Updates to Help Move Your LIBOR Transition Plans Forward

As you start to ramp up your preparations for the transition away from the London Interbank Offered Rate or LIBOR, we’re sharing updates that can help you better lay out your transition activities.

Updated ARM Notes and Riders

If you still originate adjustable rate mortgages (ARMS), you'll find ARM notes and riders on our Uniform Instruments webpage.

Using these updated mortgage documents can be a critical step in your LIBOR transition. They contain more robust fallback language that clearly outlines when and how a replacement index will be chosen if the current index, such as LIBOR or CMT, is no longer available.

While the mandatory use of these revised ARM notes and riders is not until June 1, 2020, you may begin using them immediately. Review Single-Family Seller/Servicer Guide (Guide) Bulletin 2020-1 for special delivery requirements.

The revised fallback language was recommended by the Alternative Reference Rates Committee (ARRC) and both Freddie Mac and Fannie Mae (GSEs) have incorporated this language into the applicable ARM uniform instruments.

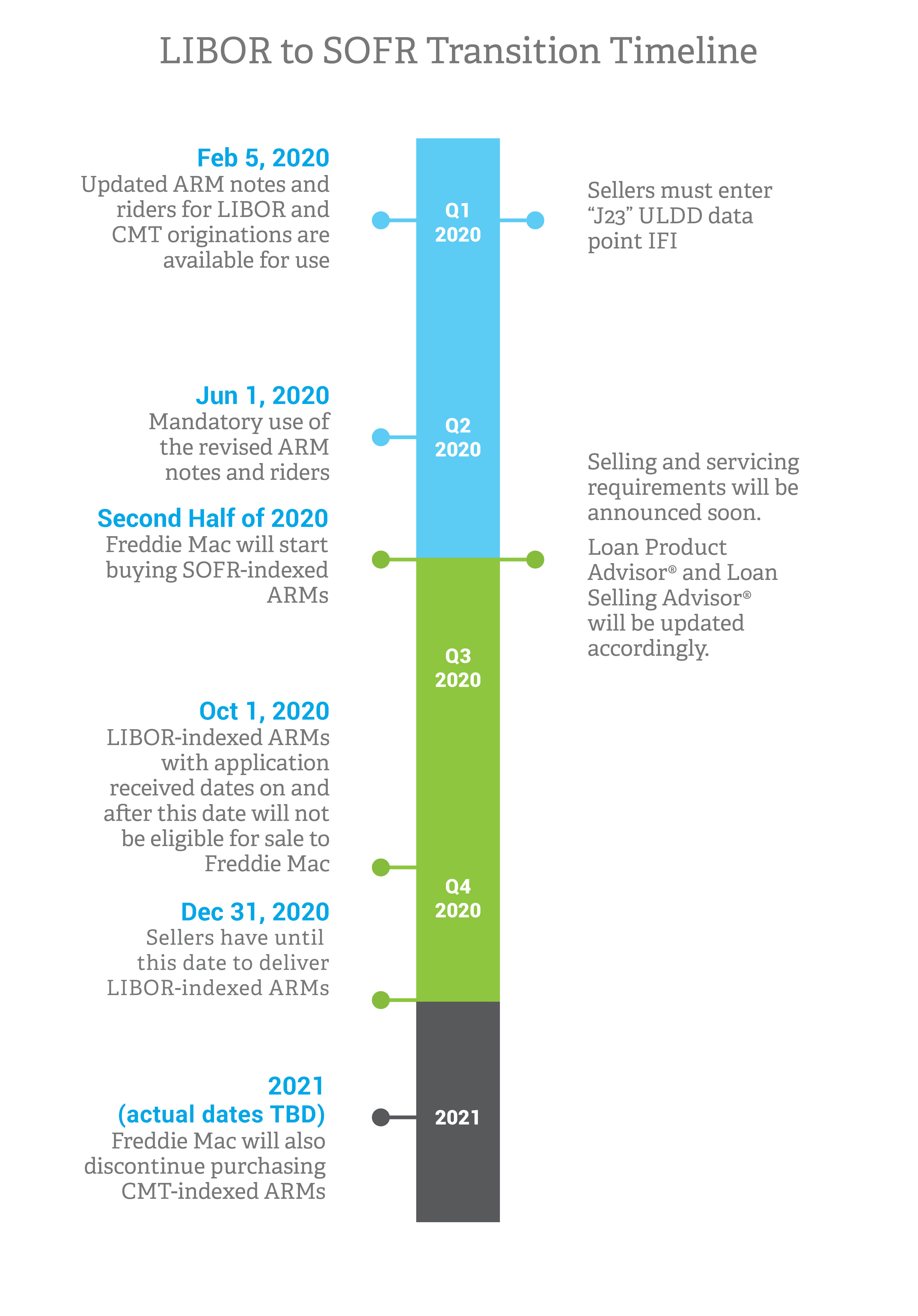

Implementation Timeline

While we are still hammering out the details of our SOFR ARM offering, we can share some critical implementation dates we are targeting.

With Federal Housing Finance Agency guidance, Freddie Mac and Fannie Mae have aligned on the retirement of the purchase of LIBOR-indexed ARMs in 2020 and will introduce a suite of ARMs indexed to the Secured Overnight Financing Rate (SOFR).

Review this timeline to help you in your transition planning. We will refine this timeline in the coming months to provide you with more critical information as you work with your vendors and get your systems and processes ready for SOFR ARMs.

We will also update the appropriate sections of the Guide with detailed eligibility and other requirements in a future Guide Bulletin.