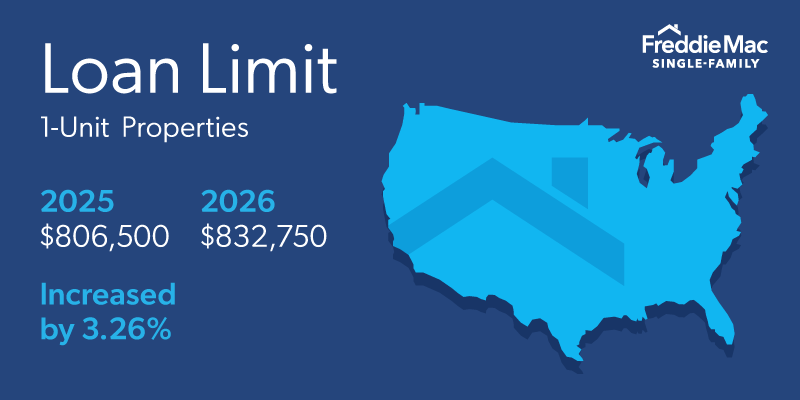

2026 Loan Limits Increase by 3.26%

In line with the U.S. Federal Housing (FHFA) announcement, we’re increasing our maximum baseline conforming loan limit and high-cost area loan limit values.

FHFA's seasonally adjusted house price index data indicate that house prices increased 3.26% on average, between the third quarter of 2024 and 2025. Therefore, the maximum baseline conforming loan limit values in 2026 will increase by the same percentage.

The Single-Family Seller/Servicer (Guide) will be updated in December to reflect the 2026 loan limit values.

Base Loan Limit Values

The following chart shows the 2026 maximum baseline conforming limit values for mortgages secured by properties that are not located in designated high-cost areas.

| Number of Units | Maximum baseline conforming loan limit values for properties NOT in Alaska, Hawaii, Guam and U.S. Virgin Islands | Maximum baseline conforming loan limit values for properties in Alaska, Hawaii, Guam and U.S. Virgin Islands | ||

|---|---|---|---|---|

| 2026 | 2025 | 2026 | 2025 | |

| 1 | $832,750 | $806,500 | $1,249,125 | $1,209,750 |

| 2 | $1,066,250 | $1,032,650 | $1,599,375 | $1,548,975 |

| 3 | $1,288,800 | $1,248,150 | $1,933,200 | $1,872,225 |

| 4 | $1,601,750 | $1,551,250 | $2,402,625 | $2,326,875 |

Important Note about Connecticut: The Census Bureau amended the census boundaries in Connecticut to replace the eight counties and associated codes with nine new county-equivalent regional planning organizations and codes. Our tools will reflect these amended boundaries beginning on December 7, 2025.

Loan Limits in High-Cost Areas*

For properties located in designated high-cost areas*, we’ll purchase mortgages with original loan amounts up to the following limits:

| Number of Units | Maximum loan limits for properties in designated high-cost areas NOT in Alaska, Hawaii, Guam and U.S. Virgin Islands | Maximum loan limits for properties in designated high-cost areas in Alaska, Hawaii, Guam and U.S. Virgin Islands | ||

|---|---|---|---|---|

| 2026 | 2025 | 2026 | 2025 | |

| 1 | $1,249,125 | $1,209,750 | $1,873,675 | Not Applicable |

| 2 | $1,599,375 | $1,548,975 | $2,399,050 | Not Applicable |

| 3 | $1,933,200 | $1,872,225 | $2,899,800 | Not Applicable |

| 4 | $2,402,625 | $2,326,875 | $3,603,925 | Not Applicable |

*Actual loan limit values for certain high-cost areas, as determined by FHFA, may be lower than the maximum high-cost area loan limits identified. Loan limit values are available on the FHFA website.

Note: Two counties in Hawaii (Maui and Kalawao) will be high-cost areas in 2026.

Originating Mortgages and Taking Out Contracts Before January 1, 2026

- Loan Product Advisor® (LPA®) will be updated on December 7, 2025. However, mortgages with original loan amounts that exceed the 2025 loan limit values but not the higher 2026 limits are not eligible for sale to Freddie Mac until on or after January 1, 2026.

- The Income Limits application programming interface (API) will be updated on December 7, 2025. When using this API, submit a request that includes the subject property address, and you’ll receive a response that provides a scrubbed property address and the conforming loan limit values for the corresponding county. Visit the Freddie Mac Developer Portal to learn more about the Income Limits API and our other APIs.

- Loan Selling Advisor® will be updated on December 7, 2025. If you take out a cash contract in December 2025 that has an expiration date on or after January 1, 2026, and are allocating a mortgage with an original loan amount that exceeds the 2025 loan limit values but is eligible under the 2026 loan limit values, you must enter a 2026 date in the “Requested Settlement Date” field.