aims to provide your underwriting and review team with a better understanding of the terminology, principles and techniques involved in market analysis and the derivation of proper adjustments, so you can meet your obligations under the Guide.

Terminology

The terms “neighborhood” and “market area” are often used interchangeably, but they have distinct meanings. To better understand the relationship between these two concepts, it’s helpful to look at each term individually.

What is a Neighborhood?

A neighborhood is defined as, “a congruous group of complementary land uses.” In other words, a neighborhood is a community of people living near each other and sharing amenities. Neighborhood boundaries are driven by the collection of residences and support facilities (e.g., gas stations and markets). The boundaries themselves are usually major roads, significant geographic features (e.g., a lake), or geopolitical boundaries (e.g., a county line or city limit). Guide Section 5605.3 provides more information about neighborhood description and analysis requirements.

Subdivision names are often used as neighborhood names, but many residential subdivisions are not “neighborhoods” because they lack necessary support facilities. The definition of “neighborhood” requires a mix of land uses, not just residences. Older guidelines for analyzing comparable sales used a one-mile distance parameter as an indicator that the comparable home was in the same neighborhood. Such guidelines have been eliminated from Freddie Mac collateral underwriting criteria in recognition that the one-mile parameter is not a good proxy for neighborhood boundaries. It’s quite common for homes in the same neighborhood to be a mile or more apart.

What is a Market Area?

A market area is defined as the geographic region where similar demand and competition is located for a subject property. When a potential buyer is considering purchasing a certain type of home in a given area, what other locations would they also strongly consider? When a home is listed for sale in a certain location, what other locations contain homes that would compete for similar buyers? The answers to these questions help define the market area for a property.

The market area typically, though not always, encompasses a geographic region that is larger than just the immediate neighborhood. Market areas are commonly composed of all or parts of multiple neighborhoods. In identifying the market area for a property, an appraiser can use various types of data. Some appraisers routinely ask the buyer’s agent what other properties the buyer considered, while others use tools to import sales data and produce heat maps showing geographic regions where similar homes sell for similar prices.

Market Area Analysis

Once the market area has been identified, the appraiser must analyze economic supply and demand and determine the market area trends required by the Uniform Standards of Professional Appraisal Practice (USPAP). Freddie Mac requires that appraisal reports for loans sold to Freddie Mac must contain the analysis that supports the market trend and any adjustments made for market conditions.

Changes in home prices are driven primarily by supply and demand. When demand is greater than supply, prices tend to rise. When supply is greater than demand, prices tend to fall. However, there may be different levels of market demand for different types of homes. Therefore, it’s possible for different types of homes to experience different price trends, even though they’re located in the same neighborhood. For example, price trends for detached single-family homes often differ from the trends for attached condominium homes in the same area. Or homes of a certain style may change prices at a different rate compared to homes of another style.

The appraiser gathers data on closed sales and active listings within the market area and uses that data to report on the relative levels of housing supply, the typical time taken to sell a home and the sales price trends for the market area. There are numerous tools available for appraisers to use in conducting market area analysis, including tools designed specifically for that purpose.

Market Trend

The market trend identified in the appraisal report must reflect the overall movement of the market based on a minimum of 12 months of data. A specific market condition adjustment to a comparable sale may differ from the identified market trend since the determination of whether to make an adjustment to a comparable sale is based on market changes between the contract date of the comparable sale and the effective date of the appraisal.

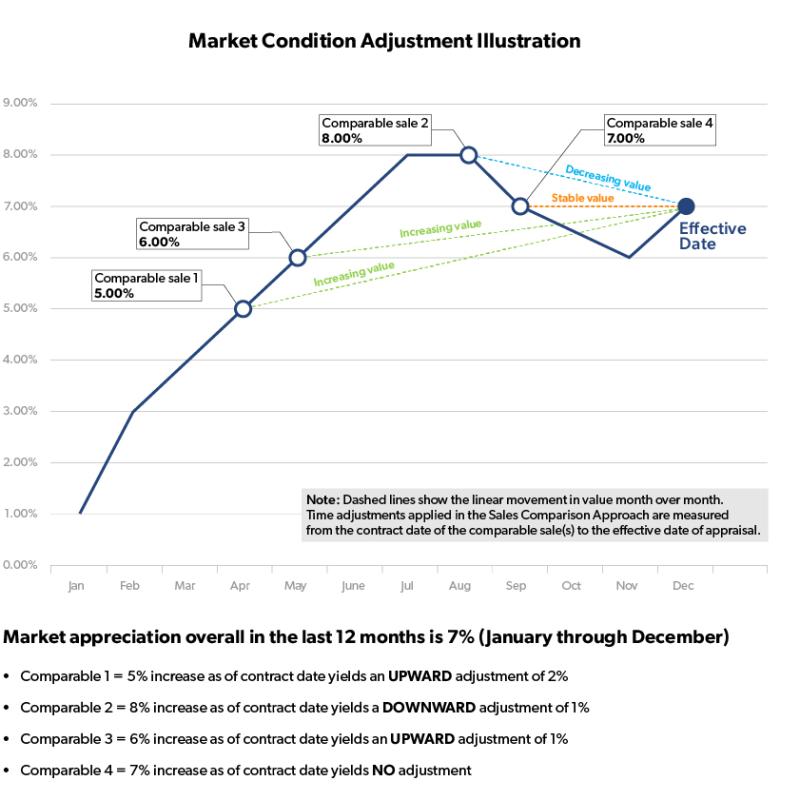

Consider this illustration, which is part of Guide Exhibit 44:

In the 12 months before the effective date of the appraisal, there were periods of time when prices were increasing, stable and decreasing. However, the overall trend, based on a 12-month analysis, should be reported as “Increasing” for an appraisal report using a Uniform Residential Appraisal Report (Form 70) or other Uniform Appraisal Dataset (UAD) 2.6 forms.

Market Condition Adjustments

As previously noted, appraisal reports must contain support for both the reported market trend and the market condition adjustments (often referred to as time adjustments) applied in the comparison approach. When no market condition adjustments are present, that should be treated as equal to making an adjustment of $0, and support for lack of an adjustment must be included in the appraisal report. Failure to apply market condition adjustments when they’re warranted is an unacceptable appraisal practice (see item 11 in Guide Section 5603.4).

When reviewing an appraisal report, it can be helpful for your collateral underwriters to keep these important considerations in mind:

- The trend indicated in the Neighborhood section of a UAD 2.6 appraisal report reflects the overall price change based on analysis of at least 12 months of data.

- Distance parameters (such as one mile) are not good proxies for a neighborhood.

- The adjustment applied to each comparable should reflect market change from the date the comparable went under contract until the effective date of the appraisal.

- Because that trend is an overall indication, the individual market condition adjustments to comparable sales may be positive, negative or zero, regardless of the overall trend.

- Markets may not change in a strictly linear fashion, which means it’s possible to have credibly supported market condition adjustments that are both positive and negative.

- Refer to Guide Exhibit 44 for illustration of these concepts.

Supporting the Adjustment

Appraisers may support market condition (time) adjustments in a variety of ways. In most cases, support will involve analyzing data from local or regional data sources on closed sales and active listings of similar properties. Examples of typical, and acceptable, analysis of such data include:

Repeat Sales Data – This involves looking at repeat sales of the same property, with consideration given to any changes made to the property since the last sale. If a property has undergone little or no change, resale data can be a very strong indicator of market change. However, repeat sales data is often very limited, and this approach is rarely used by residential appraisers.

Paired Sales – This approach, which is used to support many adjustments, involves comparing recent sales with prior sales of very similar homes, and extracting the price change rate over that time period.

Grouped Sales Data – This approach involves looking at price metrics for a group of homes and analyzing the change over time. If there is enough data, the data may be grouped by month, but often it’s necessary to group by quarters because of data limitations.

Use of Regression (Linear and Nonlinear) – This involves populating market data into regression software to produce a trend line. The trend line produced may be linear or nonlinear. The trend line shown in Guide Exhibit 44 is an example of a nonlinear trend line that might be derived using regression.

Reliance on Home Price Index (HPI) Data –Several entities produce an HPI that tracks changes in home price over time. Our Market Conditions Analysis Industry Resources document contains a list of available HPIs. While this data is readily available and can be used as the basis for market condition adjustments, HPIs show an average rate of change that may or may not reflect the change in the subject property’s specific market segment.

All these methods have strengths and weaknesses, and in many cases an appraiser will use a combination of these techniques. The results from each analysis are then reconciled, in much the same way appraisers reconcile the value indications of individual comparables into a final value opinion.

Once an adjustment rate has been derived, the adjustment should be made based on the market change between the contract date (not the settlement date) of the comparable and the effective date of the appraisal. The adjustment may be positive, negative or zero, regardless of the overall trend indicated.

The Critical Role Lenders Can Play

An appraisal report provides a professional and objective assessment of a home's value. Appraisal reviews are often overlooked in the appraisal industry, but they play a crucial role in ensuring that appraisals are fair, credible and reliable.

While the Guide requires Sellers to review appraisal reports, that review also plays a critical role in helping to ensure that an appraiser has completed an effective market conditions analysis that accurately reflects changing market conditions. The absence of such analysis could lead to ripple effects throughout the industry – from influencing the accuracy of potential comparables used in subsequent appraisal reports to impacting the data used by Freddie Mac in its collateral risk management oversight activities.