2025 Updates to the Cost to Originate Study

Navigating Mortgage Lending in 2025 and Beyond

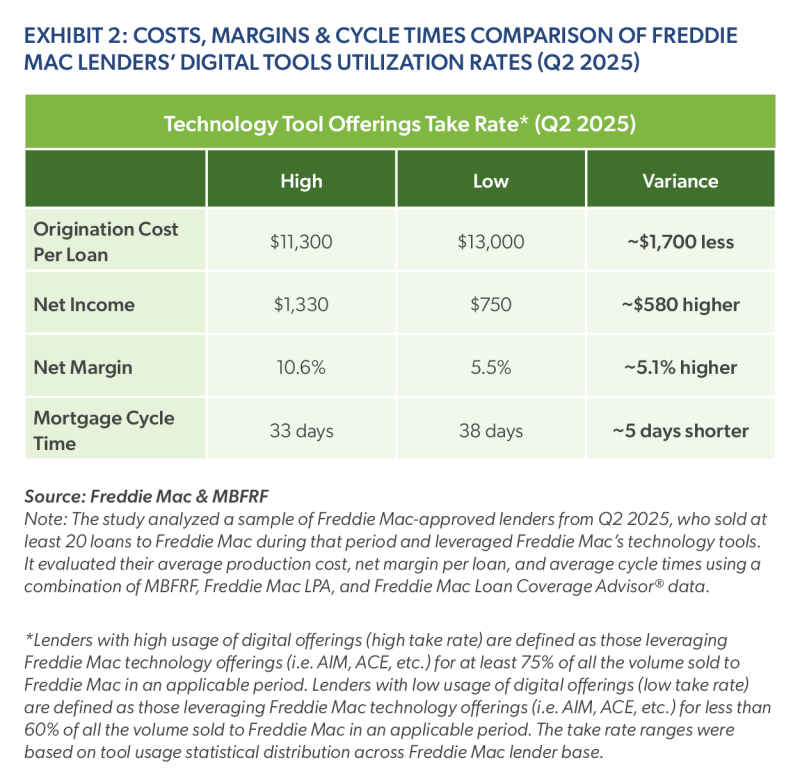

Our mission—to make home possible for families across the nation—drives us to innovate relentlessly, especially in today’s dynamic market. Today’s mortgage market is bringing small but tangible tailwinds – marginal rate relief, modest volume improvement and stronger home purchases. Yet, escalating costs remain a persistent challenge. That’s where our flagship automated underwriting system, Loan Product Advisor® (LPA®) – stands out as a competitive advantage to help lenders thrive. Our latest analysis shows that maximizing usage of LPA digital capabilities delivers savings of up to $1,700 per loan, empowering lenders to enhance profitability and streamline operations, while creating more loan opportunities and savings for borrowers (Exhibit 2).

The cost to originate loans continue to rise, but lenders using LPA digital capabilities save $1,700 per loan – about a 13% increase from 2024.

To assist our lenders and industry stakeholders in navigating the current mortgage market and maximizing operational opportunities, we’ve refreshed the findings from our prior 2024 Cost to Originate study.

2025 Cost to Originate Findings: Opportunities Amid Cost Pressures

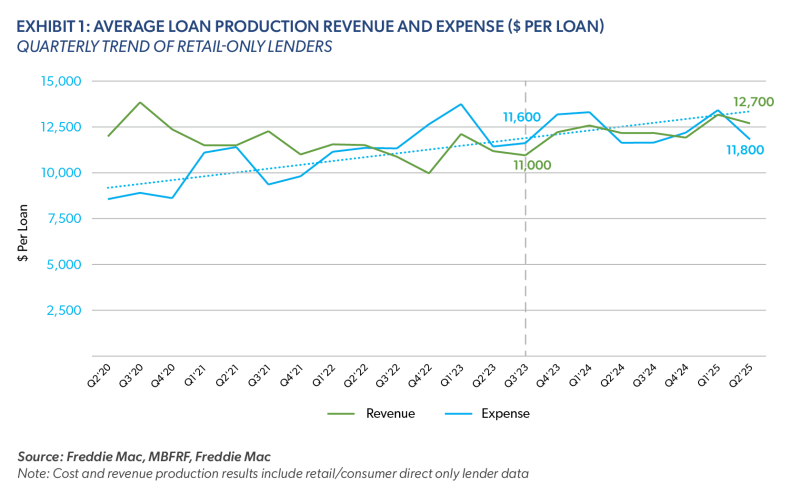

The Q2 2025 financial results for retail-only mortgage lenders paint a cautious picture. While lenders have reported the highest pre-tax net income per loan of $900 since 2021, production costs continue to trend upward.

