Go Beyond Traditional Credit with Borrower Cash Flow Assessment

Imagine you’re working with a borrower who has an application deserving of a loan, except their credit doesn’t meet Loan Product Advisor® (LPASM) requirements and you receive a Caution risk class. Instead of abandoning the submission, adding a bit more information could potentially flip the Caution to an Accept. With LPA’s borrower cash flow assessment, you have more opportunities to expand the borrower’s access to credit and turn them into homeowners.

Got a Caution? Go with the Borrower Cash Flow

LPA can identify positive cash flow in the borrower’s transaction history from lender-supplied bank data such as checking, savings, investments and more. If identified, it doesn’t impact the debt-to-income ratio or related documentation requirements and can only positively impact the risk assessment, including the potential to turn a Caution to an Accept.

This existing LPA capability has the potential to help all borrowers, but especially first-time homebuyers, and supports our efforts in increasing sustainable homeownership.

No Credit Score? No Problem

Single-Family Seller/Servicer Guide Bulletin 2024-6 recently announced that credit scores are no longer needed for the assessment to run on your submissions. In other words, LPA can automatically assess your submission for positive cash flow and all you need for it to do so is one thing: the asset verification report.

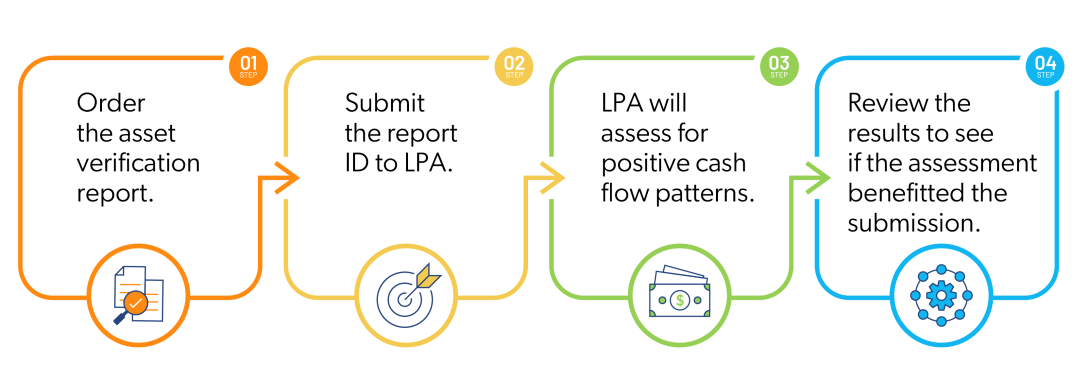

Clear the Caution with the Power of One Asset Verification Report

Minimize the documentation burden for yourself and your borrower by ordering an asset verification report from your chosen service provider (which must be a provider deemed eligible by Freddie Mac to submit such reports). The report must include at least 12 months of account data for LPA to accurately capture cash flow patterns. These are the same asset verification reports that you use with our LPA asset and income modeler (AIM) offerings to assess assets and income for representation and warranty relief eligibility, automate the 10-day PCV requirement and for LPA to identify rent payment history – that’s the Power of One.

Maximize the Positive Cash Flow Potential

LPA helps drive the automation of processes to help you save time, potentially cut costs and deliver a more hassle-free borrower experience. Use the practices below to optimize your resources to give your borrower a better chance of qualifying for borrower cash flow assessment:

- Review the feedback certificate to check for positive cash flow opportunity on the submission – look for message FCL0421.

- Use our AIM service provider list to find and engage a service provider that offers asset account data verification and fits your business operations.

- Encourage your borrower to link as many primary bank accounts as they can (e.g., checking, savings, investment accounts) into which their paychecks are deposited, to increase opportunities to find positive cash flow.

- Refresh reports if needed.

- Make sure the report ID of the verification report transfers correctly to the loan origination system, whether that’s an automatic process or if you enter it manually.

- Use the Expanding Credit Opportunities dashboard in ECO® to see which of your submissions may benefit from borrower cash flow assessment.

Access Additional Resources and Trainings

For additional guidance on using borrower cash flow assessment in LPA, check out these recommended resources and trainings: