Evergreen Home Loans Leverages Freddie Mac Solutions to Achieve a More Efficient Closing Process

Want to deliver a faster, easier closing experience for your borrowers but don’t know where to start? Finding challenges switching to digital eMortgage production? With the right game plan, lenders like you are finding that the transition to eMortgage can be simpler than they thought.

Evergreen Home Loans, an independent mortgage banker founded in 1987 by President & CEO Don Burton, achieved major success by leveraging Freddie Mac solutions to overcome various challenges in the eMortgage space during COVID-19.

Evergreen has 65 offices and is licensed in 10 Western states with an annual production of $6 billion and $8.2 billion in loan servicing. With the implementation of a new Loan Origination System (LOS) in 2014 and the adoption of electronic signatures on initial disclosures, they saw an excellent opportunity to improve their closing and funding process.

The company challenged itself to eliminate paper closing packages and become more efficient. There were some barriers to achieve those goals, but the company worked very closely with Freddie Mac to overcome them.

Already paperless since 2015, they thought, “If we can eSign initial disclosures, why can’t we eSign closing documents?”.

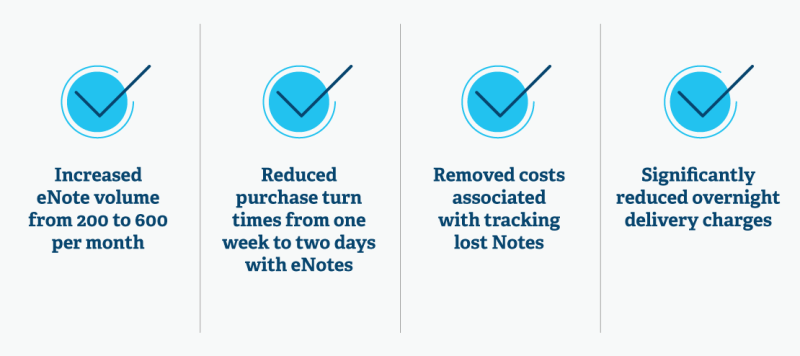

Four Outcomes from Evergreen’s Use of Freddie Mac eMortgage Solutions

1. Data-Driven Results

Evergreen’s percentage of total eSign completion increased from 35% in 2019 to 64% in 2021, resulting in:

2. Changes in Morale and Team Results

eSigned documents meant no more missing signatures, initials or dates, allowing the independent mortgage banker to speed up its post-closing review process. Additionally, funders preferred the eNotes, contributing to an overall boost in team morale and positive disposition toward eMortgages.

3. Improvements in Customer Service

By providing an online closing package to its customers, Evergreen was able to meet a growing demand for a more digital experience and increase customer satisfaction. On average, 86% of Evergreen’s customers preview their documents in advance of signing. In addition, delivering the eSigned documents online eliminated scanning which reduced stress and saved time. Evergreen created customer surveys and made changes based on the feedback received to continuously improve their eMortgage closing and funding process. Currently, Evergreen’s average customer rating for their eClosing experience is 4.8 on a scale of 5.

4. Business Growth

Thanks to process changes, Evergreen funders were able to efficiently fund more loans daily, leading to business growth for the company. In-person escrow signing was minimized from one hour to 15 minutes, resulting in easy accommodation of same day fundings.

What Opportunities Were Presented to Evergreen?

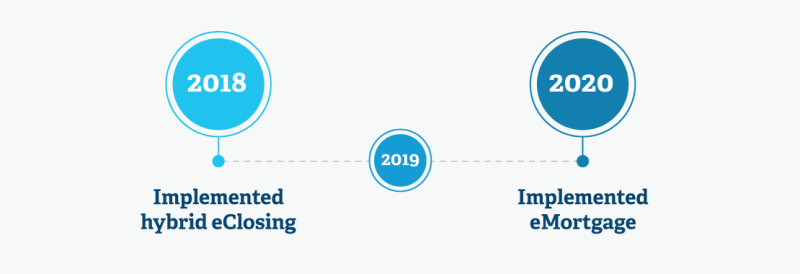

Evergreen worked closely with Freddie Mac to determine their best path. Freddie Mac’s eMortgage checklist provided some clarity and insights that helped Evergreen decide what they needed to breakdown the process into two phases: hybrid eClosing and eMortgage.

This phased approach presented an opportunity to fast-track implementation. When Evergreen was ready to implement the second phase, i.e., eMortgage, Freddie Mac expedited approval during COVID-19 and helped successfully complete the eVault testing process. As Evergreen expanded their eMortgage program by adding new warehouse banks, Freddie Mac also helped accelerate eVault testing.

Challenges in the Digital Closing Journey

Initially, there were a few implementation challenges. One key challenge was that Evergreen’s LOS provider did not have an eClosing solution. To maintain efficiency and minimize costs, Evergreen did not want to use a vendor that would require them to go outside of their LOS to produce documents.

While the company generated closing documents from their LOS, the LOS did not support the SMARTDoc eNote and did not tag other closing documents for eSigning. So, Evergreen had to find a vendor that could tag the closing documents on their behalf and support both hybrid eClosing and eNotes, while allowing them to use their current LOS.

Another challenge at the time was that the independent mortgage banker had only one warehouse bank accepting eNotes and they did not have any investors accepting eNotes except for Freddie Mac and Fannie Mae (the GSEs).

“Evergreen also did not want to use a vendor that would require them to go outside of their LOS to produce documents because of the loss for efficiency and added cost.”

How Did Evergreen Changes its Process to be Successful?

Evergreen identified escrow closers and loan officers as two key groups for successful eClosing adoption.

Loan Officer and Escrow Adoption

Evergreen removed the option for its loan officers to opt out of the process, and instead only allowed the borrower to opt out. Eliminating the decision on the business side enabled a smoother process for both the borrower and loan officer and allowed the borrower to customize their experience.

Printing the Paper Package and Wet Signing by Escrow Closers

When the borrower completed their eSign documents and were asked to wet sign during closing, it created confusion. So, Evergreen implemented system controls to ensure escrow is printing only wet signable docs, thus eliminating double signing.

What Does the Future of eMortgage Look Like for Evergreen?

The COVID-19 pandemic has propelled the digital mortgage landscape faster than expected and is only becoming more prominent in the housing industry.

Lenders who were not yet doing hybrid eClosings and eMortgages prior to the pandemic struggled to implement a digital closing process; however, Evergreen was fortunate they were two years ahead with hybrid eClosings, which helped them deliver eMortgages seamlessly during the pandemic.

With improved visibility into Freddie Mac eMortgage solutions, Evergreen hopes to promote more widespread remote online notarization into their digital closing platform as well as work with more warehouse banks and investors for eMortgage deliveries.

“Improving your mortgage experience and reviewing your digital closing roadmap for you and your borrower with eClosing should start with Freddie Mac solutions,” said Lilly Matautia, Evergreen Home Loans.