Our analysis of retail-only lenders’ financials reveals the average cost to produce a mortgage in Q2 2025 was approximately $11,800. While this is certainly an improvement as compared to Q1 results ($13,400), the costs are still about $200 higher when compared to the Q3 2023 period ($11,600).

As mortgage rates continue to gradually lower, we’re seeing the “rate-lock” effect begin to thaw, potentially unlocking inventory and spurring transactions. Economists continue to project modest growth, underscoring the need for cost-effective tools to capitalize on these trends.

Delivering Tangible Cost Savings and Operational Excellence

At the core of Freddie Mac’s technology offerings, LPA helps lenders automate underwriting by evaluating loan applications against Freddie Mac’s credit requirements, delivering real-time risk assessments and eligibility determinations like representation and warranty (R&W) relief. This isn’t just technology, it’s a proven cost-saver. LPA’s digital capabilities automate tasks which help minimize errors. This update shows that lenders optimizing LPA digital offerings can:

- Save ~$1,700 per loan

- Shorten production timelines by 5 days

- Nearly double net margins

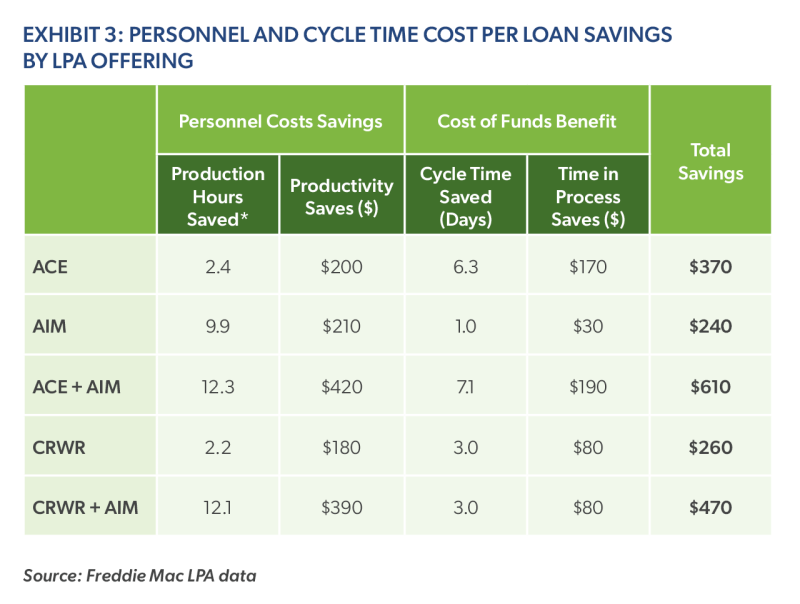

Drilling further into individual LPA digital capabilities like the asset and income modeler (AIM), automated collateral evaluation (ACE) and collateral representation and warranty relief (CRWR), we find that lenders can now save up to $610 per loan in personnel and funds-related expenses (Exhibit 3). But the benefits don’t stop there. With capabilities like ACE and ACE+ PDR (property data report), borrowers also stand to gain, reducing their closing costs by up to $600 and $400, respectively when compared to using traditional appraisals.

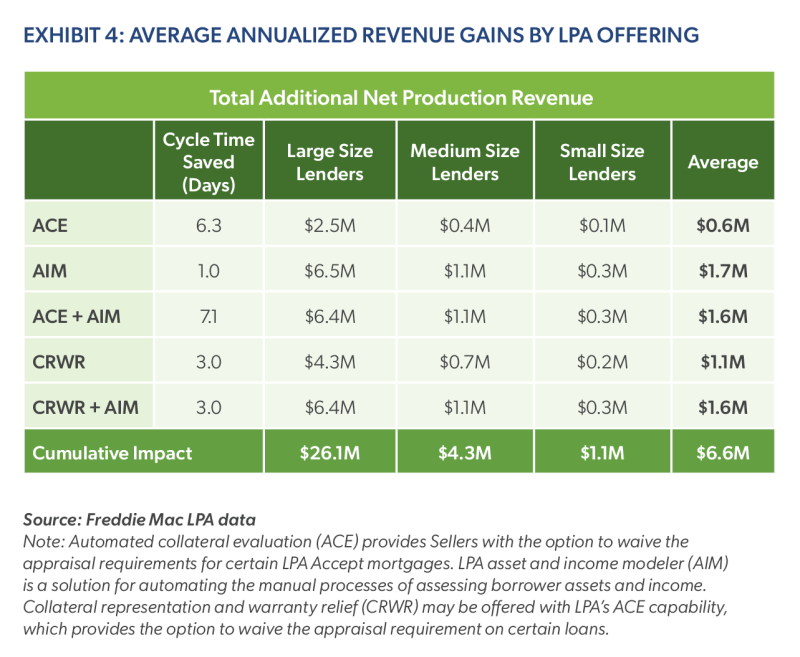

Additionally, we estimate that the combination of shorter cycle times, enhanced borrower satisfaction and reduced rework can lead to an average increase in the pull-through rate by 1.8%. This improvement translates into an impressive incremental revenue boost of $6.6 million annually on average. (Exhibit 4).

These savings and benefits directly tackle risings costs and somewhat depressed revenues, turning high-cost operations into the profitable ones.

The Downstream Impact of Digital Innovation

In addition to the savings noted above, LPA digital capabilities have also demonstrated a significant impact on reducing loan defects. Lenders who extensively use these capabilities experience 40% fewer loan defects compared to those with low usage1.

Increased usage of AIM correlates with lower Non Acceptable Quality (NAQ) rates2. Specifically, lending institutions using AIM for more than 30% of their loans sold to Freddie Mac achieve approximately a 40% better NAQ rate compared to those using AIM for less than 30% of their loans. The improvement in NAQ rate is even more substantial—around 50%—when compared to lenders originating loans without AIM technology.

Additional Benefits Create New Opportunities

Our cost to originate analysis focuses on the impact of LPA digital capabilities to cost savings, however, recent enhancements are paving the way for lenders to ramp up operational excellence.

- A redesigned feedback certificate simplifies compliance and accelerates lender decisions. The updates offer clearer insight into potential missed opportunities for borrowers, an improved employment/income grid for transparent R&W relief eligibility and an asset verification grid that aligns borrower data with third-party reports.

- LPA ChoiceSM feedback messages provide clearer insight into factors that are causing a loan to receive a Caution risk class or potential missed opportunities for your borrowers.

- LPA’s machine learning powered analytics evaluate credit, income, assets and collateral with precision, qualifying loans for R&W relief and minimizing repurchase risks— and also supports affordability programs like Home Possible®, expanding lender’s market reach without added overhead.

- Used in conjunction with tools like DPA One® for down payment assistance, LPA expands opportunities for first-time homebuyers who now account for 59% of all agency purchases3.

Collaborating with Freddie Mac

At Freddie Mac, we’re your collaborators in success through innovation. Our tailored solutions and expertise help lenders implement best practices, manage risk and expand their business opportunities.

KeyBank serves as an excellent example of how implementing LPA can drive business growth and savings. Freddie Mac LPA experts helped KeyBank operationalize LPA in under a year.

Within three months, KeyBank accelerated data-driven closings by automating over half of the loan applications submitted through LPA.

Adopting digital capabilities is essential for lenders to rise above current market challenges. Our focus is on how we can help grow your business, by finding opportunities, reducing costs and providing our lender partners with dedicated support.

Get Started

- Contact your Freddie Mac representative

- Call our Customer Service (800-FREDDIE)

- Explore LPA training resources

1Sourced from 2023 Digital Innovation Drives Loan Quality study.

2The Non Acceptable Quality (NAQ) rate is defined as the proportion of not acceptable quality loans within a designated sample for specified time periods.

3Sourced from eMBS and Freddie Mac; Data as of July 2025 includes Freddie Mac, Fannie Mae and Ginnie Mae agency acquisition data.